on MTU Aero Engines Holding AG (ETR:MTX)

MTU Aero Engines Launches New Convertible Bond Offering

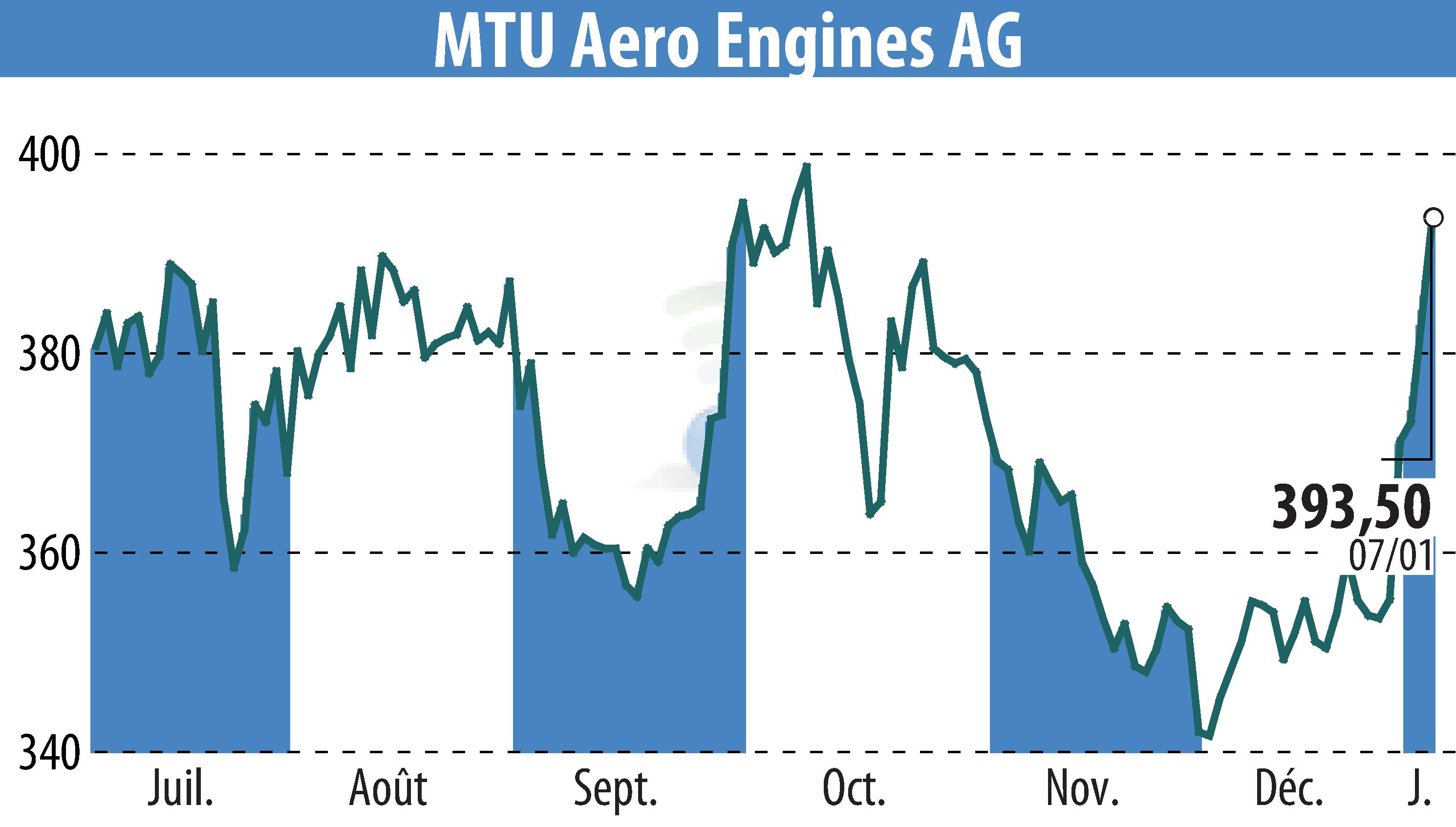

MTU Aero Engines AG has announced the launch of a new offering of senior unsecured convertible bonds totaling EUR 600 million, maturing in 2033. Concurrently, the company is inviting investors to sell their outstanding convertible bonds due 2027, amounting to EUR 500 million. This dual strategy aims to optimize MTU’s capital structure and mitigate dilution risks associated with the existing bonds.

The new bonds will mature over seven and a half years, with a coupon rate between 0.125% and 0.625%. The conversion price will have a premium of 42.5% to 47.5% above the reference share price on XETRA. Settlement of this issuance is expected by mid-January 2026.

The company is targeting institutional investors for this offering, excluding several restricted regions including the US and Japan. BNP PARIBAS, Deutsche Bank, and HSBC are acting as joint coordinators for the transaction, supporting MTU’s efforts to extend its debt maturity profile.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all MTU Aero Engines Holding AG news