from Namibia Critical Metals Inc. (CVE:NMI)

Namibia Critical Metals Inc. Announces Positive Pre-Feasibility Study for the Lofdal Heavy Rare Earths Project

HALIFAX, NS / ACCESS Newswire / December 3, 2025 / Namibia Critical Metals Inc. ("Namibia Critical Metals" or the "Company" or "NMI") (TSXV:NMI)(OTCQB:NMREF) is pleased to announce the results of its Pre-Feasibility Study ("PFS") for the Lofdal Heavy Rare Earths Project "Lofdal 2B-4" ("Lofdal" or the "Project") in Namibia.

The Lofdal deposit has the potential for significant production of dysprosium ("Dy"), terbium ("Tb") and yttrium ("Y") which are the main economic drivers for the Lofdal project. The PFS presents a Base Case - representing a conservative but realistic post-normalization scenario, assuming partial easing of China's recent export bottlenecks and a Divergent Case - consistent with consensus divergence pricing logic and the geopolitical reality of prolonged export controls, slow non-Chinese separation build-out and rising strategic demand from OEMs.

The Project is being developed in joint venture with Japan Organization for Metals and Energy Security ("JOGMEC") targeting a long term, sustainable supply of heavy rare earths to Japan.

Highlights:

Metric | Base Case | Divergent Case |

Net Present Value (NPV, discount rate 5%) | Pre-tax: US$389.2 million After-tax: US$275.5 million | Pre-tax: US$1,245.6 million After-tax: US$747.9 million |

Internal Rate of Return (IRR) | Pre-tax: 21.7% After-tax: 19.0% | Pre-tax: 44.1% After-tax: 34.8% |

Life-of-Mine Nominal Cash Flow | Pre-tax: US$709.6 million After-tax: US$513.1 million | Pre-tax: US$2,027.4 million After-tax: US$1,242.3 million |

Pre-Production Capital Costs | US$273.4 million | Same as Base Case |

Total Capital Costs | US$347.9 million (including contingency of US$57.4 million) | Same as Base Case |

Capital Payback Period (after-tax) | 4.2 years | 2.75 years |

Average Annual Production | 1,478 tonnes TREO (ex La, Ce), including: 119 t Dy, 17.8 t Tb, 841 t Y | Same as Base Case |

Mine Plan | 32 million tonnes Proven and Probable Reserves | Same as Base Case |

Estimated Life of Mine | 13-year mine life | Same as Base Case |

Metric | Base Case | Divergent Case |

Rare Earth Oxide Prices Used (average Life of Mine) | Dy203:US$663/kg Tb203: US$2,880/kg Y203: US$60/kg Nd203: US$114/kg Pr6011: US$119/kg | Dy203:US$855/kg Tb203: US$3,712/kg Y203: US$130/kg Nd203: US$146/kg Pr6011: US$152/kg |

Basket Price (average Life of Mine pricing) | US$158/kg excluding LaCe | US$230/kg excluding LaCe |

Pricing assumptions used in this study include Base Case YâOâ USD $60/kg and Divergence Case YâOâ USD $130/kg, together with independently benchmarked pricing for DyâOâ, TbâOâ and Nd2O3 and Pr6O11.

The Divergence Case differs from the Base Case only in pricing assumptions. Mining, processing and capital parameters are identical.

Darrin Campbell, President of Namibia Critical Metals, stated:

"Lofdal is well positioned as one of very few advanced major Dy/Tb- and Y projects outside China, with a supportive jurisdiction, a mining license, fully environmentally permitted, an excellent relationship with the communities and a key strategic JV partner (JOGMEC). The Project's economic case is now underpinned by three value pillars: Dy/Tb high-temperature magnet demand, Yttrium demand from aerospace, semiconductors and turbine industry and Nd/Pr magnet demand. This diversified critical-material exposure increases the strategic attractiveness of Lofdal for OEMs and governments."

