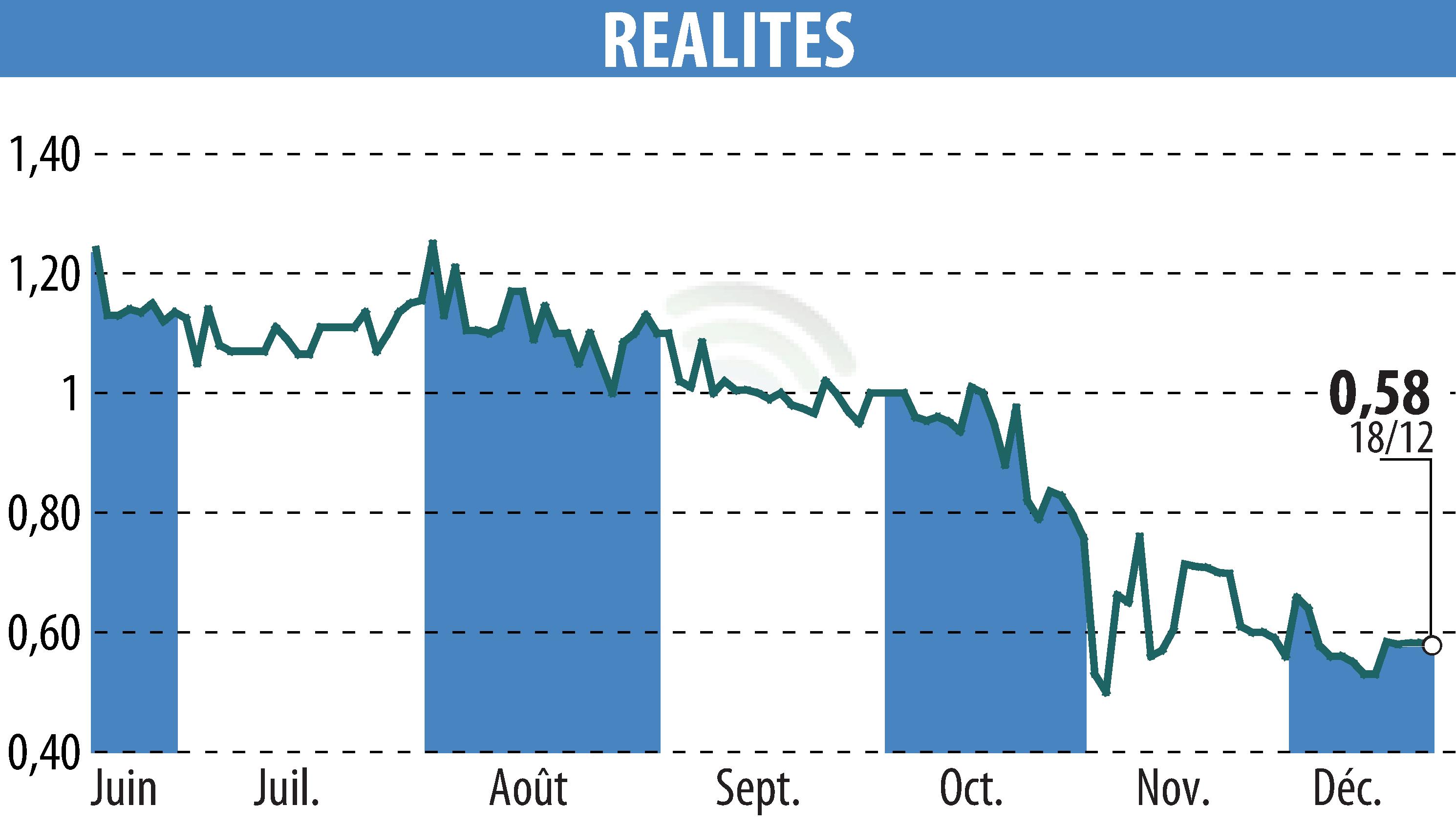

on REALITES (EPA:ALREA)

REALITES unveils its recovery plan after three years of restructuring

Real estate developer REALITES has presented its creditors and shareholders with a plan to emerge from receivership. The measures include debt repayment over ten years and a conversion into equity, resulting in significant dilution for current shareholders. This proposal, to be put to a vote on January 19, 2026, is crucial for finalizing ongoing projects and preserving 500 jobs.

The strategy is based on three pillars: rationalization through the sale of non-strategic activities, debt reduction via a debt conversion plan, and stabilization of governance around a strengthened executive committee.

To adapt to a transformed real estate market, REALITES is strengthening its core business in property development, focusing on joint ventures, and developing a sales network with ISIA. The transformation into a limited partnership with shares aims to ensure sustainable and engaged governance.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all REALITES news