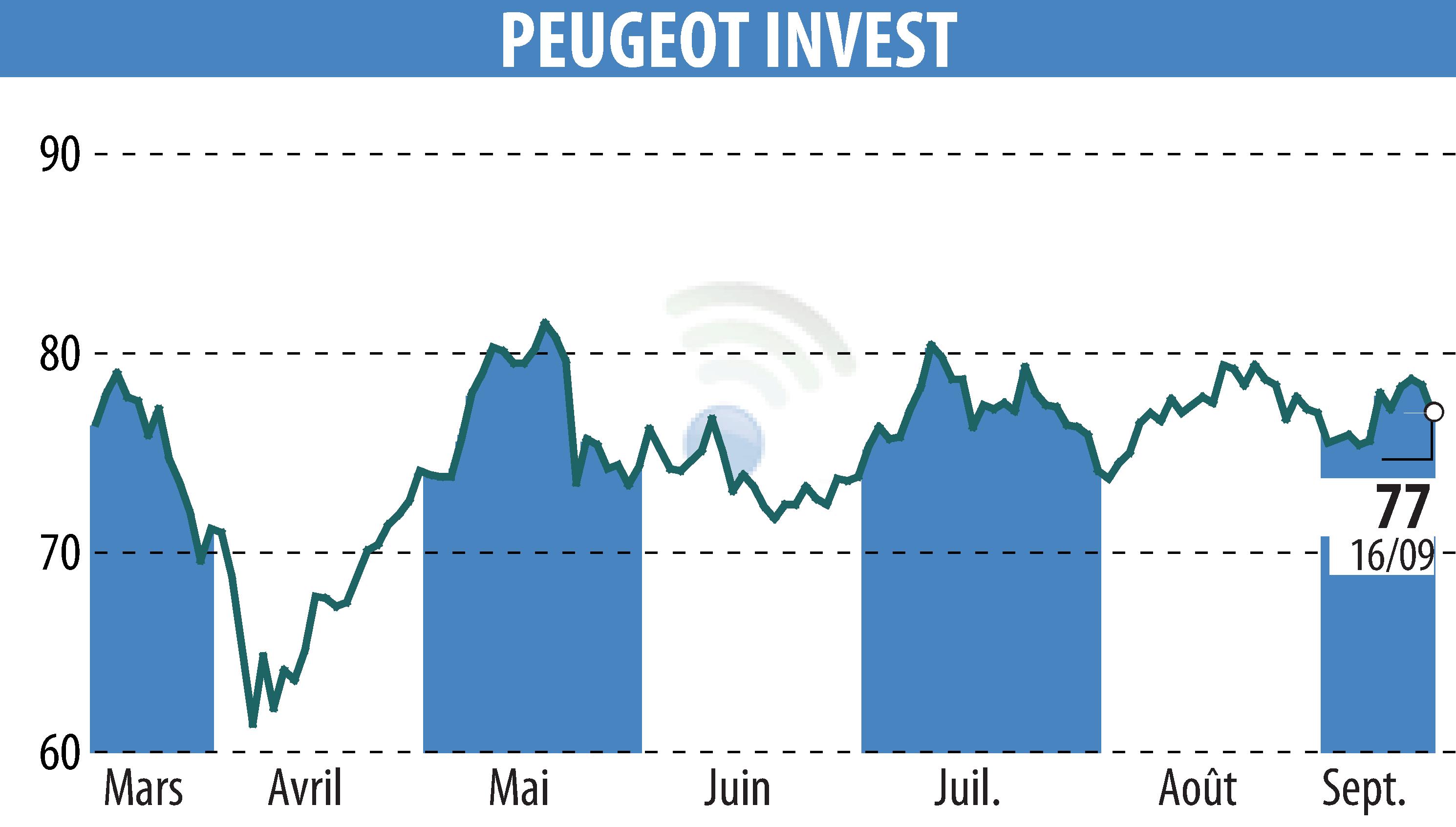

on Peugeot Invest (EPA:PEUG)

Peugeot Invest's Strategic Shift Amid Challenging Market Conditions

As of June 2025, Peugeot Invest implemented a new investment strategy amidst volatile market conditions. The company's Net Asset Value (NAV) dropped to €157.9 per share, a -11.8% performance, primarily impacted by a 33% decline in Stellantis' share price and a €160 million currency loss due to dollar depreciation.

The firm continues to realign its portfolio, exiting SPIE, JDE Peet’s, and IHS, and making new investments in Novétude and BroadStreet Partners. These strategic moves are part of a larger plan focusing on concentrated and sector-specific investments.

Despite setbacks, investments performed robustly at constant exchange rates, achieving a +9.2% gain. The company's net debt reduced to €339 million, showcasing strong financial flexibility and a low 7.5% Loan-to-Value ratio, positioning Peugeot Invest well for future opportunities.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Peugeot Invest news