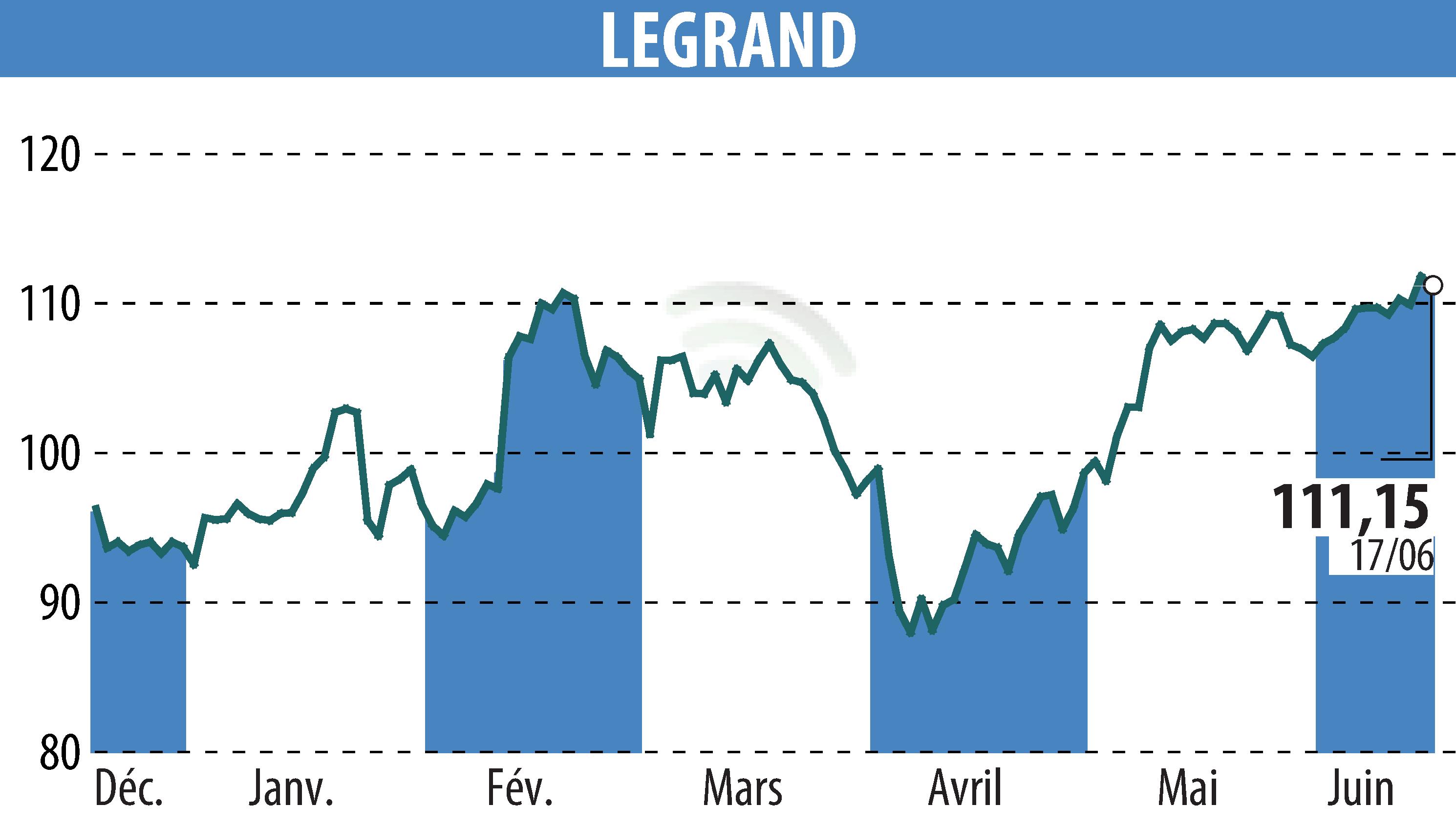

on LEGRAND (EPA:LR)

Legrand launches €800 million convertible bond issue

On June 18, 2025, Legrand, a specialist in electrical and digital building infrastructure, announced the launch of a senior unsecured bond offering. These bonds, convertible into new shares and/or exchangeable for existing shares, mature in 2033.

The nominal amount of the issue is set at €800 million, comprising an initial amount of €700 million and an option for an additional €100 million. The bonds will bear interest at an annual rate between 1.375% and 1.875%.

This offering is intended exclusively for qualified investors. The bonds will be issued at 100% of their principal amount with an initial conversion premium of between 45% and 50% above the Legrand share price on Euronext Paris.

The funds raised will meet Legrand's general business needs. The company has provided for an early repayment mechanism that may be possible before 2033 under certain conditions.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all LEGRAND news