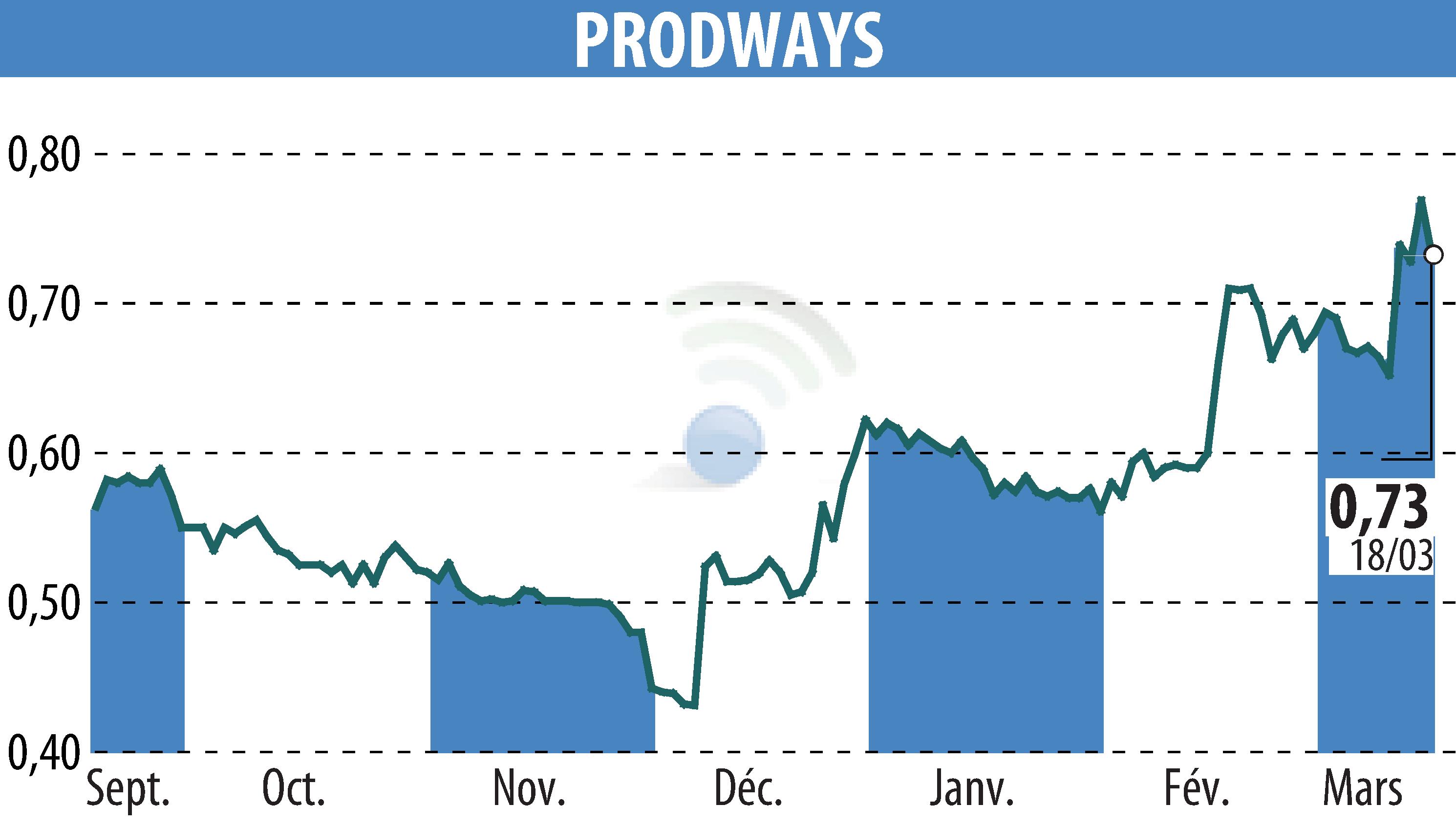

on PRODWAYS (EPA:PWG)

Prodways 2024 Review: Strengthened Stability and Profitability

Prodways Group recorded revenue of €59 million in 2024, unchanged from 2023. The recurring EBITDA margin climbed to 9%, marking a remarkable improvement, particularly in the second half, when it reached 10%. This performance demonstrates the group's discipline in the face of a challenging market.

The company also strengthened its operating cash position, reaching €4.4 million, an 18% increase compared to last year. This was accompanied by a reduction in working capital requirements and tax expenses.

The Systems division benefited from an increased industrial focus, while the Products division suffered from declining revenues. The group plans to address this in 2025 to improve profitability.

Finally, the transfer of listing to Euronext Growth Paris, voted in March 2025, aims to better adapt the regulatory framework to the group's needs and to optimize its profitability.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all PRODWAYS news