on DEUTZ AG (ETR:DEZ)

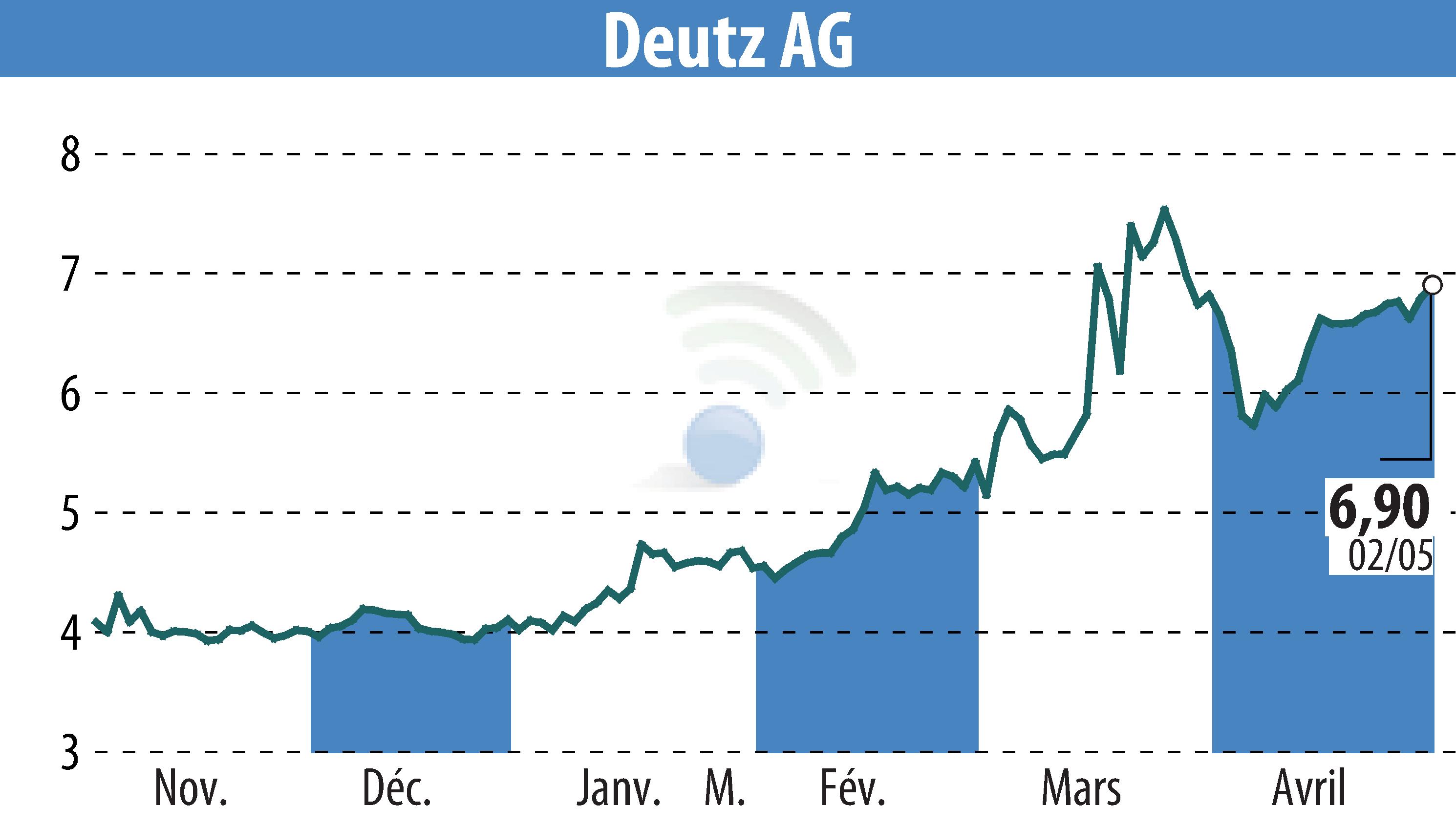

Strong Start to 2025 for Deutz AG Despite Challenges

In the latest research by Quirin Privatbank, Deutz AG has received a positive outlook with a "Buy" recommendation. The company experienced a successful beginning to fiscal year 2025, evidenced by an impressive 30.3% year-over-year increase in order intake, totaling EUR 546.1 million for Q1/25.

Even with geopolitical uncertainties, DEZ is poised for growth. Key factors include recent acquisitions like Blue Star Power Systems in the US and RRPS distribution activities which are expected to bolster revenues. Despite a cyclical downturn in its core engine business, service revenues show promising growth potential in 2025. Forecasts predict annual revenues reaching EUR 2,275 million, up by roughly 25% year-over-year, with an adjusted EBIT of EUR 117.5 million.

The potential for growth also exists in the military and security industries, with current contributions just below 2%. On the valuation side, DEZ, with low multiples and comparatively discounted valuations, still offers attraction, reflected in the increased target price from EUR 8.00 to EUR 9.00.

R. H.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all DEUTZ AG news