Introduction

Location: Lofdal is located approximately 450 kilometers (km) northwest of the capital city of Windhoek and 25 km northwest of the town of Khorixas in the Kunene Region of the Republic of Namibia. The project area is linked to the regional port of Walvis Bay via 390 km of well-maintained main roads.

License: The Lofdal Project is licensed with a Mining License ("ML200") which was issued by the Ministry of Mines and Energy in May 2021 and is valid for 25 years to May 10, 2046. The Mining License was issued to the Company's 95% owned subsidiary, Namibia Rare Earths (Pty) Ltd., with the balance held by Philco One Hundred Ninety-Six (Pty) Ltd. ("Philco 196"), a company incorporated to fulfil the license requirement of a 5% shareholding of Historically Disadvantaged Namibians.

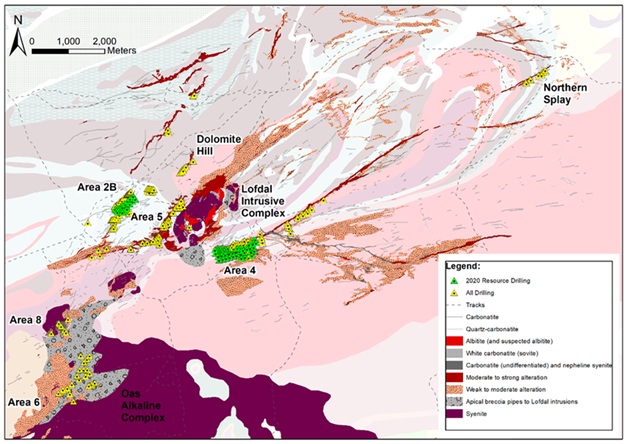

Geological setting: The Lofdal property is centered on the Neoproterozoic Lofdal Intrusive Complex associated with regional-scale occurrences of rare earth element (REE) mineralization. The REE mineralization is bound to multiple structurally-controlled zones of hydrothermal alteration, predominantly albitization and carbonatization which stretch in northeasterly directions over a prospective area of about 20 km by 10 km Figure 1).

Mineralogy: The major REE-mineral is xenotime, a heavy rare earths element (HREE[1]), phosphate, which occurs disseminated throughout all mineralized zones.

Exploration: The Company conducted extensive exploration programs over the past 15 years including geophysical surveys and drilling of a total of 58,039 meters (m) in 411 boreholes. The two mineralized zones that underly the PFS for the project "Lofdal 2B-4" are "Area 4" and "Area 2B", (Figure 1). At Area 4, the zone of mineralization has been traced for over 1,100 m at surface, where it is characterized by an intensely altered core zone of 15 m to 30 m thickness with a less altered halo of 50 m to 60 m that may extend up to 100 m in thickness. The alteration zone at Area 2B has a strike length of 600 m and its thickness ranges from 20 m to 35 m.

Regional sampling, mapping and reconnaissance drilling suggest that the HREE-mineralization extends over several kilometers in parallel structural zones with major splays forming mineralized zones such as the 4-kilometer-long zone "Area 5" in the central project area (Figure 1).

Mineral Resources: The MSA Group (Pty) Ltd ("MSA") updated the Mineral Resource Statement for the project "Lofdal 2B-4" in 2024 ("NI 43-101 Technical Report - 05 April 2024 Mineral Resource Estimate" dated May 21, 2024) with the following key results:

Combined Measured and Indicated Mineral Resources of 58.5 million tonnes at 0.16% TREO for the combined Area 4 and Area 2B deposits based on a cut-off grade of 0.1% TREO (including Y2O3)

Contained tonnages of Dysprosium and Terbium - the most valuable heavy rare earth elements - amount to 4,503 tonnes Dysprosium oxide and 692 tonnes Terbium oxide in the combined Measured and Indicated Resource categories;

Total Rare Earth Oxide (including Y2O3) tonnage in the combined Measured and Indicated Resource categories of 93,730 tonnes.

