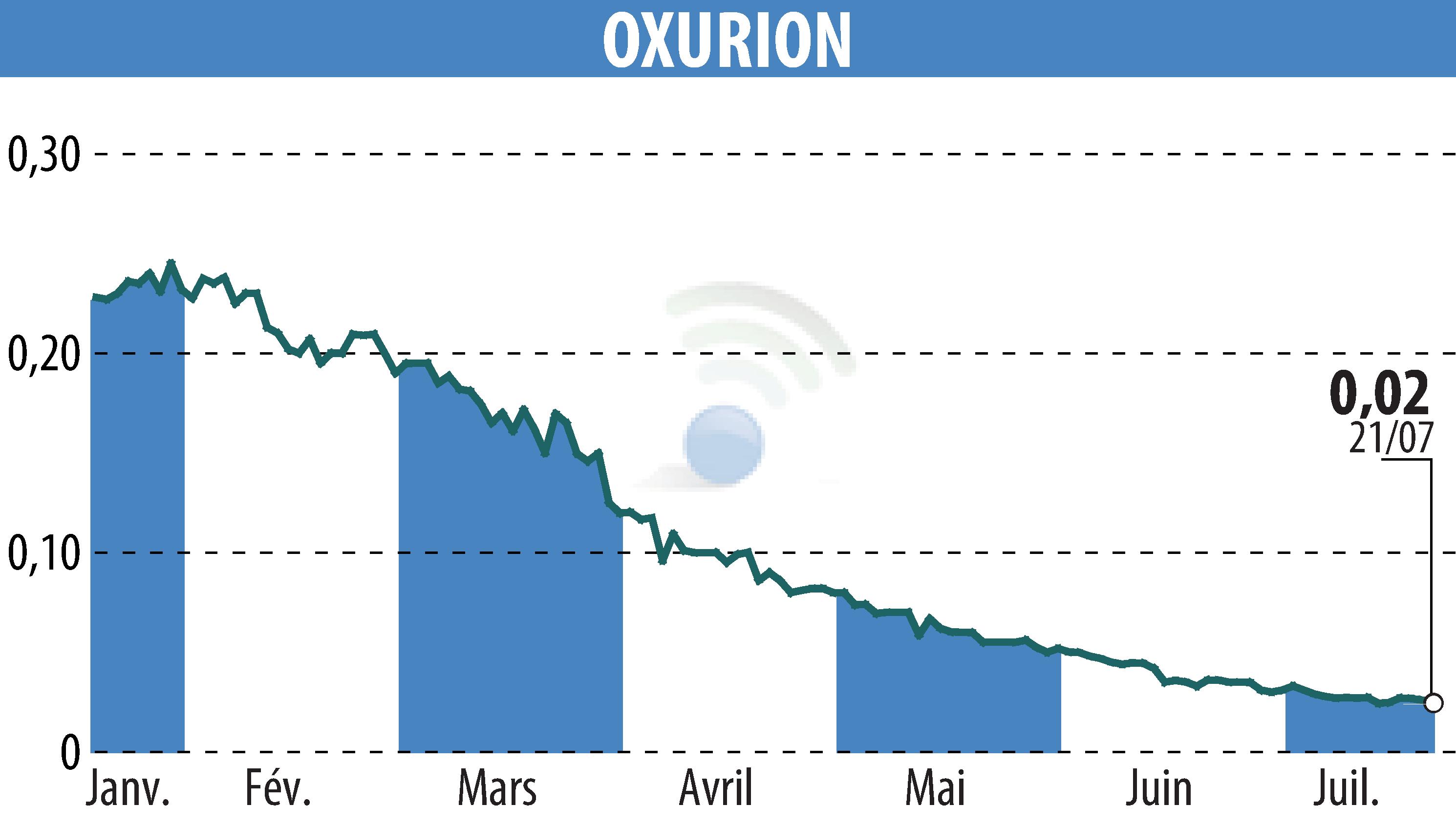

on OXURION (EBR:OXUR)

Oxurion to Diversify Treasury with Digital Assets

Oxurion NV, a biopharmaceutical company based in Leuven, has announced an indicative agreement with Atlas Special Opportunities for a €10 million convertible bond program. The funds raised will be invested in digital assets, specifically Bitcoin and Ethereum. This move is part of Oxurion's long-term strategy to enhance financial consolidation and support growth.

The agreement includes €1 million tranches convertible at a 10% premium over the 15-day volume-weighted average price (VWAP). The funds will help Oxurion leverage Bitcoin and Ethereum as part of its core business growth strategy. Aiming to close the transaction by August 2025, Oxurion's management sees this as a positive development.

The convertible bonds will have a 12-month maturity, a 6% annual coupon, and an issue price at 90% of nominal value. A default clause allows investors to terminate the funding if share prices fall below the conversion price significantly.

Oxurion believes this strategy will diversify and strengthen its resources, aligned with its ambition to become a leading European player in clinical data and biotechnology.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all OXURION news