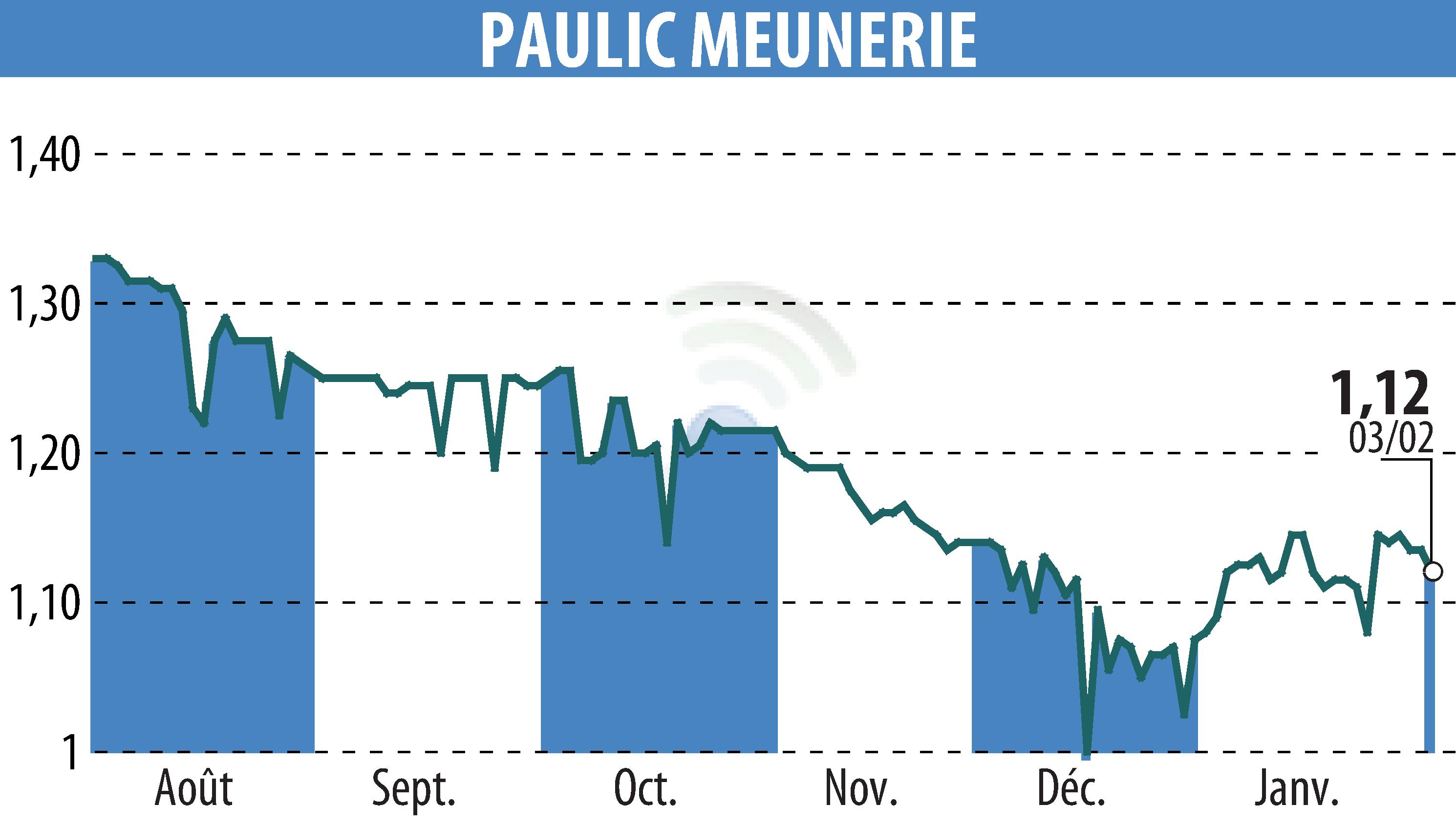

on PAULIC MEUNERIE SA (EPA:ALPAU)

Paulic Meunerie: 2025 Review and 2026 Outlook

In 2025, Paulic Meunerie experienced stable volumes with an annual production of 39.3 kT, representing a slight increase of 0.2% compared to 2024. Despite a decrease in turnover of 4.9%, settling at €18.25 million, the company is forecasting a significant improvement in gross margin, rising to 35% of turnover compared to 30% the previous year.

This performance is linked to a context of falling wheat prices and a strengthened commercial strategy. The integration of new contracts, particularly with large retailers, is seen as a growth driver. The grocery and foodservice segments are showing positive momentum, with respective volume increases of 15% and 9%.

Optimistic forecasts for 2026 are put forward thanks to a robust commercial pipeline and industrial investments, promising increased volumes and improved profitability.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all PAULIC MEUNERIE SA news