Table 1 Lofdal Mineral Resource Estimates (MRE) April 2024 at a 0.1% TREO cut-off grade

2024 MRE | |||||||

Area | Million tonnes | Grade | Content (tonnes) | ||||

(Mt) | TREO (%) | Dy2O3 (ppm) | Tb2O3 (ppm) | TREO (t) | Dy2O3 (t) | Tb2O3 (t) | |

Measured Resource Area 4 | 6.6 | 0.21 | 130 | 19 | 13,650 | 855 | 124 |

Indicated Resource Area 4 | 49.2 | 0.15 | 69 | 11 | 75,730 | 3,391 | 528 |

Indicated Resource Area 2B | 2.7 | 0.16 | 97 | 15 | 4,350 | 257 | 40 |

Total Measured & Indicated Resources | 58.5 | 0.16 | 77 | 12 | 93,730 | 4,503 | 692 |

Inferred Resource Area 4 | 10.5 | 0.14 | 58 | 9 | 14,950 | 611 | 97 |

Inferred Resource Area 2B | 4.4 | 0.15 | 75 | 13 | 6,650 | 326 | 56 |

Total Inferred Resources | 14.9 | 0.14 | 63 | 10 | 21,600 | 937 | 153 |

Notes:

All tabulated data have been rounded and as a result minor computational errors may occur.

The Mineral Resource was reported from within a Whittle optimised pit she

Mineral Resources, which are not Mineral Reserves, have no demonstrated economic viability.

TREO = Total Rare Earth Oxides and includes Y2O3

Mineral Resources are inclusive of those converted to Mineral Reserves.

Summary of Processing Results

Starter pit at Area 4 and bulk sample extraction

The Company developed an open pit in the central part of the Area 4 deposit. A first box cut of 60 m x 20 m to 15 m depth was excavated in 2022 and 30,000 t of material removed. A blended ore sample of 550 t was produced with a grade of 0.18% TREO and samples were sent to TOMRA (Hamburg, Germany) and Rados (Johannesburg, South Africa) for sorting tests. Additional samples were sent to Geolabs (South Africa) for geotechnical tests and to SGS Canada Inc. in Lakefield, Ontario ("SGS Lakefield"), for pilot-scale flotation and hydrometallurgical test work.

A significant extension and deepening of the open pit took place in February 2025 (Figure 2) and a total of 15,000 t of material was excavated to a depth of 17 m. A total of 500 t bulk samples from 5 different ore zones were selected and crushed and screened. Three different bulk samples were prepared representing the hanging wall zone, main ore zone and footwall zone for bulk XRT and XRF sorting tests and subsequent flotation tests.

Ore Sorting

Mineralization at Lofdal is amenable to XRT sorting by detection of higher density minerals which are co-genetic with xenotime. Results indicate that XRT sorting technology can provide significant upgrades to the run of mine ("ROM") by rejecting waste in form of albitite, gneisses, muscovite and chlorite schists.

Ore sorting tests were part of the company's value engineering during the PFS process "Lofdal 2B-4". The tested flowsheet for the PFS aimed at upgrading a low-grade stream by XRT sorting prior to flotation, with high-grade ore supplied directly to flotation.

Initial tests with TOMRA's new AI based and deep learning application OBTAIN, yielded improved XRT sorting results as compared to previous test programs. This formed the basis for bulk sample test programs carried out by Gecko Namibia with the upgraded TOMRA sorter at the Ondoto LREE Mine in northern Namibia. The pilot-scale XRT test program was conducted on about 300 tons of ROM in July-August 2025. Sorting tests were conducted separately on bulk samples from the hanging wall, the main ore zone and the footwall zone as these three zones are characterized by different host lithologies (gneisses, pegmatites, amphibolites) and mineralization pattern.

