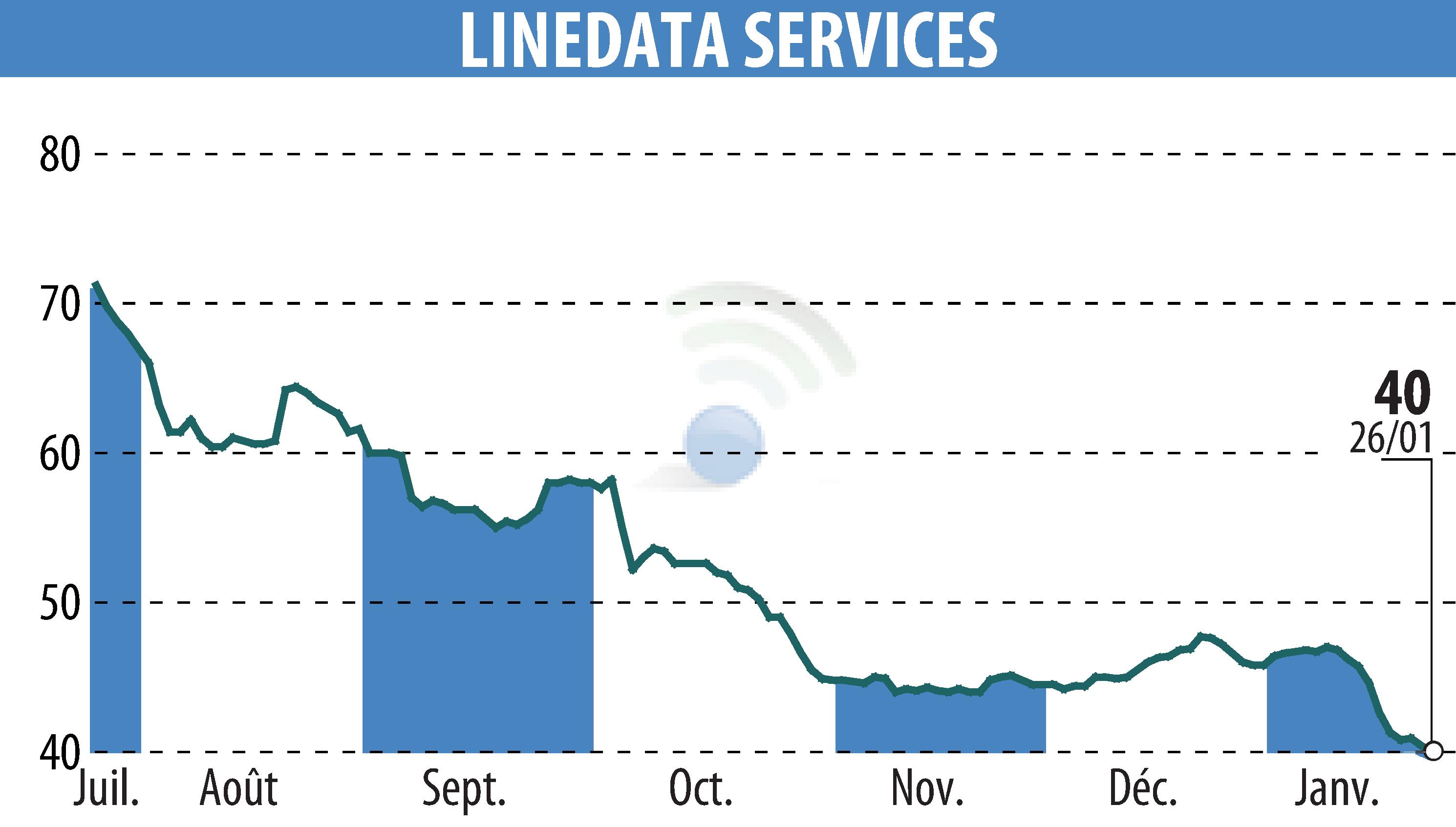

on LINEDATA SERVICES (EPA:LIN)

Linedata Services: Revenue expected to decline by 7.7% in 2025

In 2025, Linedata Services, specializing in solutions and services for asset management, insurance, and credit, recorded revenues of €169.6 million, a decrease of 7.7% compared to the previous year. This decline, in line with forecasts, includes a 6.1% drop on a like-for-like basis, excluding currency effects and the acquisition of NRoad.

The Asset Management segment experienced a 10% decline, heavily impacted by a cyberattack in August. In contrast, Lending & Leasing maintained its revenue at €63 million. Recurring revenue accounted for 78% of the total, despite a 27.4% decrease in annual bookings.

For 2026, Linedata is planning an adjustment to its structure and a reduction in costs following the impacts of the events of 2025.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all LINEDATA SERVICES news