on POXEL (EPA:POXEL)

Poxel's Financial Results and Governance Changes in H1 2025

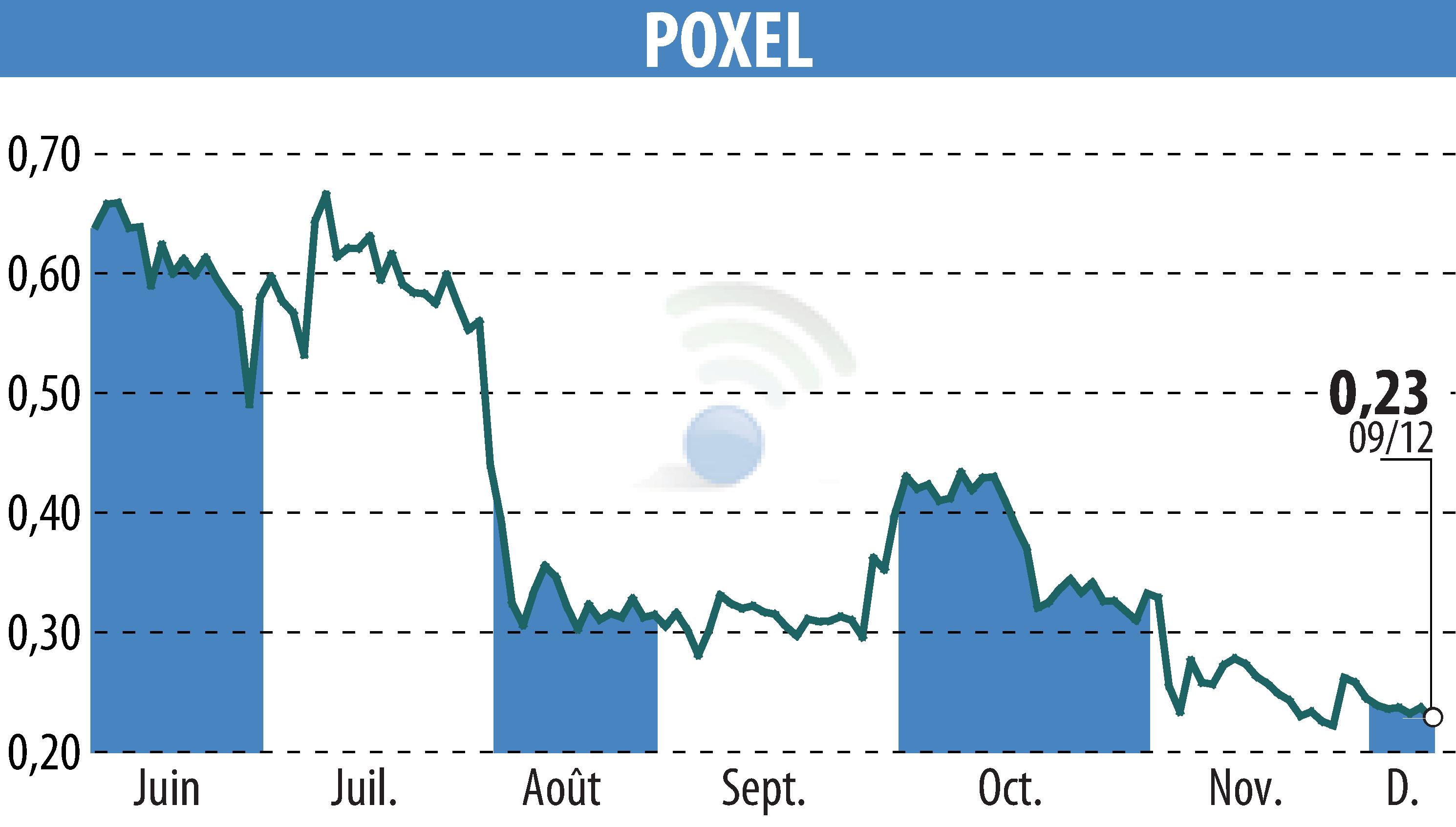

Poxel published an 88% revenue increase and reduced net losses to €2.6 million in H1 2025. Despite financial improvements, the company faces receivership proceedings initiated following a declaration of insolvency. These proceedings will be observed until February 5, 2026, with a recovery plan pending court approval.

Revenue rose to €2.183 million, primarily from royalties on TWYMEEG® sales in Japan. Yet, costs of sales were significant at €1.877 million due to royalties payable to Merck Serono. Despite reduced administrative expenses from cost-saving measures, Poxel recorded ongoing financial losses.

Significant governance and strategy shifts included appointing Yves Decadt to the Board, aiming to support recovery and growth through strategic partnerships. The upcoming shareholders' meeting on December 11, 2025, could play a pivotal role in Poxel's future financial and strategic direction.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all POXEL news