A total of 200 different test runs were conducted on a TOMRA COM Tertiary XRT at Gecko Namibia's facilities. The test work was conducted as a combination of two different image processing methods, Dual Energy and Inclusion Detection. A special Multi Density Class Model was applied to distinguish between six different sensitivities. For the inclusion detection TOMRA's deep learning-based classification CONTAINTM was tested to detect visual patterns and textures to recover finely disseminated mineralization within the low contrast Lofdal material. The test results were steadily improved through 27 test settings by systematically adapting the multivariate test principles, parameters and algorithms based on the results as the program advanced. While the nature of mineralization with fine veins of xenotime is not the ideal type of material for XRT sorting, the test results exceeded the targeted upgrade and recoveries. The overall test results on low-grade (0.10-0.17% TREO) footwall and hanging wall ore yielded REE upgrade factors of 2.3 to 2.7 and REE recoveries of 60% to 70%.

Flotation test program

Flotation is the key step in beneficiation of Lofdal's xenotime ore. Flotation test work was carried out at SGS Lakefield and other international laboratories with over 170 individual flotation tests using several types of collectors, depressants and considered thrifting of physical flotation conditions. The Company built on SGS Lakefield's extensive experience in mineral processing of rare earth deposits. Earlier test programs compared upgrades and recoveries of XRF and XRT products through direct flotation followed by magnetic separation, and through magnetic separation followed by flotation. The test program was further amended to include flotation tests directly on the fresh, low-grade samples representing future run-of-mine grades.

The impact of high intensity conditioning ahead of flotation yielded improved flotation performance. Best flotation results regarding upgrade, recoveries and operating costs were achieved using moderate dosages of the collector Florrea 3900 and Calgon as depressant. Considering the better performing flotation tests, cleaner flotation concentrates yielded overall mass pulls of 2.7-3.9% with a product grade of 4-6% TREO and a recovery of up to 70% TREO. More importantly, the high value Heavy Rare Earth Elements, mainly hosted in xenotime, showed significantly better recoveries (58-75% HREO) than the Light Rare Earth Elements (49-58% LREO). Four bulk flotation tests demonstrated repeatable flotation performances on the low-grade feed material. The cleaner flotation produced a concentrate ranging from 4.7 - 6% TREO.

The objective of the 2023-2024 test program was to scale up tests, including locked-cycle testing for a high level of confidence in metallurgy, and confirmation of engineering design criteria for PFS capital and operating cost estimation. The locked cycle tests were completed and confirmed a steady circuit. No significant detrimental effect was observed due to the recirculation.

A 5 tons run of mine ore sample, at head grade of 0.18% TREO, was shipped to SGS Lakefield for pilot plant testing in a continuous milling and flotation regime for recovery of a rare earth concentrate. The main objectives were to validate the flowsheet that had been developed at bench scale in a continuous pilot plant and to generate a sufficient mass of flotation concentrate for downstream hydrometallurgical test work. A continuous flotation pilot plant was run on the ROM Bulk-1 sample at an average throughput of 44 kg/h, for a total of about 105 hours of operation. The results of the flotation pilot plant closely matched the benchmark results and demonstrated the viability of the flowsheet in a scaled up and continuous operation. The total rare earth recovery in the second cleaner concentrate was 55.5% at a grade of 2.65% TREO (including yttrium) and an average mass pull of 3.8%. The average recoveries of terbium and dysprosium were 55.2% and 56.2%, respectively.

Hydrometallurgical test work and results

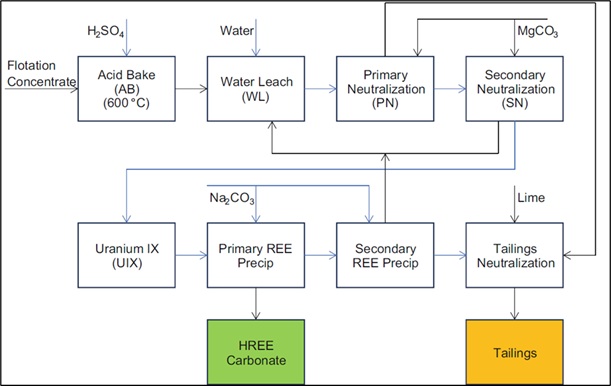

The PFS test program has shown that a simplified acid bake and liquor treatment flow sheet consisting of a high temperature acid bake, two stage (primary and secondary) impurity removal, followed by UIX and two stages (primary and secondary) of HREE carbonate precipitation is able to produce a high grade HREE carbonate. The flow sheet developed in this program (Figure 3) has eliminated several unit operations from the original flowsheet in the PEA. The removal of crude REE precipitation, re-leach and thorium solvent extraction forms a significant simplification and overall reduced reagent demand.

