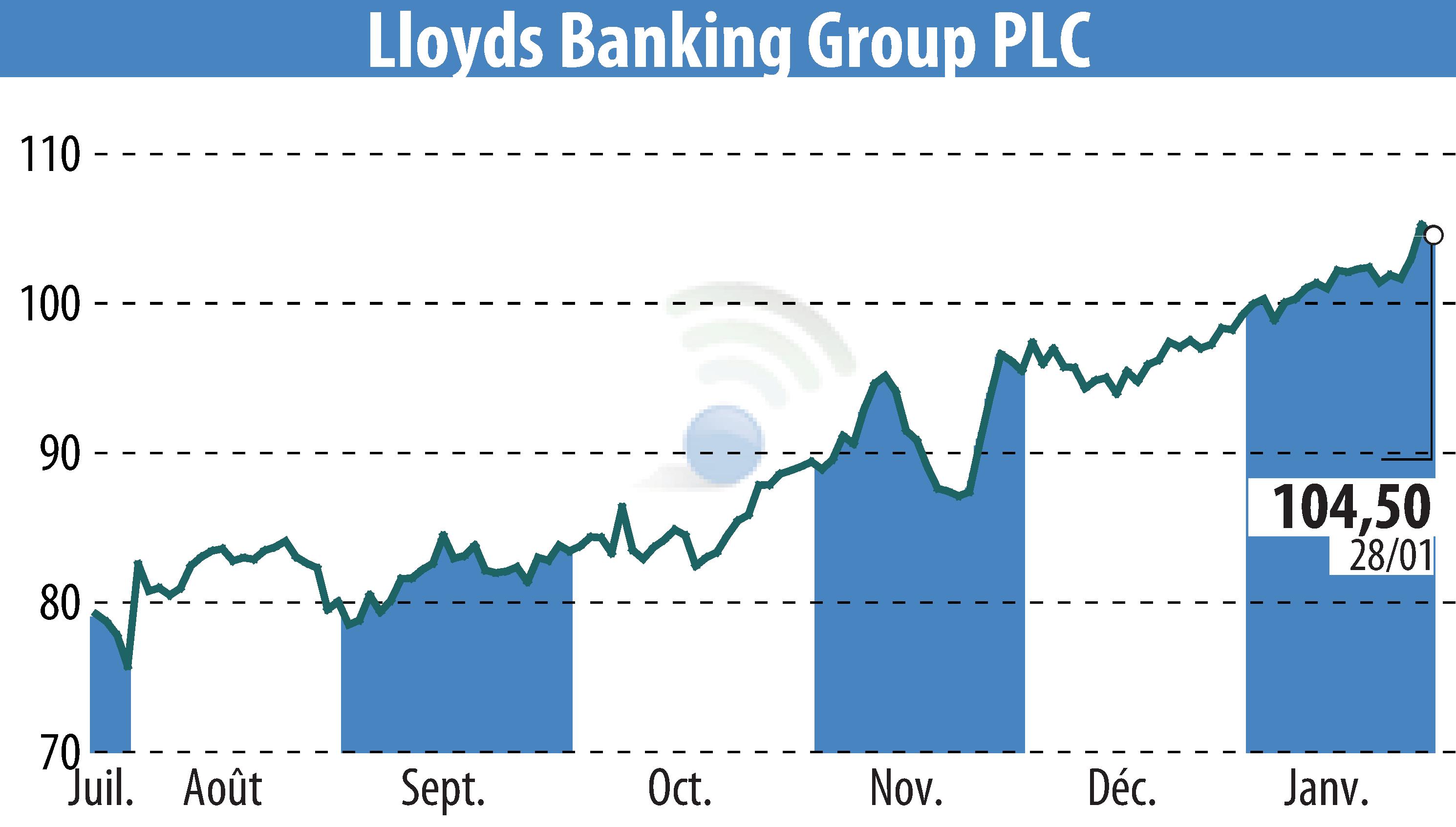

on Lloyds Banking Group (isin : GB0008706128)

Lloyds Banking Group 2025 Annual Results

Lloyds Banking Group has reported its 2025 financial results, showing overall positive financial performance amidst strategic transformation. The bank delivered a statutory profit before tax of £6.7 billion, up from £6.0 billion in 2024. Contributing factors included higher total income and fleet growth, offset by increased operating expenses and impairment charges.

Key financial highlights include a 6% rise in underlying net interest income to £13.6 billion, and a 9% increase in other income driven by strategic initiatives. Underlying loans to customers grew by £22 billion, with retail and commercial segments both showing growth. Customer deposits rose by £13.8 billion. The Group's CET1 ratio stood at 13.2%, supporting strong capital returns including a share buyback and increased dividends.

Heading into 2026, Lloyds anticipates continued growth with expectations of a net interest income of around £14.9 billion and an improved cost-to-income ratio. The group remains optimistic about exceeding its strategic targets, focusing on digital and AI advancements to enhance efficiency and maintain competitive strength.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Lloyds Banking Group news