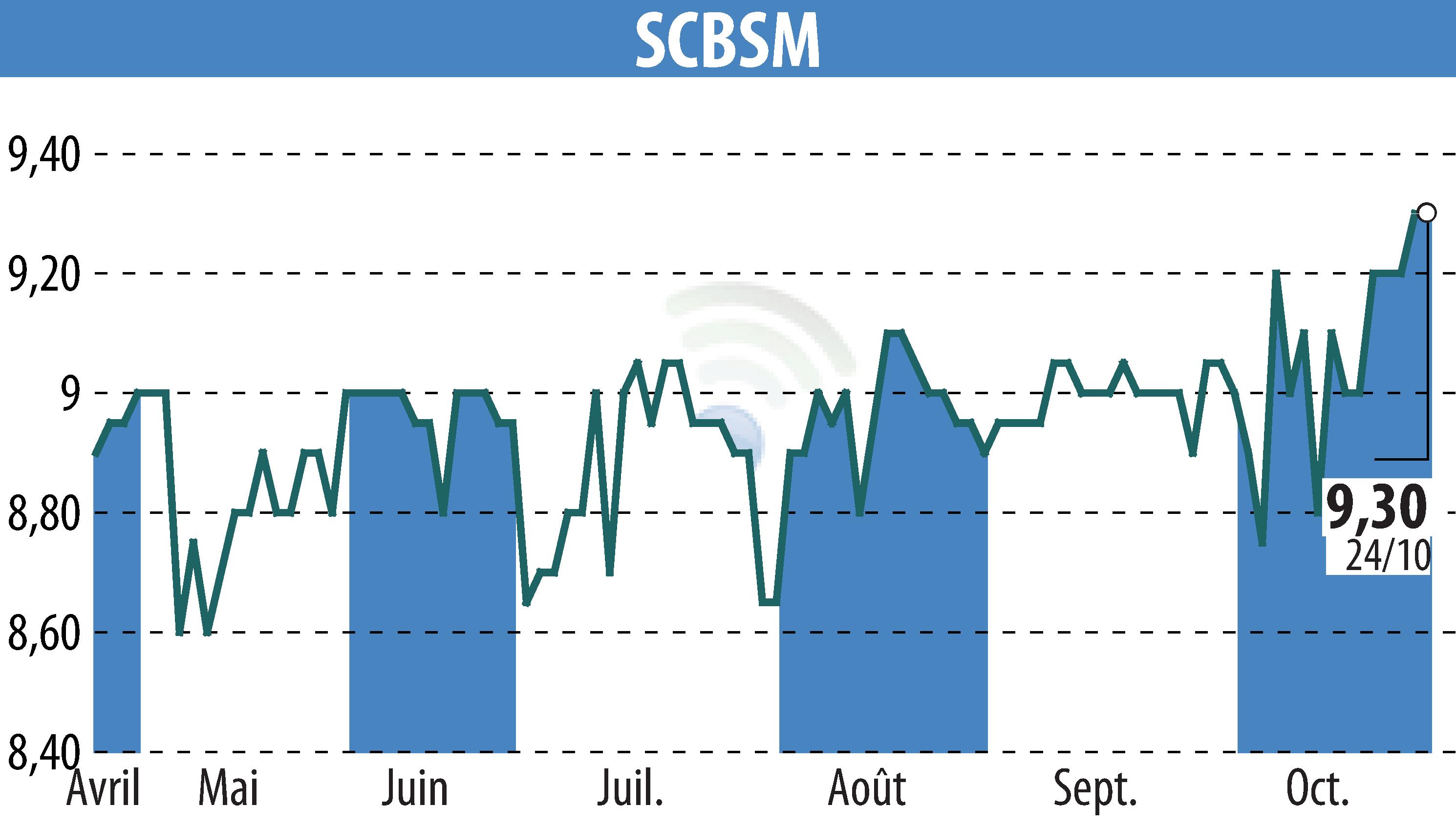

on SCBSM (EPA:CBSM)

SCBSM: Solid Results and Optimistic Outlook for 2024-2025

SCBSM, a real estate company listed on Euronext Paris, has unveiled its results for the 2024-2025 financial year. The company announced an 11% increase in the value of its assets, reaching €468.4 million, primarily concentrated in the Paris CBD. Strategic investments, including the acquisition of a building on Boulevard Haussmann, consolidated this increase.

The debt-to-equity ratio (LTV) rose slightly to 39.7%, while recurring income increased by 15% to €12.4 million. SCBSM also renegotiated certain loans, thereby optimizing its credit costs. Net income amounted to €12.9 million, marking a significant increase thanks to a sound investment strategy.

SCBSM continues to aim to improve the quality of its assets, which is reflected in an increase in Net Asset Value per share to €19.33. At the same time, the Board of Directors is proposing a dividend increase to €0.19 per share for the coming year.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all SCBSM news