on PVA TePla AG (ETR:TPE)

PVA TePla Increases Order Intake, Eyes Moderate Growth in 2026

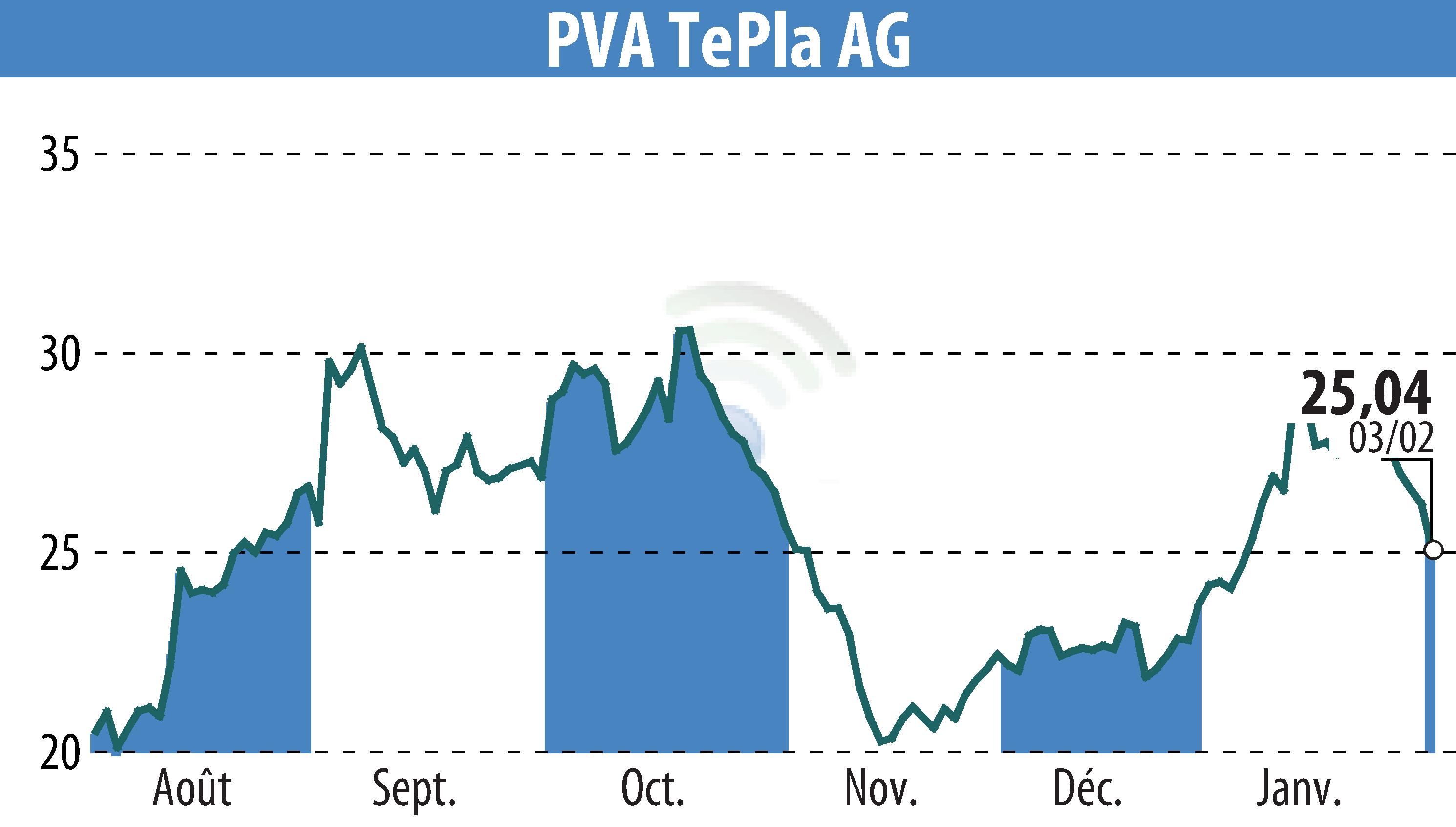

PVA TePla AG, a leader in materials and measurement technology, reported a significant increase in order intake for 2025, despite a challenging market environment. This sets a solid foundation for future growth. However, project-related delays impacted the company's revenue and earnings, with 2025 revenue at EUR 244 million, down from EUR 270.1 million in 2024. EBITDA also decreased to EUR 25 million from EUR 47.8 million.

The company saw order intake rise to EUR 268 million, surpassing revenue and maintaining a book-to-bill ratio above 1. Despite trade policy uncertainties affecting project timelines, CFO Markus Groß expects progress in 2026, with a revenue range of EUR 255 million to EUR 275 million and EBITDA between EUR 26 million and EUR 31 million.

Looking beyond 2026, PVA TePla aims for significant revenue growth in 2027, exceeding EUR 300 million, with future revenue targets set at EUR 500 million.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all PVA TePla AG news