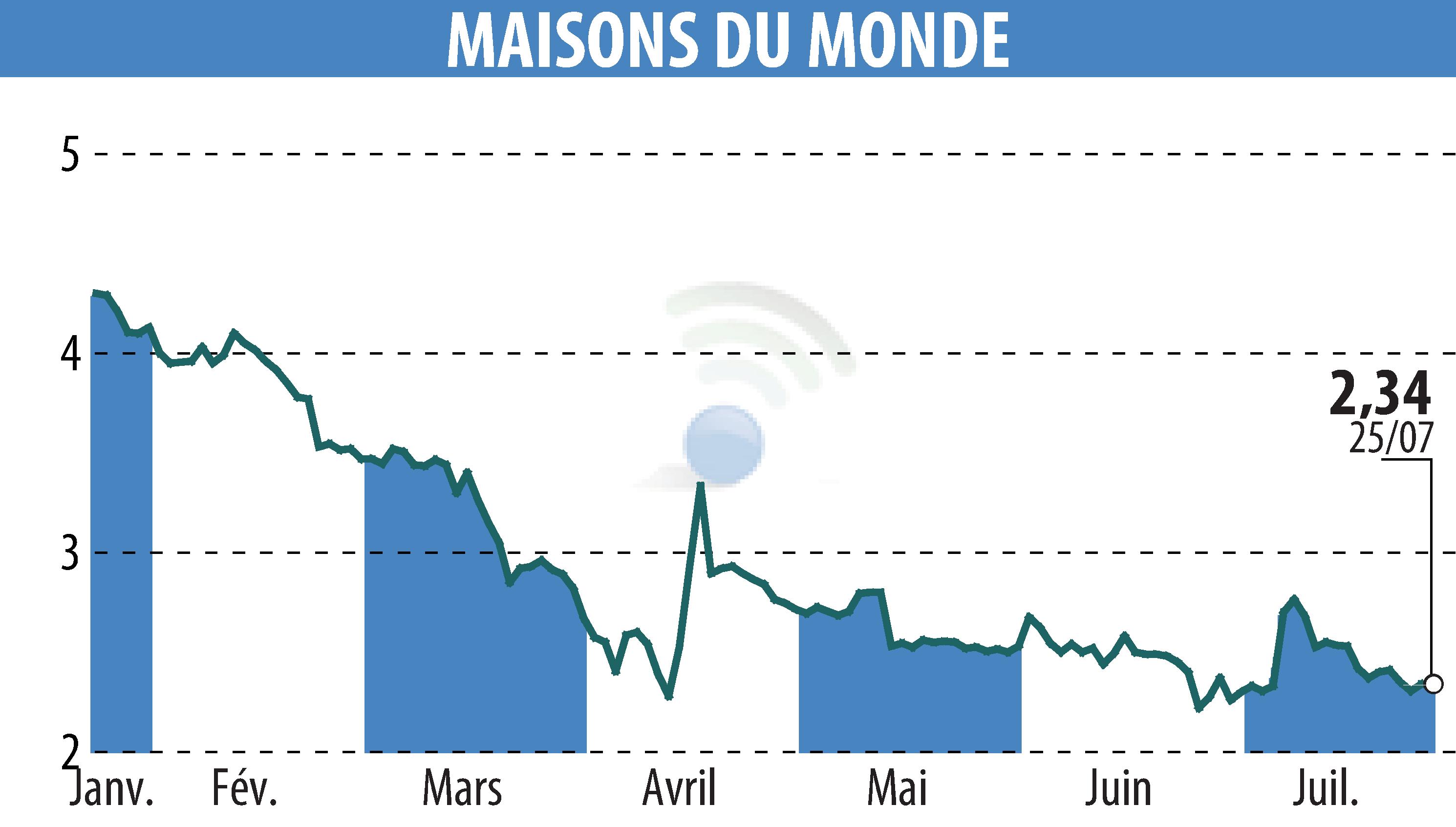

on MAISONS DU MONDE (EPA:MDM)

Maisons du Monde Reports Slight Improvement in Q2 2025 Sales

Maisons du Monde disclosed a modest improvement in Q2 2025 sales, with a like-for-like (LfL) decline of 7.5%, improving from -9.9% in Q1. The first half of 2025 showed an LfL drop of 8.7%. The gross margin remained steady at 64%. Encouragingly, Q2 2025 was bolstered by four countries returning to growth and refurbished stores outperforming expectations, particularly in shopping centers.

French and online sales showed initial positive signs, though sales in France were down 10.3% for H1. The online segment saw a decline of 15.4%, yet Q2 trends showed revival signs. Cost controls resulted in €18 million savings, contributing to a three-year savings target of €110 million.

Challenges linger with a free cash flow of -€65 million due to high inventories. Nevertheless, positive free cash flow is anticipated in the latter half of the year.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all MAISONS DU MONDE news