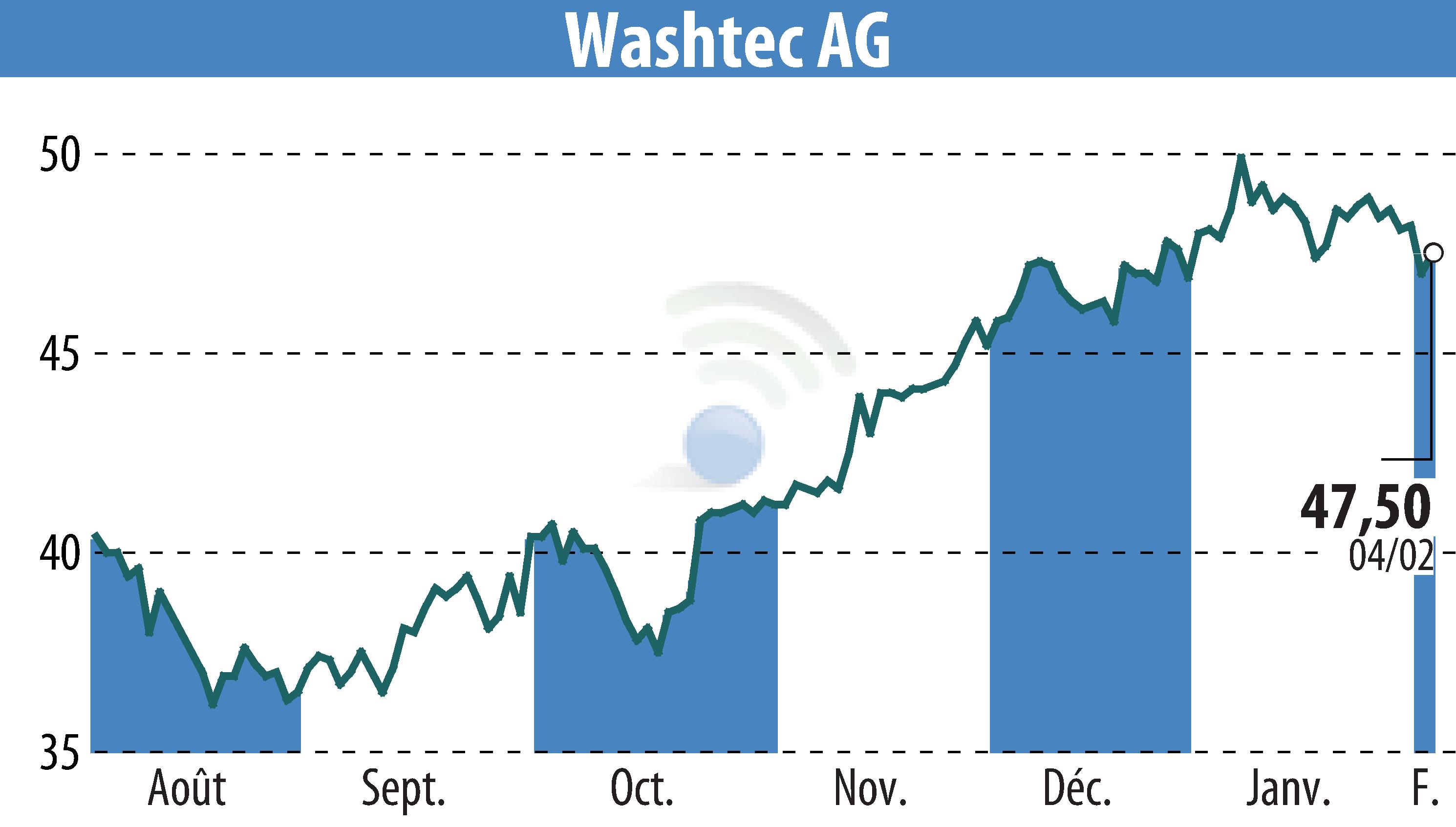

on WashTec AG (ETR:WSU)

WashTec AG Reports Strong Preliminary Results for 2025

WashTec AG has announced preliminary financial figures for the year 2025, highlighting a successful performance. The company is expected to post a revenue of €499 million, reflecting a 5% growth from the previous year's €476.9 million. This marks the highest revenue the company has achieved to date. The operating profit (EBIT) is projected at €49 million, an 8% increase from €45.5 million, with an EBIT margin improving to approximately 9.8% from 9.5%.

Despite a slight dip in fourth-quarter revenue to €140 million, the operating profit remained robust at €17 million. The return on capital employed (ROCE) increased to around 25% from 23.6%, indicating strong capital returns. Free cash flow also rose to €42 million, up from €39.5 million in the previous year.

WashTec's workforce expanded to 1,861 employees, a rise from 1,770 in 2024. The company's order backlog remains strong, supporting sustainable demand. Full financial statements with final figures will be released on March 26, 2026, with the Annual General Meeting scheduled for May 12, 2026.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all WashTec AG news