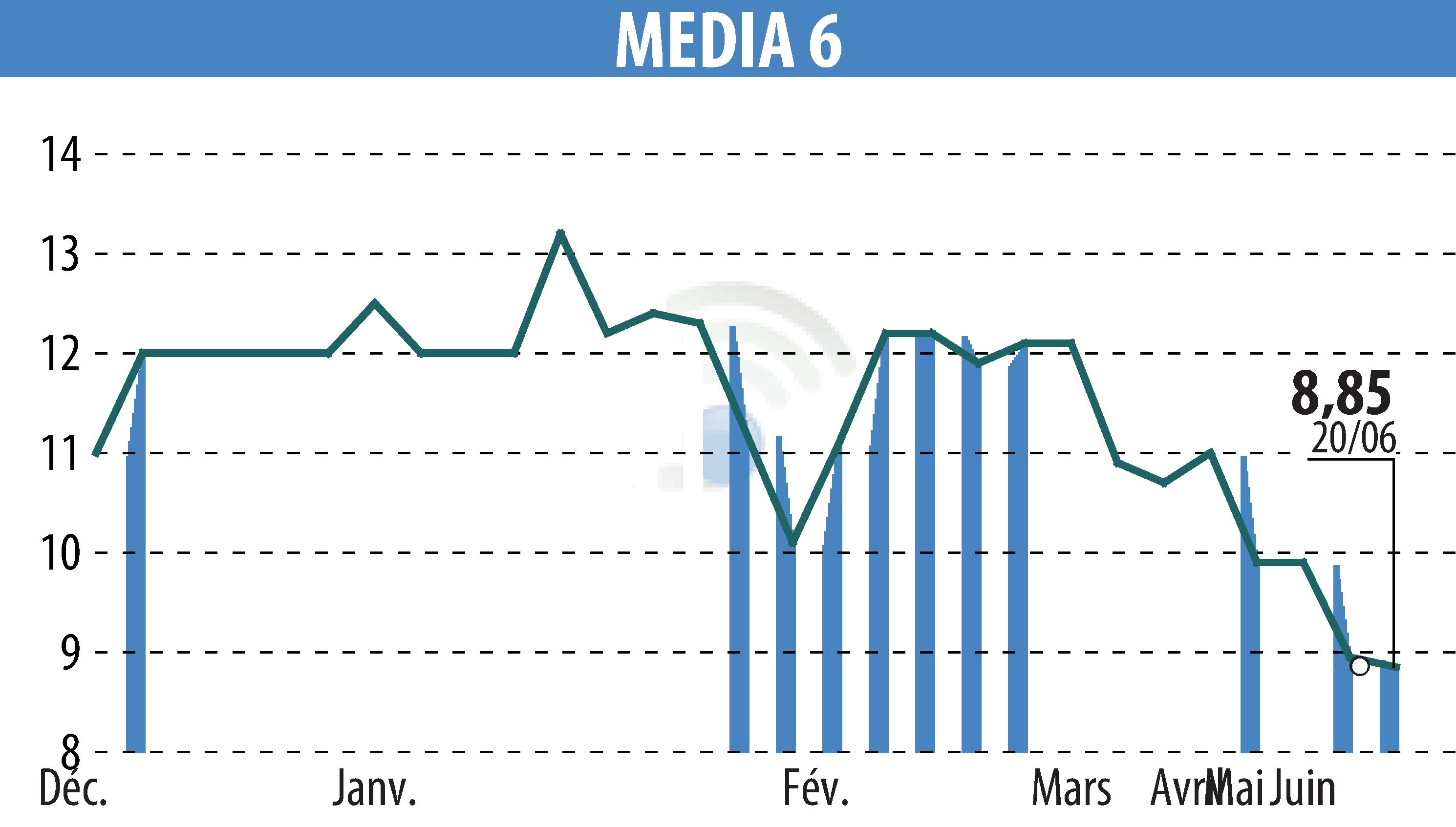

on MEDIA 6 (EPA:EDI)

MEDIA 6: Review of the First Half of 2024-2025

Point-of-Sale Marketing specialist MEDIA 6 reports a 7.0% decline in revenue for the first half of 2024-2025, reaching €40.7 million. This decline is due to a sluggish economic climate, particularly outside Europe, leading to order postponements and cancellations.

Operating profit posted a loss of €3.6 million, compounded by non-recurring costs related to readjustment efforts in France and Canada. Net profit widened to a loss of €2.9 million, compared to a loss of €677,000 the previous year. Despite these negative figures, the financial structure remains healthy, with shareholders' equity of €26.1 million.

For the second half of the year, MEDIA 6 expects a recovery thanks to strategic actions, particularly in Portugal and the consolidation of Canadian sites. The outlook for a return to balance remains strong, supported by a stable balance sheet and secure financing.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all MEDIA 6 news