on PNE WIND AG (ETR:PNE3)

PNE AG's Market Challenges and Strategic Adjustments

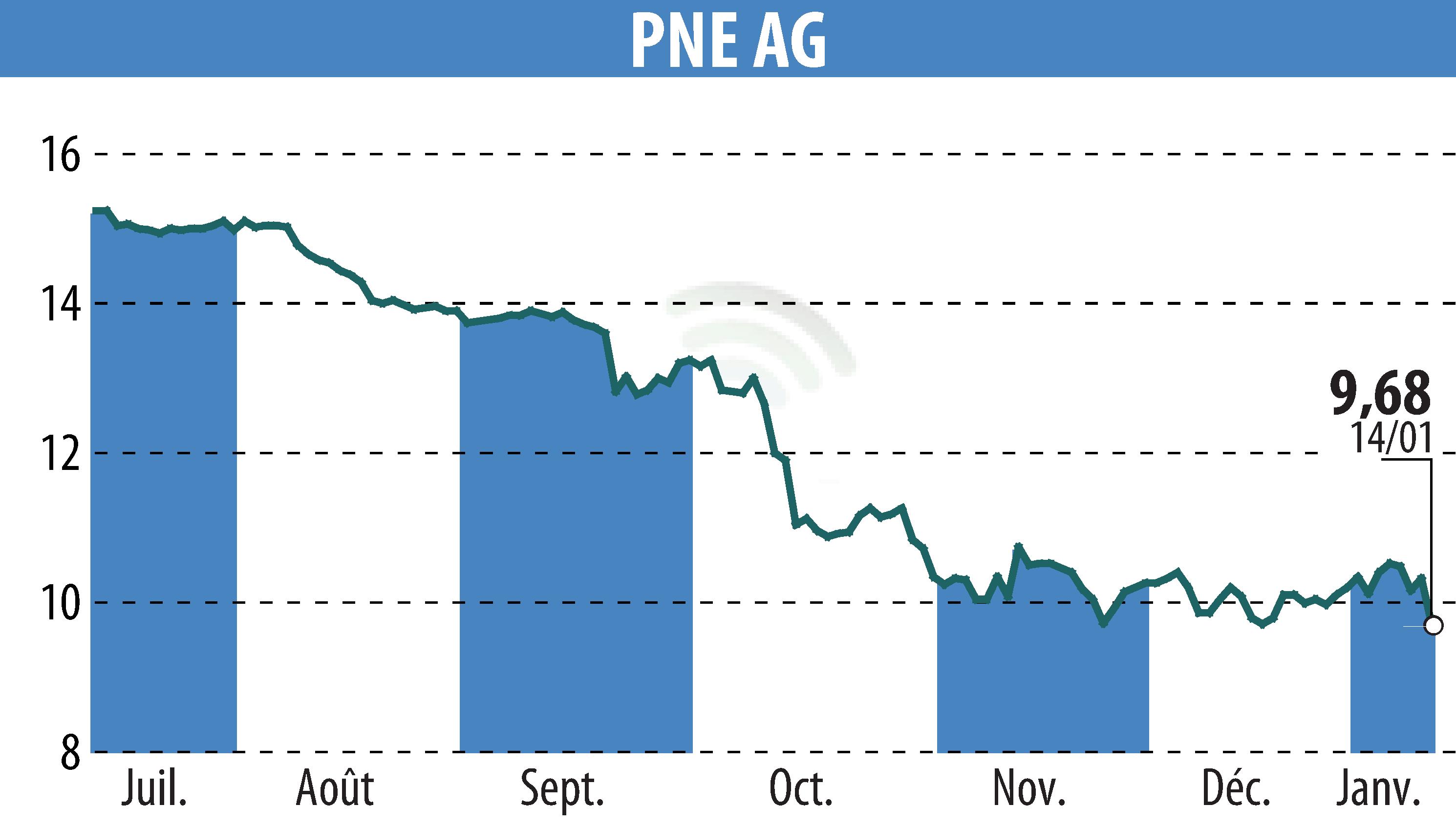

PNE AG has released a profit warning due to impairments in its project pipeline, estimated at €20 to €25 million. This is a response to worsening market conditions, particularly in Canada, Spain, and Romania. Despite these adjustments, PNE AG's current liquidity remains unaffected. The company now projects a lower EBITDA target for 2025 between €45 million and €60 million, down from the previous range of €70 million to €110 million.

The challenges faced are tied to intensified competition in the German market, which might lead to margin pressures. Nonetheless, PNE AG is seen as potentially resilient due to its streamlined project pipeline and its portfolio of green energy assets generating robust cash flows. A focus on core markets like Germany, France, and Poland, alongside a rigorous cost-efficiency program, is expected to aid in overcoming industry hurdles.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all PNE WIND AG news