on MLP AG (ETR:MLP)

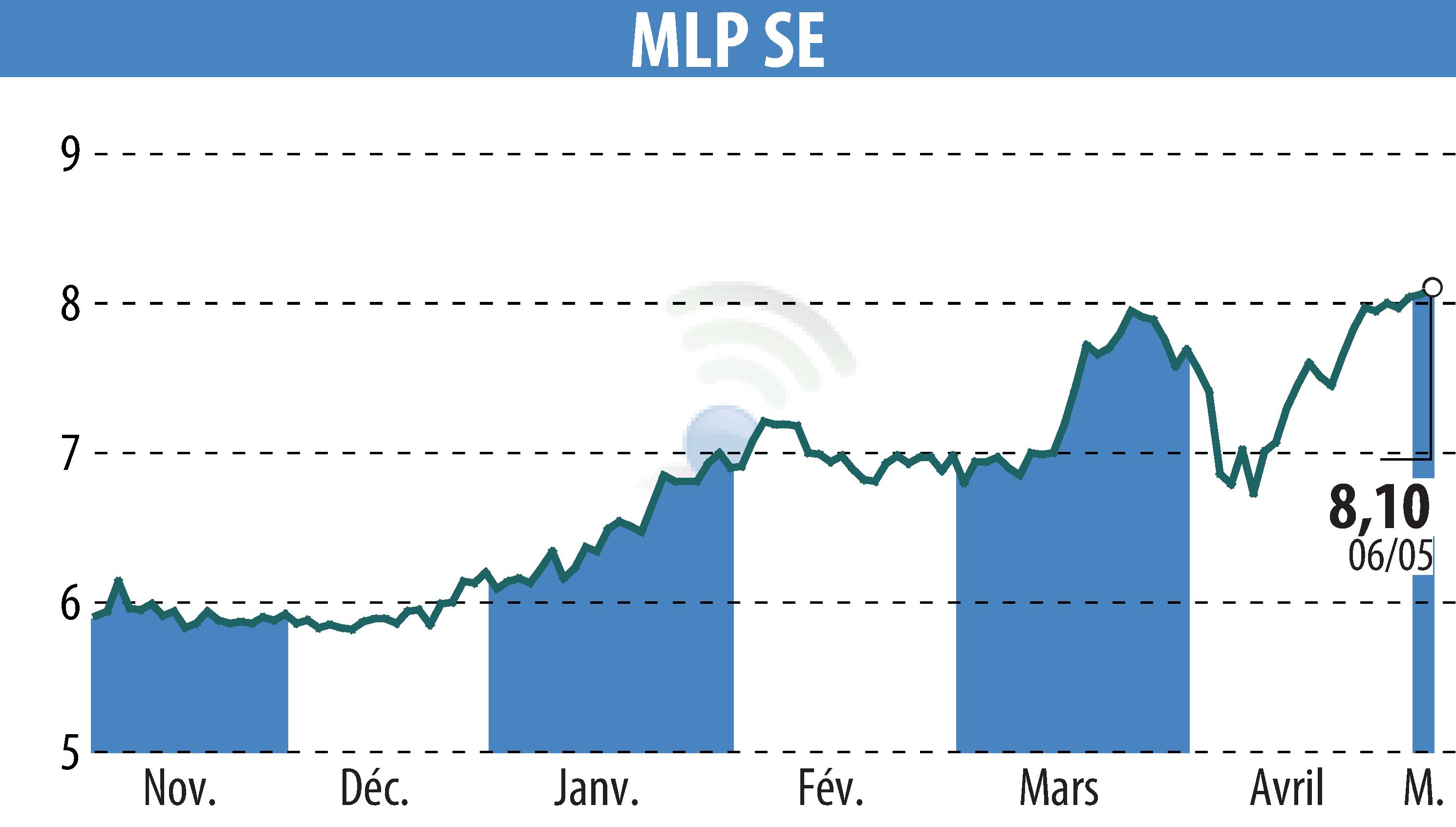

MLP SE Shows Promising Growth Despite Market Challenges

In a recent analysis by NuWays AG, MLP SE receives a "BUY" recommendation, highlighting strong potential in various sectors. MLP's first-quarter results, expected on May 15, 2025, are projected to show total sales growth of 8% year-over-year (yoy) to €307 million. This growth is largely attributed to a significant rebound in real estate sales, anticipated to rise by 358% yoy, coupled with increased activity in loans and mortgages.

Non-Life Insurance brokerage is forecasted to boost sales by 8% yoy to €105 million, supported by the expansion of MLP's insurance portfolio. Conversely, Wealth Management is expected to show modest growth due to capital market volatility, although a higher Assets under Management (AuM) base might offer some support.

EBIT is set to increase by 13% yoy, totaling €42 million, driven by a strategic shift in the revenue-cost mix and a reduction in real estate development expenses. The diversified business model of MLP continues to underpin stable growth and robust margins, reaffirming NuWays AG's positive outlook and price target of €13.00.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all MLP AG news