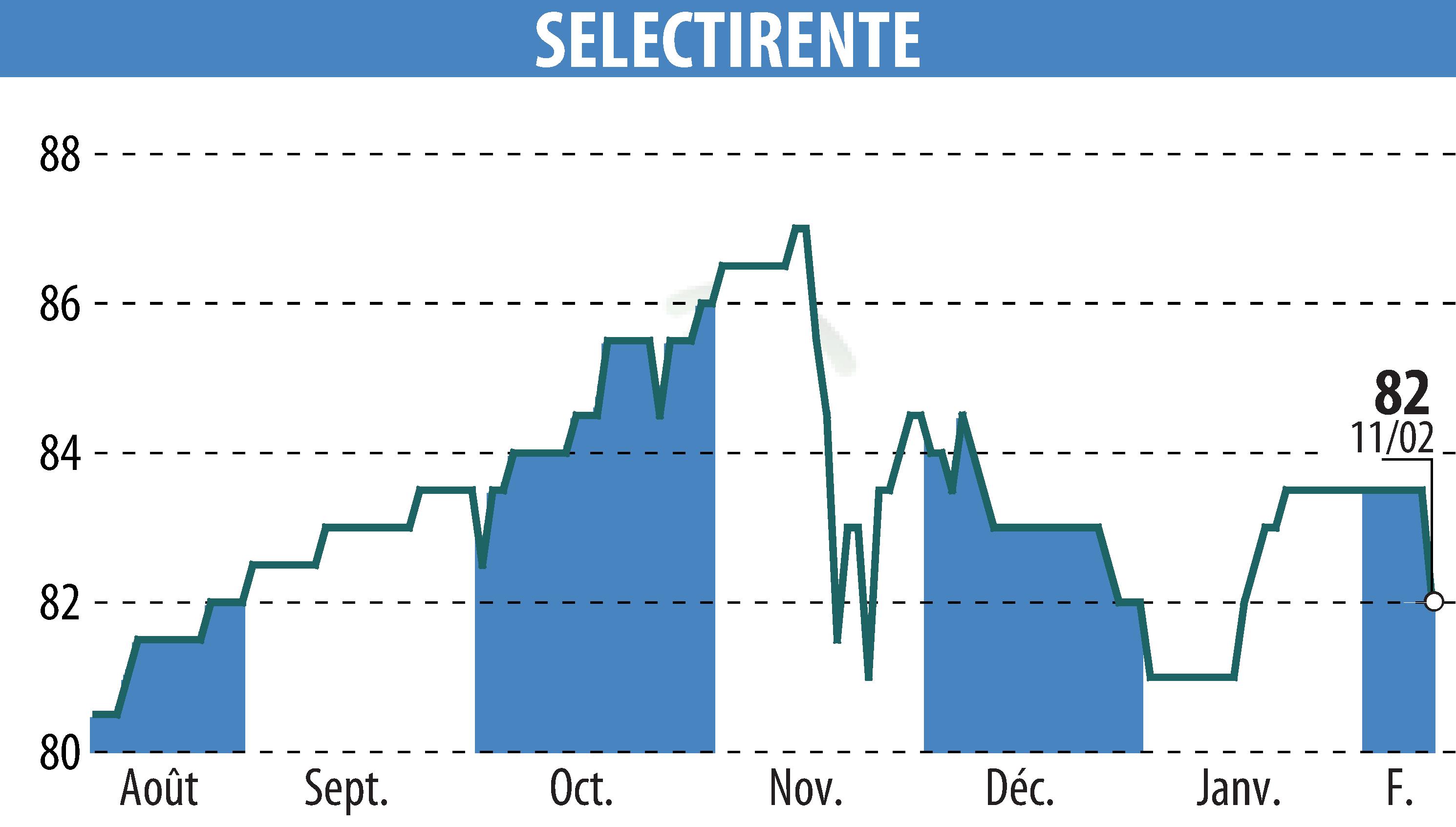

on SELECTIRENTE (EPA:SELER)

SELECTIRENTE: 2025 Review and 2026 Outlook

SELECTIRENTE recorded solid growth in its portfolio in 2025, valued at €577 million, representing a 1.8% increase on a like-for-like basis. The year was marked by targeted acquisitions totaling €18.7 million and disposals generating €6.9 million in distributable capital gains. IFRS net income reached €26.9 million, despite an average cost of debt rising to 2.47%. The proposed dividend for 2025 is €4.20 per share, an increase of 2.4%.

For 2026, SELECTIRENTE plans to leverage its €60 million investment capacity in a market favorable to acquisitions. The outlook targets a steady improvement in recurring income and cash flow to support dividend growth. The real estate company continues to strengthen its position in the local retail sector, opting for an active and selective portfolio management approach.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all SELECTIRENTE news