on MLP AG (ETR:MLP)

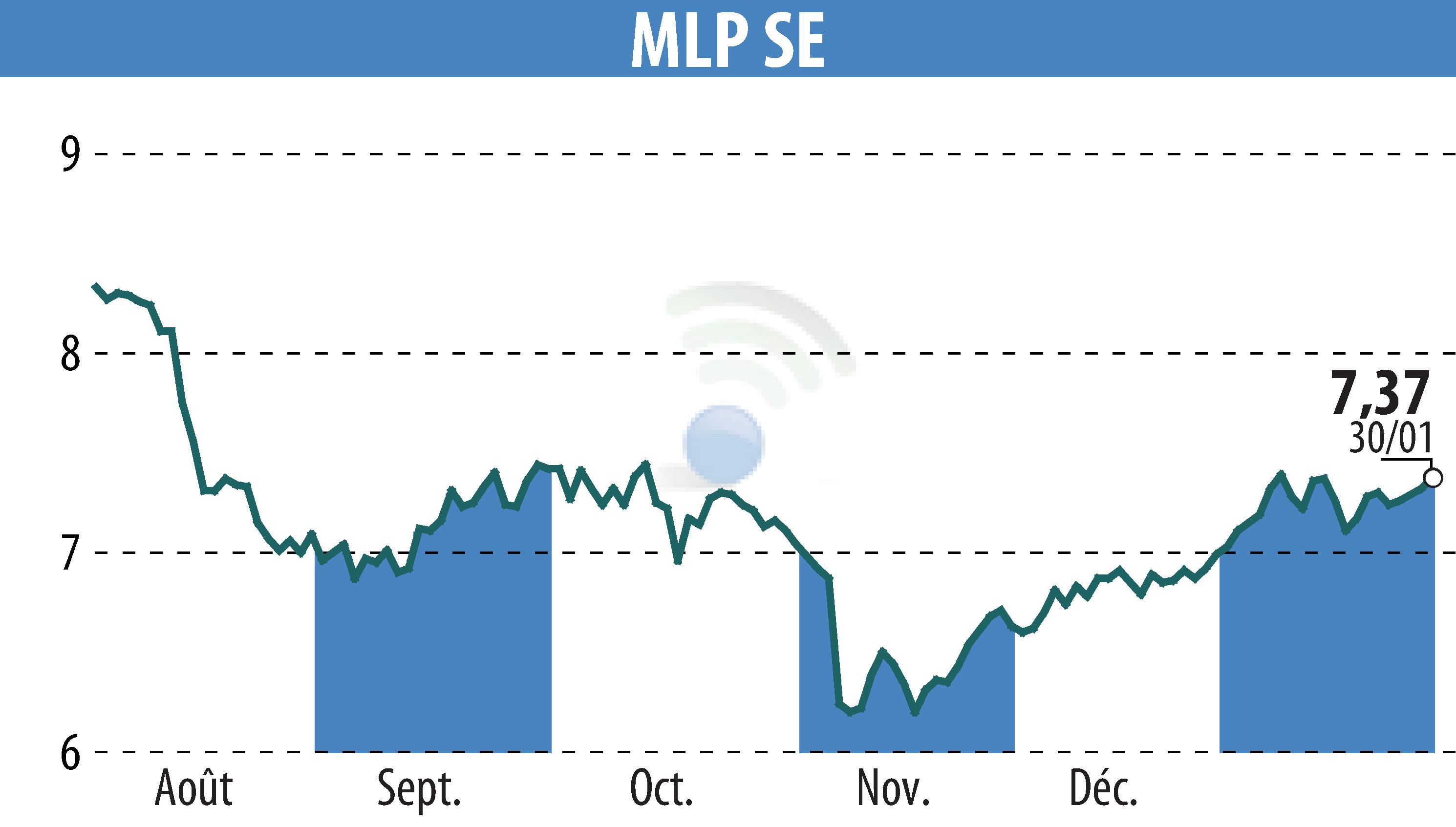

MLP SE: Growth Prospects for 2026 and Buy Recommendation

NuWays AG has issued a "Buy" recommendation for MLP SE, targeting a price of EUR 12 within the next 12 months. Analysts predict a solid 2025 despite unfavorable elements such as below-normal performance fees, real-estate restructuring, and reduced interest income. However, these challenges are expected to diminish in 2026, revealing MLP’s growth potential. The company is supported by a diverse advisory platform and strong recurring revenue, accounting for 68% of sales.

In Q4 2025, sales are projected to rise by 2.4% year-on-year to €298 million, driven by robust wealth management growth and an 8% increase in P&C insurance premiums. MLP is advancing in automated claims processing through AI, enhancing services and reducing costs. Q4 adjusted EBIT is anticipated to climb by 18% y-o-y to €33.9 million, with margin improvements arising from cost efficiencies.

Into 2026, momentum is expected to accelerate, particularly in P&C insurance, supported by stabilized ECB rates and an anticipated return of performance fees to historical levels. MLP offers an attractive 5% dividend yield, backed by robust cash flow, enhancing earnings visibility.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all MLP AG news