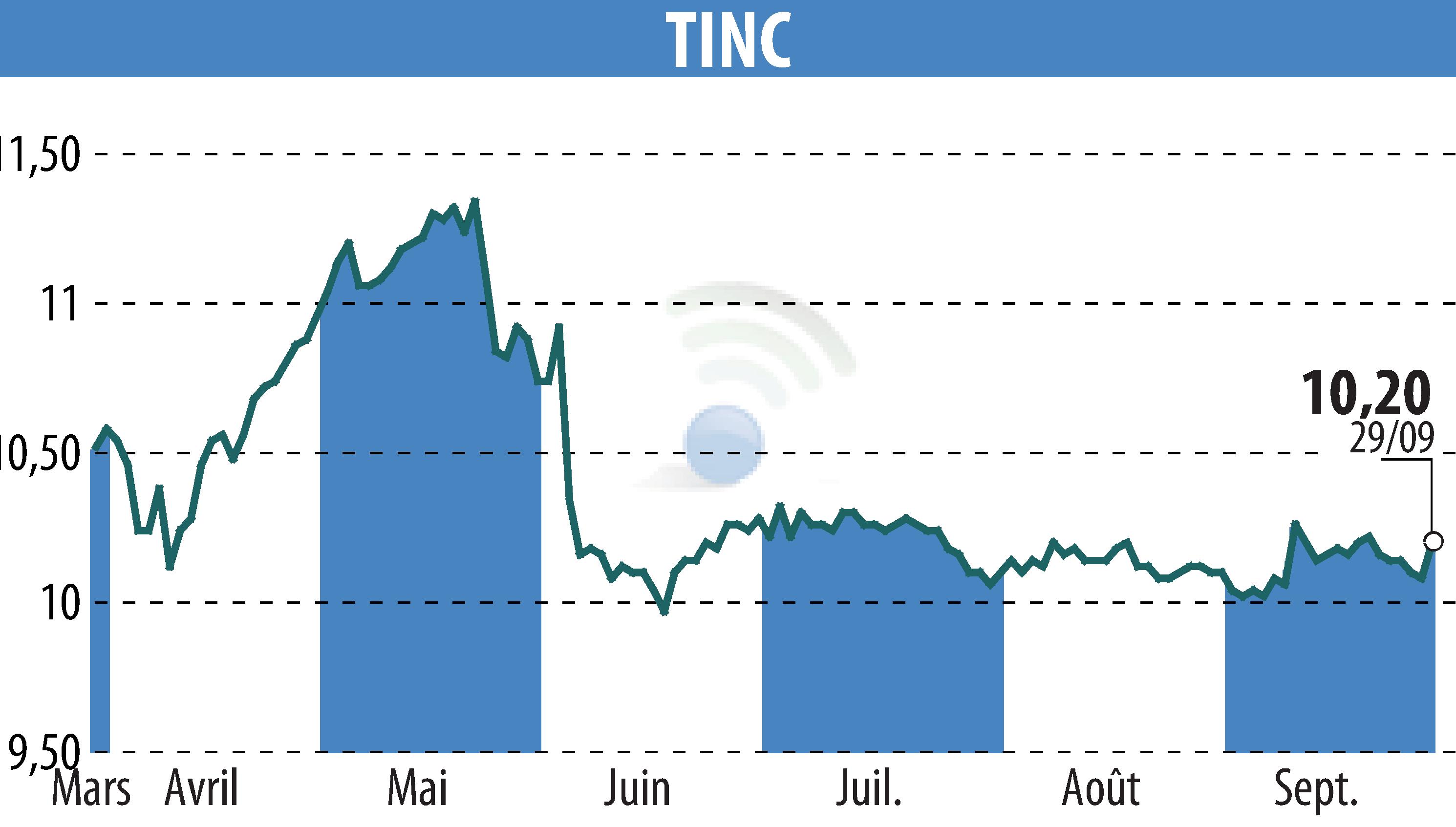

on TINC (EBR:TINC)

TINC Secures €120 Million Refinancing for Datacenter United

TINC, a key player in infrastructure investment on Euronext Brussels, confirmed the successful refinancing of its portfolio company, Datacenter United (DCU). The refinancing deal, valued at €120 million, was secured through a consortium of banks including Belfius Bank, DNB, and NIBC Bank.

This financial package comprises a €50 million drawn term loan designed to refinance existing senior debt and shareholder loans. In addition, a €50 million undrawn capex facility is allocated to support DCU's expansion and acquisitions. The package also includes a €20 million revolving credit facility to manage working capital and other corporate needs.

TINC benefits from this restructuring with a €19 million cash distribution, aligned with its 47.5% stake in DCU. These funds will help reduce TINC's revolving credit facility commitment of €200 million. As of June 30, 2025, TINC's net debt stood at €33.8 million.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all TINC news