on Nabaltec AG (ETR:NTG)

Nabaltec AG Q3 Performance Analysis and Outlook

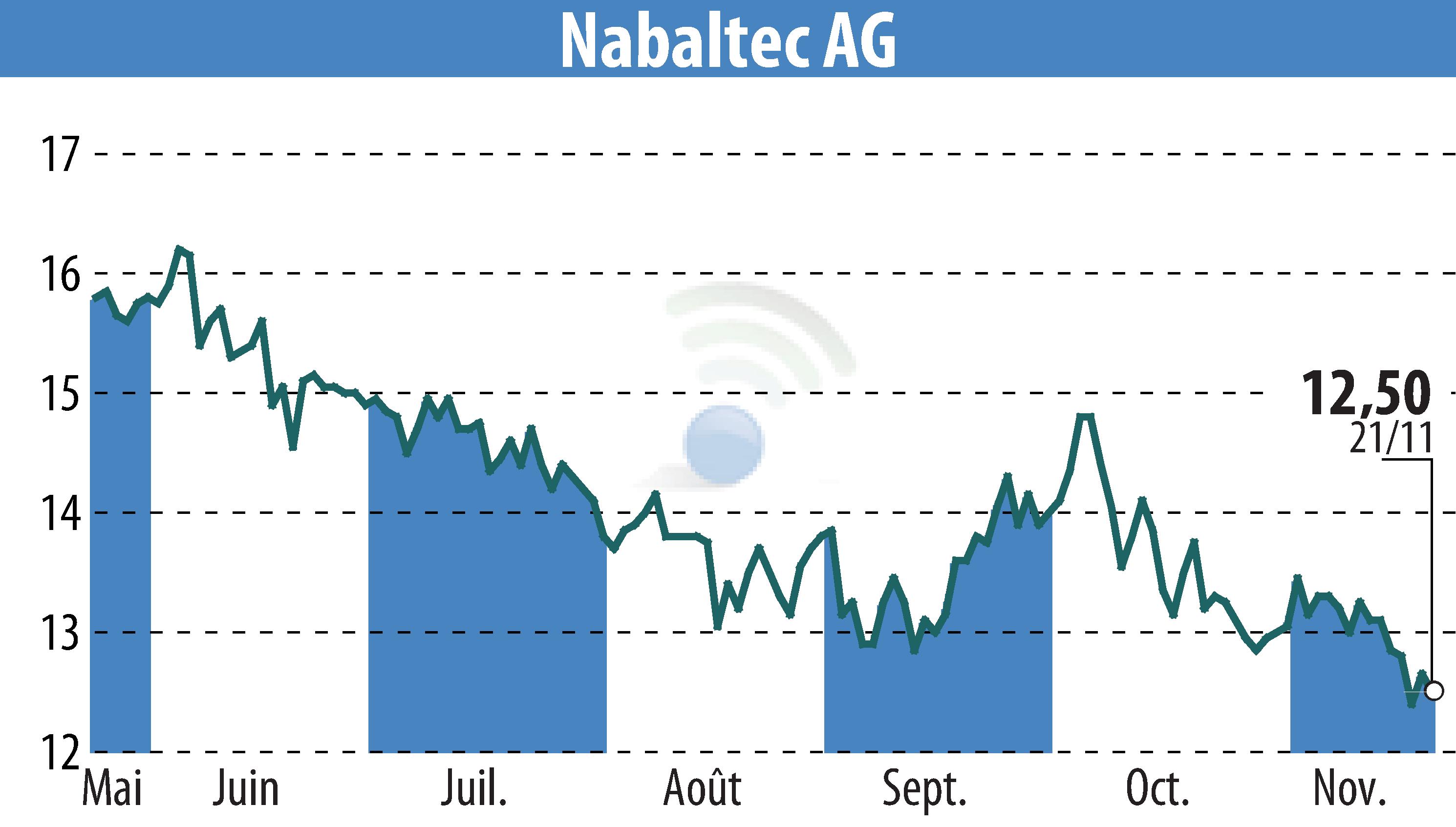

Nabaltec AG's recent release of its third-quarter results highlighted a modest decline in sales, with figures down 2.4% year-over-year to €48.6 million. This performance was in line with expectations and matched the fiscal year 2025 guidance. The decline in sales was influenced by a decrease in boehmite revenues, which are expected to drop significantly by 30% by year-end. In contrast, sales of viscosity optimized hydroxides demonstrated growth, surpassing boehmite in terms of sales contribution for the year.

The company's EBIT decreased year-over-year by 13.9%, touching €5.1 million, while maintaining a healthy margin of 10.6%, close to last year's 11.3%. Lower energy costs balanced increased personnel and project expenses, ensuring margin stability. Despite subdued boehmite demand, the expanded production capacity for ATH might benefit from a growing market.

With a retained 'BUY' recommendation and a target price of €18, NuWays AG forecasts potential growth in demand from green infrastructure investments, positioning Nabaltec well in the market for environmental flame retardants.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Nabaltec AG news