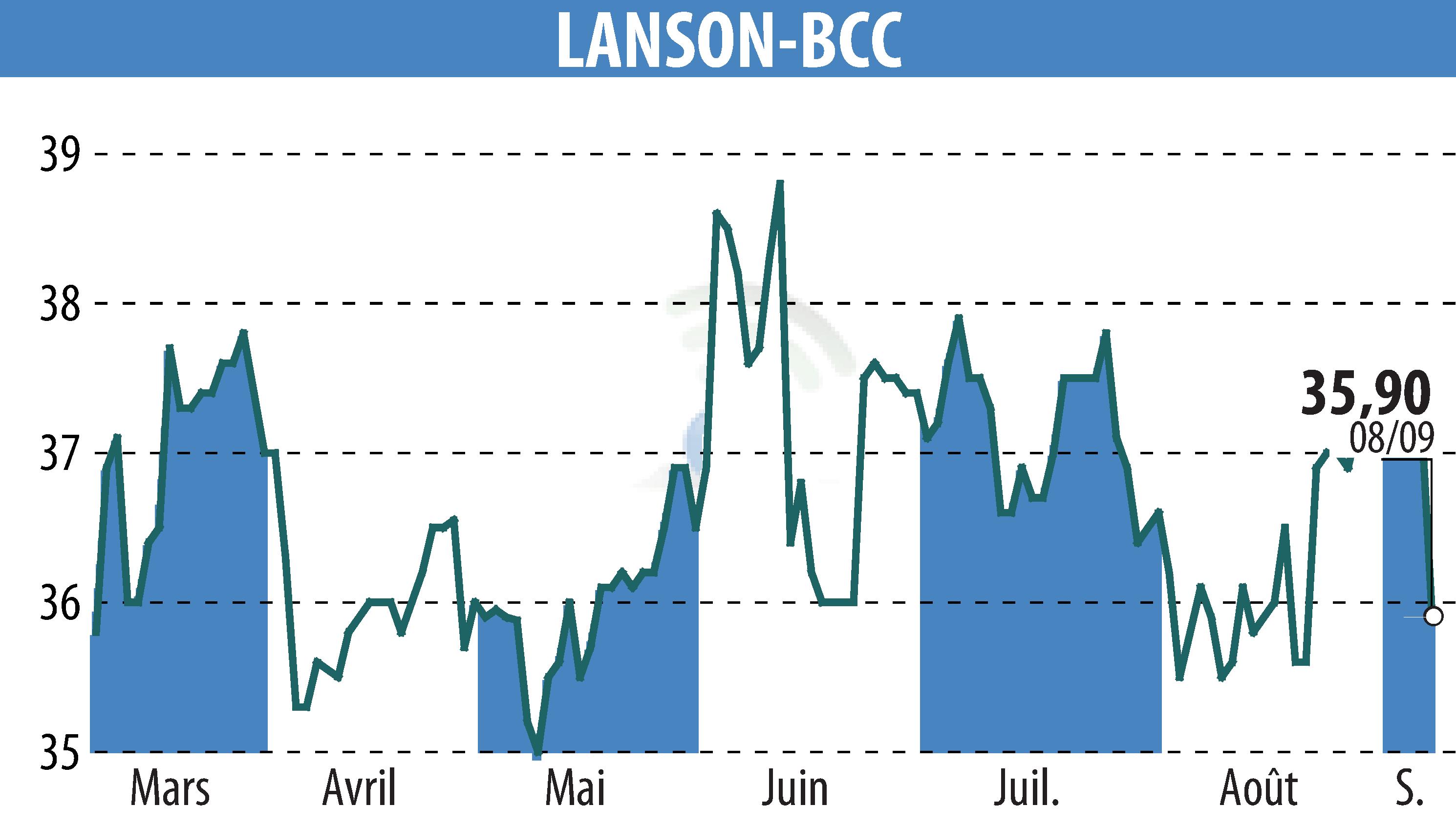

on LANSON-BCC (EPA:ALLAN)

Lanson-BCC: Strategic Fortitude Amid Market Challenges

Lanson-BCC, a Champagne specialist, reported €10.9 million in income from ordinary operations and a net income of €1.9 million for the first half of 2025. Despite a favorable price and product mix, results were affected by reduced shipment volumes, increased grape production costs, and higher financing costs for maturing stocks, which rose by 15.4% to €8.4 million.

Champagne industry shipments declined by 1.2% compared to the same period in 2024, with the French market seeing a decline of 5.2%, while export markets showed slight recovery. Lanson-BCC's strategy maintained a favorable price mix, despite a volume decline in the French market by 4.0% and a slight 0.7% increase in exports.

Consolidated revenues reached €92.05 million, increasing by 4.8% from 2024. However, finance costs rose to -€8.37 million, primarily due to interest on Champagne wine stocks, impacting net income significantly.

Despite uncertainties and market challenges, Lanson-BCC persists in its premium market strategy, focusing on quality and maintaining robust financial foundations in a competitive environment.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all LANSON-BCC news