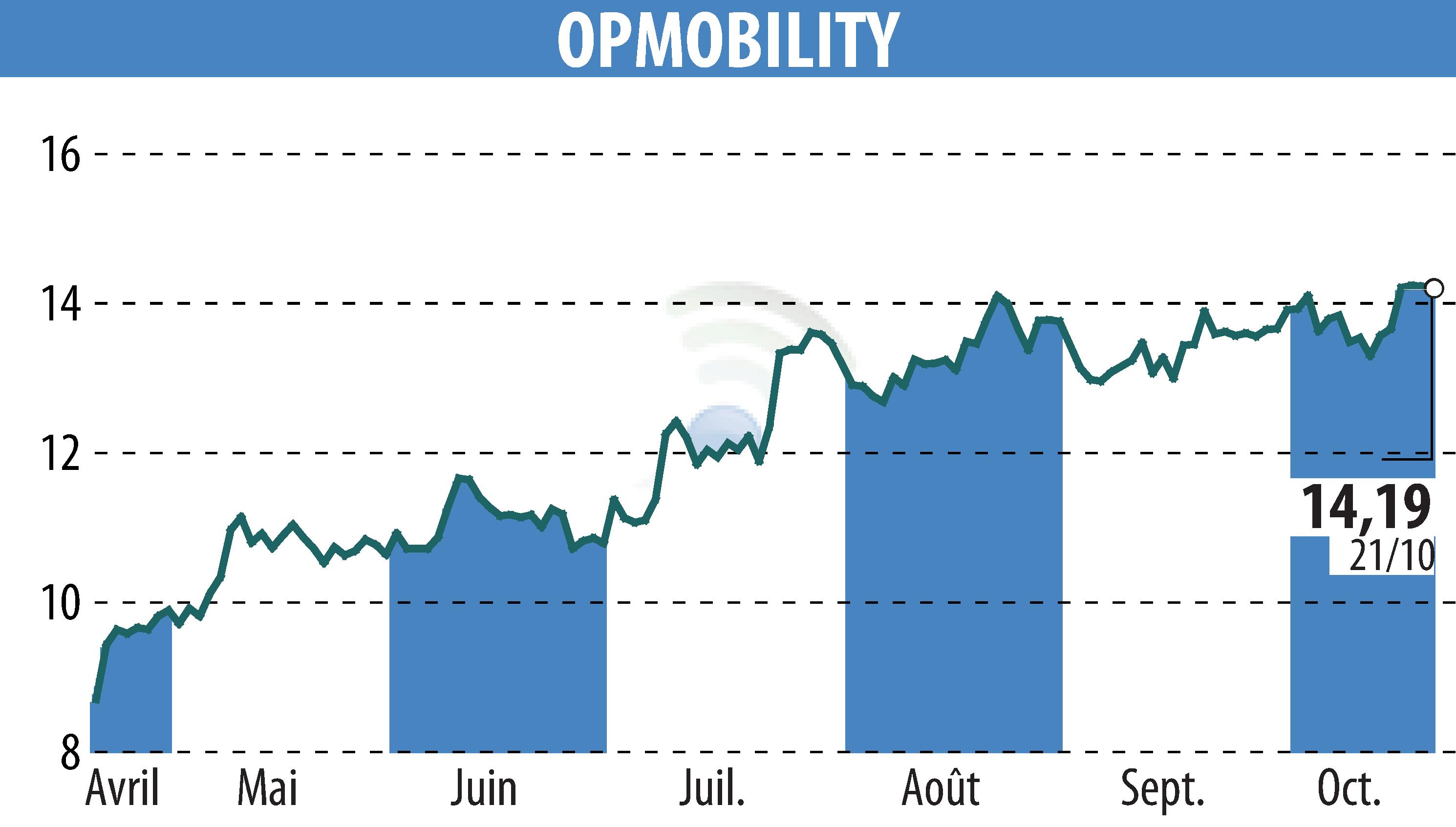

on OPMobility (EPA:OPM)

OPmobility's Q3 2025 Revenue: A Steady Climb

OPmobility reported a 2.6% organic growth in economic revenue, totaling €2,719 million for Q3 2025. This increase was primarily driven by robust performances in the Exterior and Powertrain segments, despite a 1.0% overall decline when accounting for currency effects. The joint ventures, notably in China and South Korea, experienced a significant 32.1% growth.

The company's strategy of geographical and customer diversification played a pivotal role in this growth, particularly in North America and Asia. In North America, revenue increased by 9.0%, while in Asia, a 15.9% rise in like-for-like economic revenue was noted, outperforming the regional automotive production growth rate.

With a solid financial structure bolstered by a €300 million bond issued in July, OPmobility remains optimistic about achieving its 2025 targets, focusing on cost-saving measures and strategic expansions, especially in the rapidly growing Indian market.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all OPMobility news