The following conclusions summarize key findings of the test program:

• Under optimum operating periods, continuous high (600°C) temperature sulfation in a pilot rotary kiln yielded high HREE dissolution (94% Tb/Dy).

• Batch tests were used to show that two stages of impurity removal using magnesium carbonate was able to remove practically all thorium, scandium, iron, aluminium and some of the uranium at minimum losses of HREE (~2%).

• Uranium was removed by ion exchange using a conventional strong base anion resin (Puromet MTA4601PF). Uranium levels were reduced to below detection limit (0.02 mg/L U) with negligible co-extraction of HREE.

• The U IX barren liquor was used in a mini pilot plant where a HREE carbonate was produced. The circuit consisted of two stages (primary and secondary) of precipitation using sodium carbonate.

Mine Plan and Mine Schedule

The proposed mining method is conventional open pit mining. Mineralized rock and waste will be drilled, blasted, loaded with hydraulic shovels and excavators onto off-highway dump trucks, and hauled to the processing plant or designated waste rock dumps.

The pit design and production scheduling by QUBEKA Namibia is based on the mineral resource models developed by MSA, appropriately modified for mining dilution and losses. The pits are designed at 10 m benches and 2.5 m flitches where selective mining is required. The proposed mining method allows for simultaneous selective mining of ore and waste in the incremental pit phases. A mining contractor will provide the full mining services under direction from an Owners' technical services team.

Mineral Reserves for Area 4 and Area 2B are summarized in Table 3 below. The pit designs delineated total Proven and Probable Reserves of 32 Mt at 0.176% TREO grade.

The target ROM feed is 1.10 Mt/a of high-grade material along with 1.91 Mt/a of low-grade material, for a total of 3.01 Mt/a ROM feed.

Mining involves stripping ratios for Area 4 pit of 6.4:1 and 8.7:1 for Area 2B pit for a total Life-of-Mine stripping ratio of 6.8:1, with supplemental pits improving grade continuity.

The initial Life-of-Mine for this PFS is 13 years. The overall average mining rate is approximately 20 Mt/a.

Table 2: Lofdal Mineral Reserves as of December 01st 2025

Reserve | Mineral Deposit | Tonnage | Rare Earths Grades | Contained Rare Earths Metal | ||||

LREO | HREO | TREO | LREO | HREO | TREO | |||

(Mt) | (%) | (%) | (%) | (t) | (t) | (t) | ||

Proven | Area 2B | - | - | - | - | - | - | - |

Area 4 | 6.19 | 0.068 | 0.144 | 0.211 | 4,194.0 | 8,893.2 | 13,087.1 | |

Total Proven | 6.19 | 0.068 | 0.144 | 0.211 | 4,194.0 | 8,893.2 | 13,087.1 | |

Probable | Area 2B | 1.90 | 0.075 | 0.094 | 0.169 | 1,430.3 | 1,792.8 | 3,223.1 |

Area 4 | 23.91 | 0.076 | 0.091 | 0.167 | 18,269.3 | 21,761.6 | 40,030.7 | |

Total Probable | 25.81 | 0.076 | 0.091 | 0.168 | 19,699.7 | 23,554.4 | 43,253.8 | |

Total Reserves | 32.01 | 0.075 | 0.101 | 0.176 | 23,893.7 | 32,447.5 | 56,340.9 | |

Notes on the Mineral Reserve:

Mineral Reserves are reported at a cutâoff grade of 0.10% TREO, based on a basket rare earths oxide price of US$ 86.84/kg. Mineral Reserves are reported using a conservative basket price of USD 86.84/kg for cut-off determination; economic analysis uses independently benchmarked scenario-based pricing.

Mineral Reserves are base