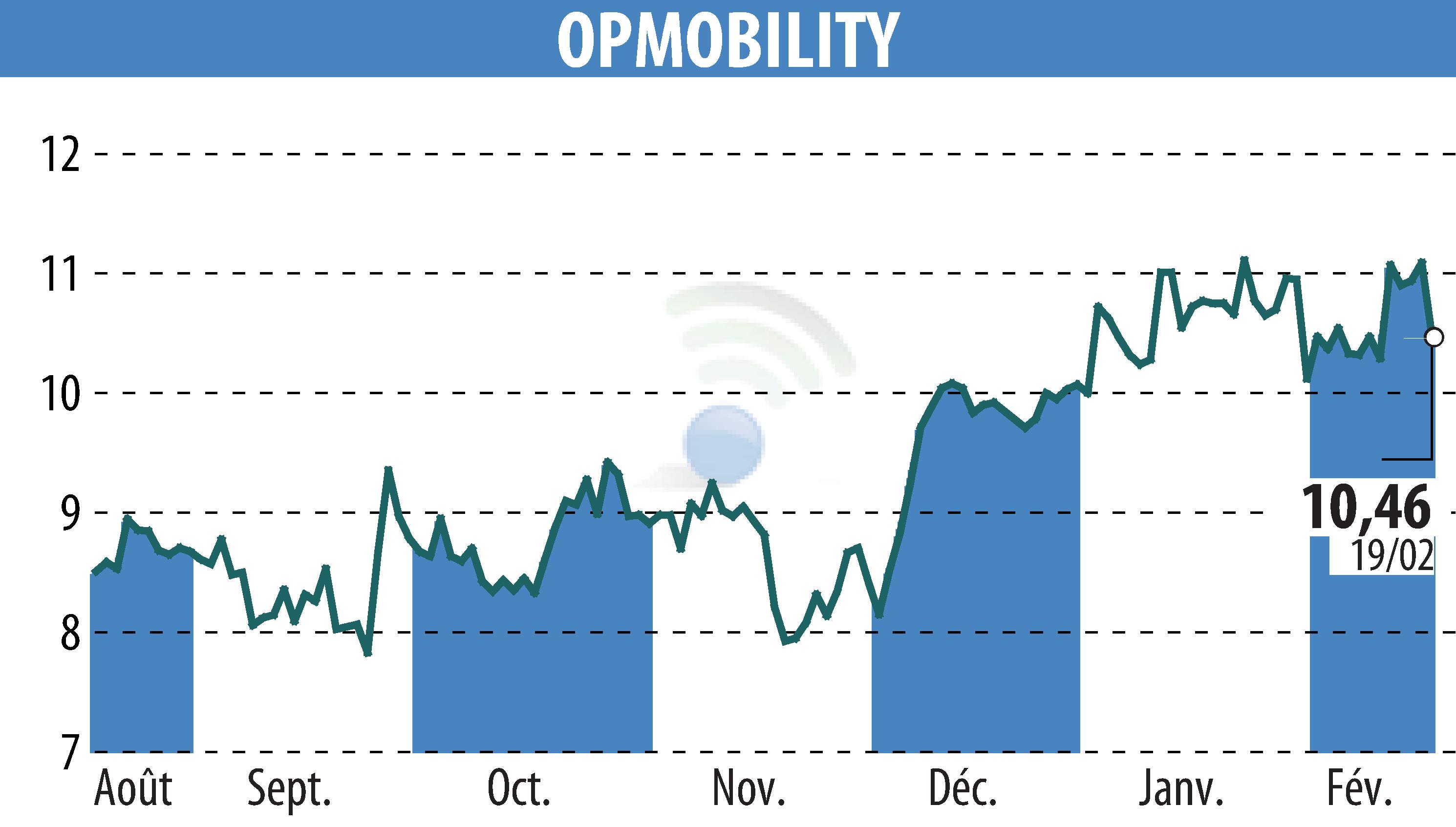

on OPMobility (EPA:OPM)

OPmobility Reports Positive 2024 Financial Results

OPmobility announced a revenue increase of 2.8% to €11.6 billion for 2024, surpassing the automotive market by 4.0 points. The company’s growth stems from a successful diversification strategy. Operating margin showed a significant improvement, increasing by 11.4% to €440 million, aided by controlled costs and robust activity. This growth also led to a 4.2% rise in net results, reaching €170 million.

The company generated €246 million in free cash flow, marking an 8% increase from 2023. OPmobility is on track to achieve carbon neutrality on scopes 1 and 2 by 2025 and received an "A" CDP Climate rating. The Board proposes a dividend of €0.60 per share for shareholders.

Looking ahead, OPmobility aims to continue its diversification strategy to maintain financial health and competitiveness amidst stable but regionally varied auto production forecasts for 2025.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all OPMobility news