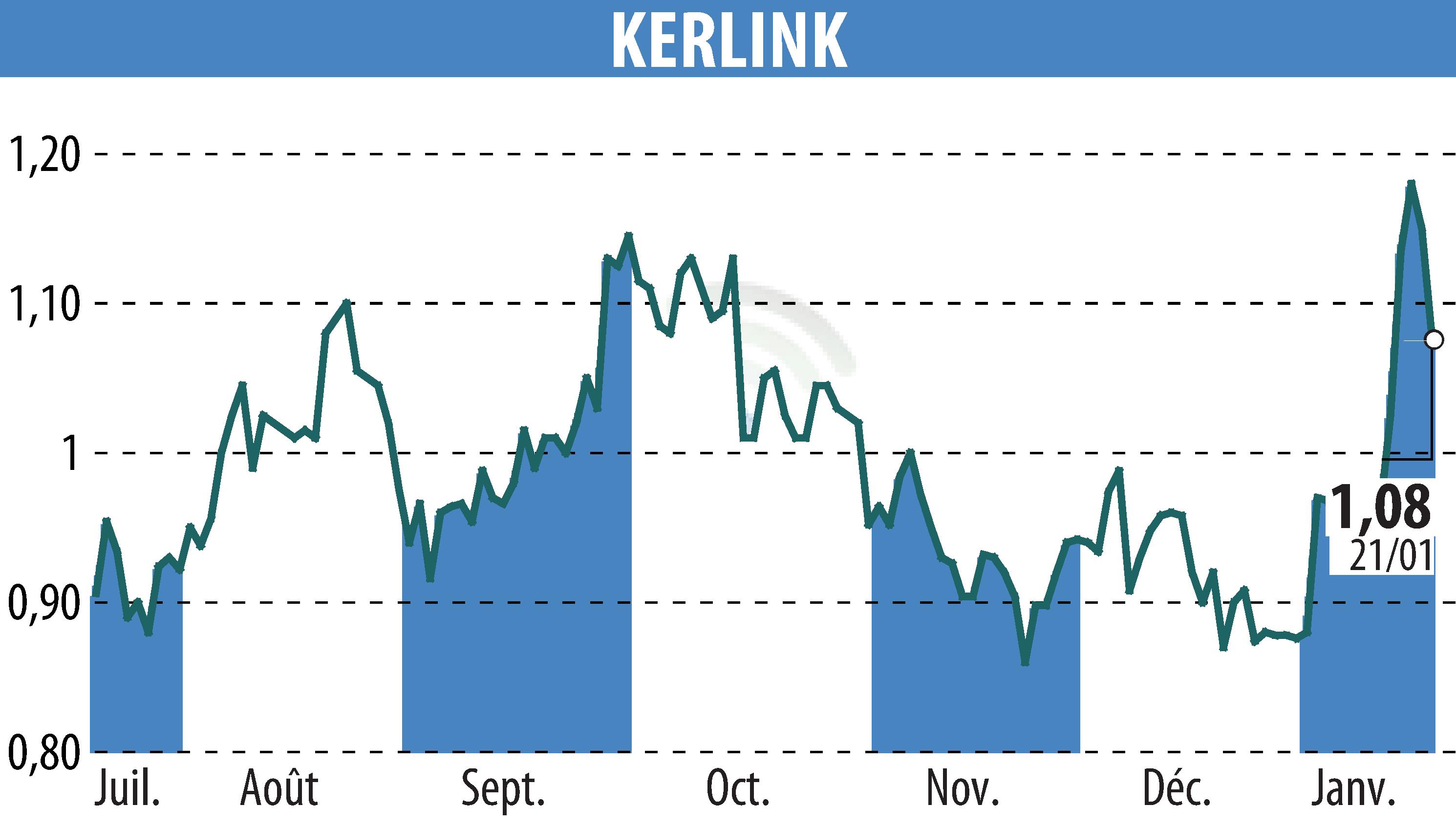

on KERLINK (EPA:ALKLK)

Kerlink Reports 26% Revenue Increase in 2025

Kerlink, a specialist provider of IoT networks and solutions, announced a 26% increase in revenue for 2025, reaching €14.7m. This growth comes despite a challenging economic climate, with private operators contributing nearly 95% of the total revenue, up by 27% compared to the previous year. The EMEA region accounted for 89% of revenue, growing by 20% to nearly €13m, while the Americas saw a significant increase, rising five-fold to €1.1m. In contrast, the Asian market remained minimal.

Sales from network infrastructure formed 86% of the annual revenue, despite a 29% decrease in service sales due to the end of two Network As A Service contracts. This change reflects a strategic shift towards integrating essential services into the Plug and Play offering.

Kerlink's 2026 priority is to sustain its growth momentum, focusing on the Track Value solution and expanding in the Americas and Asia. The company’s order book currently stands at €7.5m for 2026.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all KERLINK news