on OHB AG (ETR:OHB)

OHB AG Rebuilding Its Trajectory with Strategic Expansion

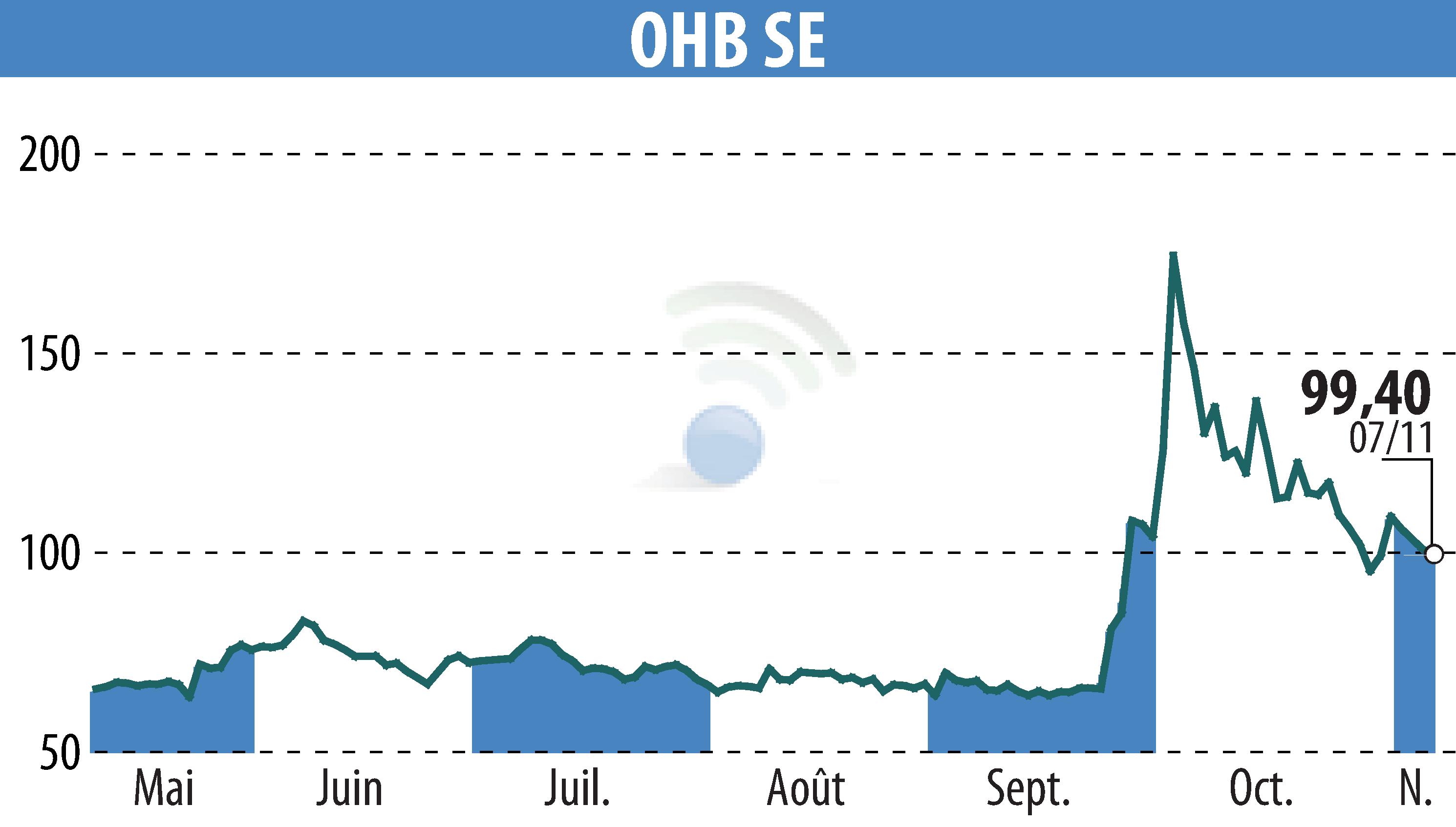

In the latest analysis by NuWays AG, OHB SE has been recommended as a "Buy" with a target price of EUR 141. The decision follows significant improvements in OHB's market dynamics and strategic positioning in Europe's space sector.

Germany's new €35bn space defense budget positions OHB to secure a substantial portion, potentially €7bn in orders, reflecting a shift in revenue focus towards defense. OHB's current order levels are fueled by civil demand, underscored by a major contract with the ESA's LISA mission.

OHB stands as Europe's third largest space OEM. A potential merger between its top competitors may further strengthen its standing. Strategic acquisitions and expansions, like the full acquisition of MT Aerospace and entry into the UK market, underscore its growth ambitions.

Operational efficiencies are expected to boost EBIT margins to 10.5% by 2030. Significant opportunities may arise if OHB is awarded the German-French JEWEL/Odin’s Eye II program.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all OHB AG news