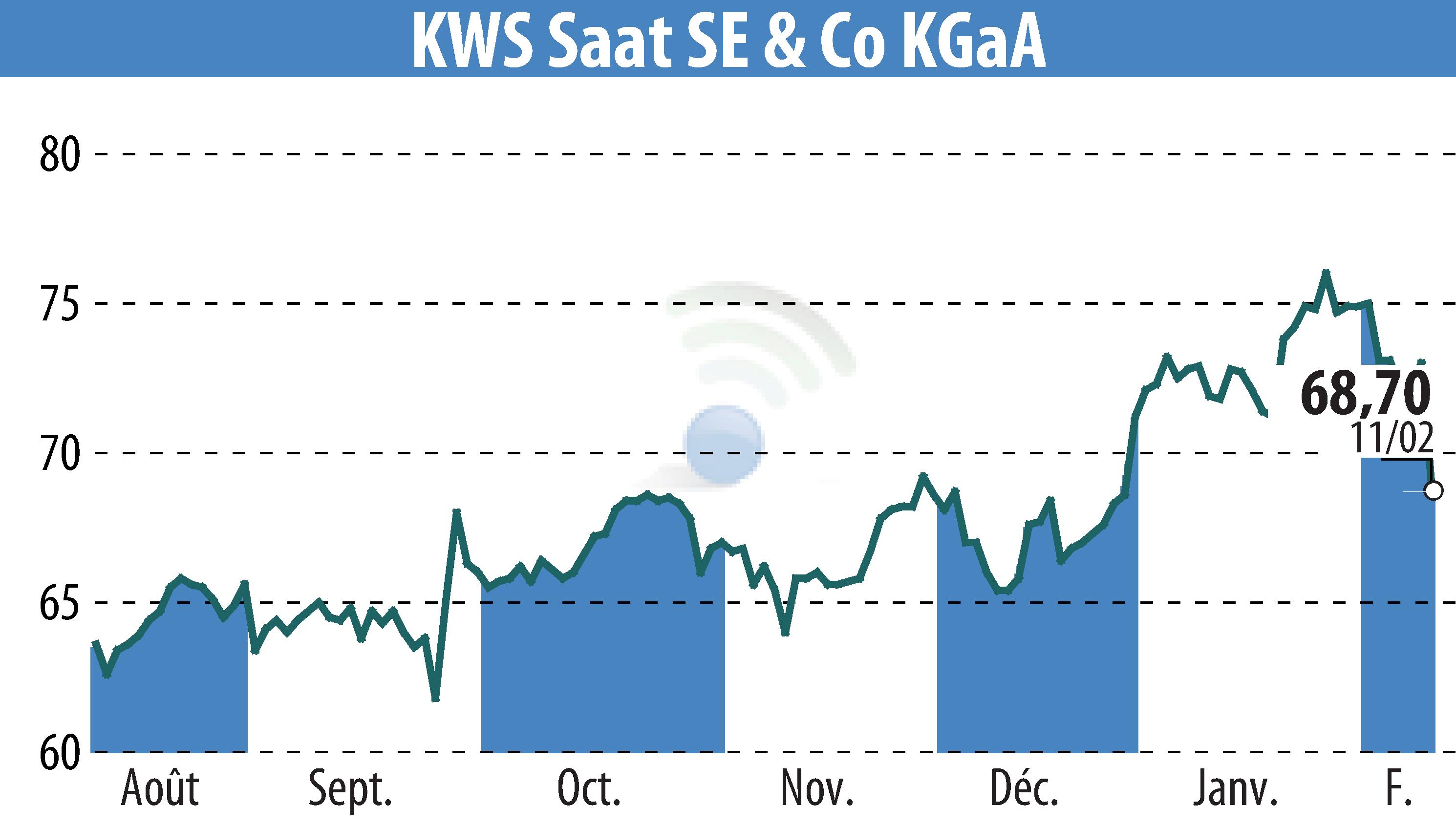

on KWS SAAT AG (ETR:KWS)

KWS Reports Growth and Updates Forecast for 2025/2026

KWS SAAT SE & Co. KGaA has released its financial results for the first half of the fiscal year 2025/2026, highlighting a 0.8% increase in comparable net sales. This growth came amid challenges in the agricultural market, driven by a robust performance in the oilseed rape and vegetable segments.

The company’s EBITDA improved to €-49.0 million, attributed mainly to a special effect from the sale of its North American corn business. Meanwhile, earnings before interest and taxes (EBIT) saw a significant improvement to €-96.8 million. KWS adjusted its fiscal year sales forecast to match the previous year’s levels while reaffirming its EBITDA margin guidance of 19% to 21%, emphasizing profitability.

By segment, the Cereals Segment achieved a rise in net sales, powered by a strong rapeseed business. Conversely, the Sugarbeet and Corn Segments faced seasonal challenges. Overall, KWS continues to navigate a volatile market, focusing on strategic investments and cost-cutting measures.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all KWS SAAT AG news