on Nabaltec AG (ETR:NTG)

Nabaltec AG Releases Q2 Figures, Maintains "Buy" Rating

Nabaltec AG has announced its final Q2 results, highlighting ongoing challenges and opportunities. The Specialty Alumina segment reported an 8% year-on-year sales decline, largely driven by weakness in the boehmite market and dependency on the steel industry. Sales for boehmite are projected to reach only €8-10 million for FY2025, down from €24 million in FY2021. This decrease is attributed to overcapacity from Chinese competitors and slower-than-expected electric vehicle demand.

Despite these challenges, Nabaltec improved its gross margin to 53.7%, largely due to reduced energy costs. The company's cash reserves grew, ending H1 with €91 million, although net cash is expected to dip slightly to €8 million by year-end due to higher anticipated investments.

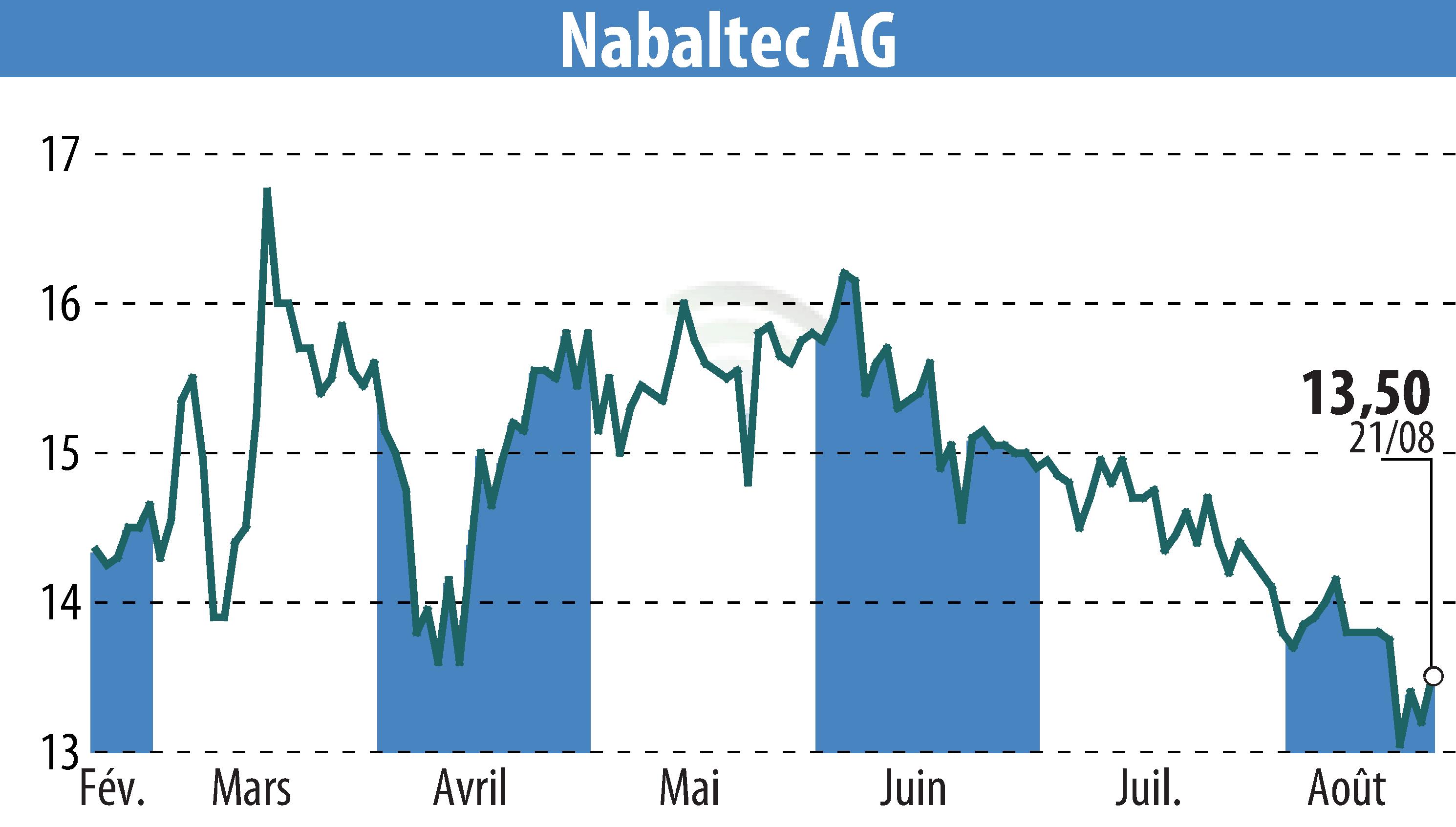

With future demand for ATH expected to grow from tighter regulations and infrastructure investments, Nabaltec remains optimistic about its mid- to long-term prospects. The current valuation presents a potential buying opportunity, with shares trading at a discount to book value. The company maintains a "Buy" rating with a target price of €18.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Nabaltec AG news