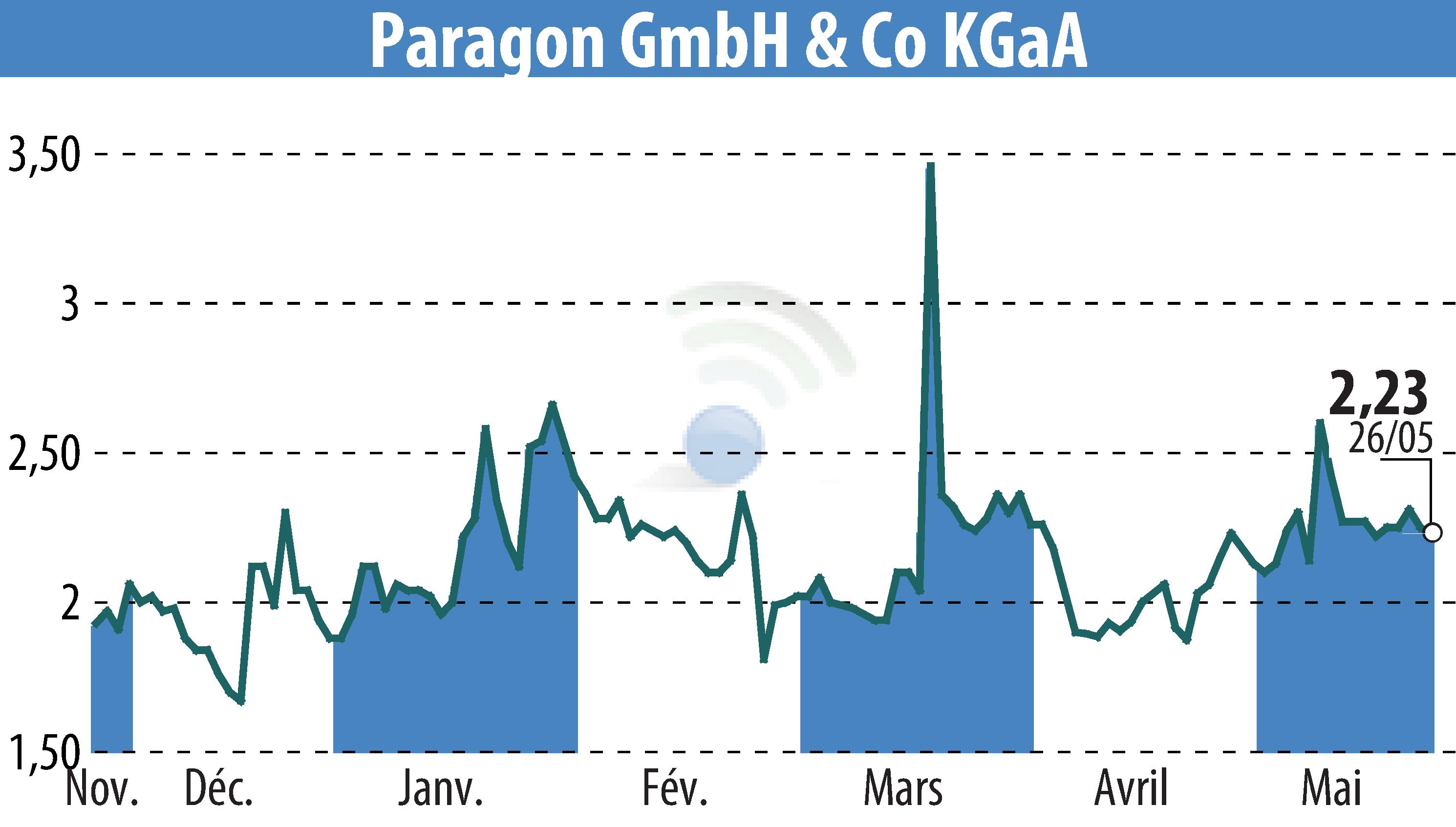

on Paragon AG (ETR:PGN)

Paragon Reports Increased Earnings Amid Stable Revenue in Q1 2025

Paragon GmbH & Co. KGaA announced an increase in earnings despite stable revenue in Q1 2025. Sales remained steady at €29.3 million compared to Q4 2024, although 28.3% lower year-on-year due to reduced customer orders and the divestment of the starter battery business.

The company reported a 9.4% rise in EBITDA to €4.5 million, driven by prior cost-saving measures. The EBITDA margin improved to 15.4% from the previous year’s 10.1%. The EBIT margin also saw a significant rise to 7.6% from 2.3% last year.

Paragon confirmed its 2025 forecast, aiming for sales between €140 to €145 million and an EBITDA of €20 to €22 million. The company plans a segment switch for its bond and anticipates a sales increase in Q2.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Paragon AG news