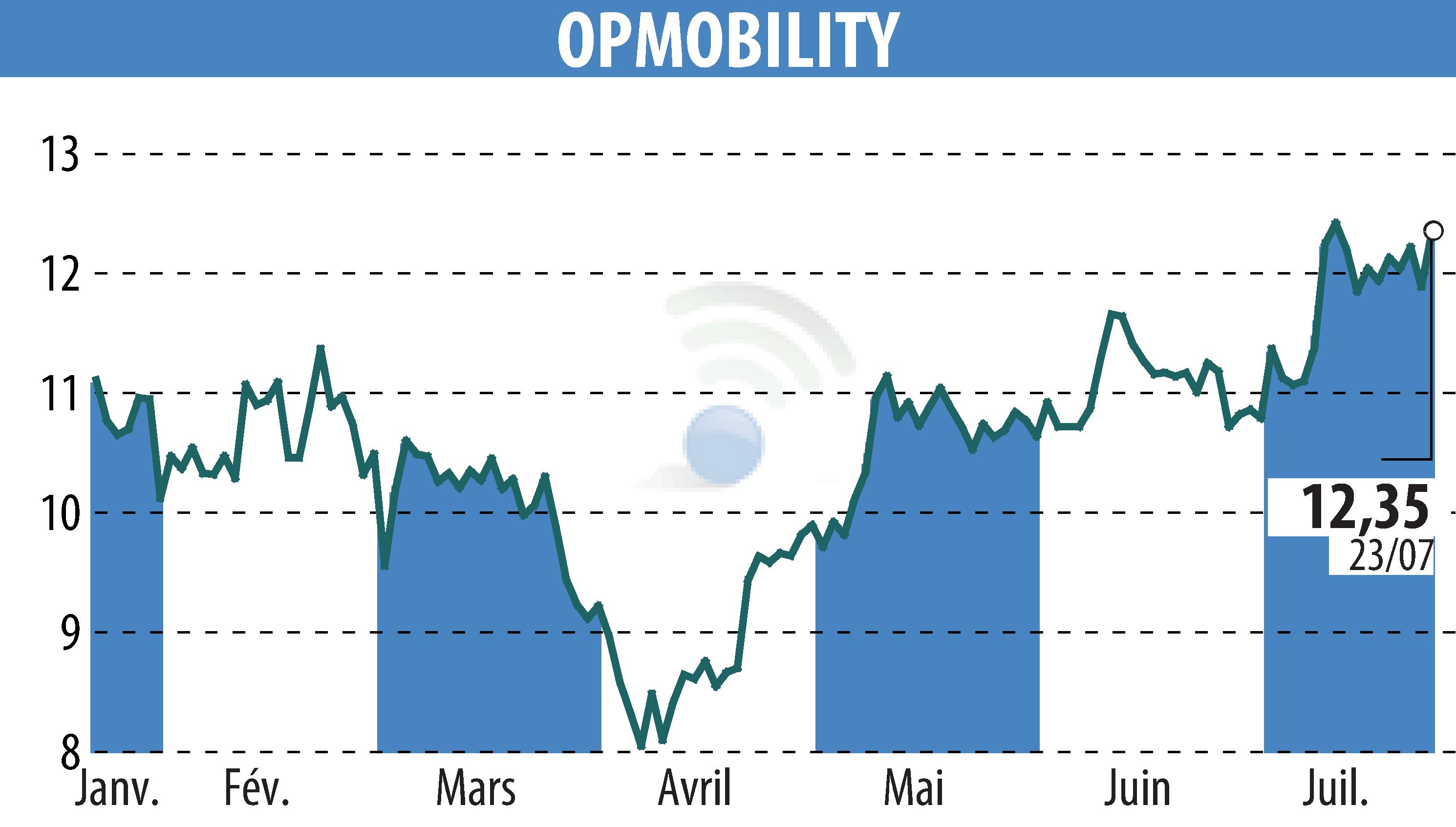

on OPMobility (EPA:OPM)

OPmobility Achieves Solid Half-Year Results Amid Industry Changes

OPmobility delivered robust results in the first half of 2025, showing an 11% rise in operating margin. The increase is attributed to accelerated cost reduction measures. The company reported a rise in free cash flow, reaching €165 million, supported by improved operating margins and controlled investments. Economic revenue rose slightly to €5,960 million, with contributions primarily from the Modules segment. Despite global automation market shifts, OPmobility is reaffirming its 2025 objectives by maintaining cost-saving initiatives and minimizing net debt. These efforts resulted in debt reduction to €1,459 million, with leverage at 1.5x EBITDA.

Despite facing a complex market environment with tariff uncertainties and currency impacts, OPmobility's adaptability proved effective. Performance in North America and Europe faced challenges, while Asia, notably Southeast Asia, saw significant revenue growth. As OPmobility continues to reinforce its market position through diversification and transformation strategies, the company remains optimistic about achieving its 2025 outlook.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all OPMobility news