on WENDEL INVESTISSEMENT (EPA:MF)

Wendel Initiates Accelerated Sales of Bureau Veritas Shares

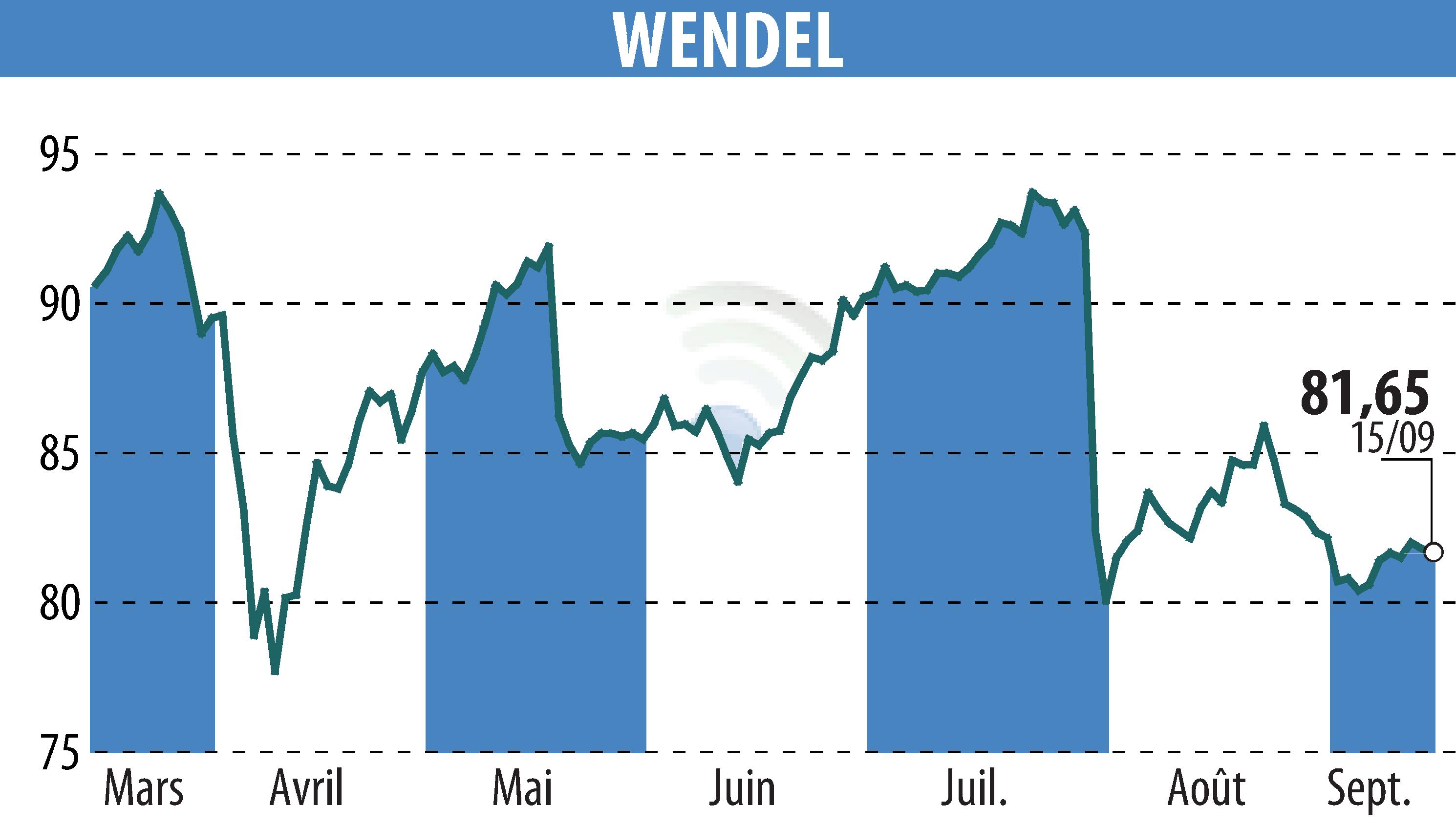

On September 15, 2025, Wendel announced the accelerated placement of approximately 23.3 million Bureau Veritas shares. These shares are linked to exchangeable bonds maturing in March 2026, issued by Wendel in March 2023. The placement targets qualified investors, including international institutional investors.

Originally, Wendel raised 750 million euros through these bonds, benefiting from a lower annual coupon of 2.625% due to its optional feature. By executing this transaction, Wendel aims to monetize the shares and manage the optional component effectively through hedging. The placement is managed by BNP PARIBAS and Goldman Sachs Bank Europe SE, who will buy 2.3 million shares as hedging counterparties.

Post-placement, Wendel's stake in Bureau Veritas will fall to 21.4% of share capital and 35% of voting rights. Settlement is anticipated on September 18, 2025.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all WENDEL INVESTISSEMENT news