on INDUS Holding AG (ETR:INH)

INDUS Holding AG Q3 Performance and 2025 Outlook

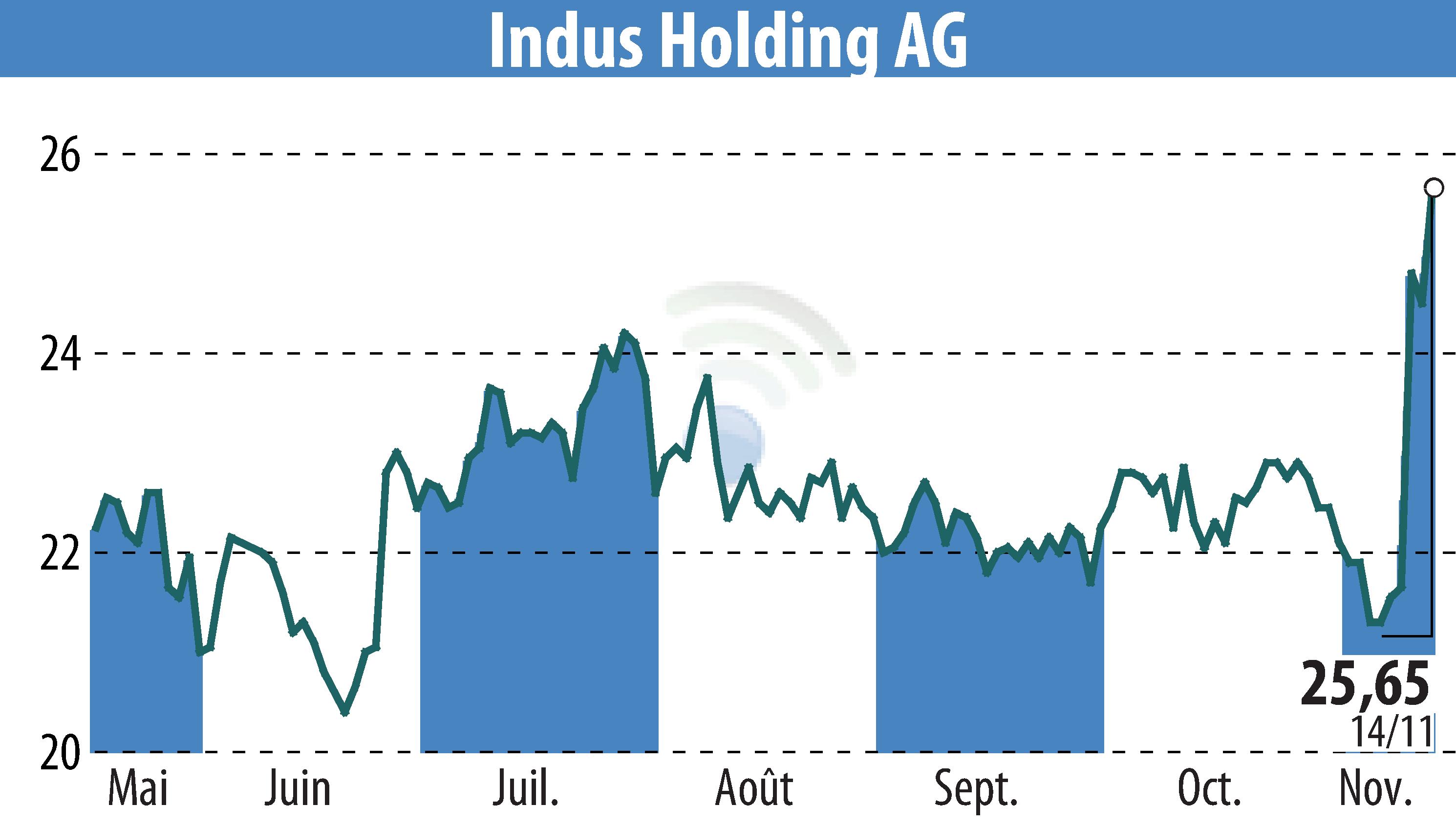

INDUS Holding AG reports its Q3 2025 results, showing a mixed financial performance. Despite a 1.3% decrease in sales, the company's adjusted EBITA rose by 10% to €48.1 million, surpassing market forecasts. This improvement is attributed to effective cost management, even within a challenging market environment. The group retains its positive outlook for the year 2025, maintaining a sales forecast between €1.70 billion and €1.85 billion with an adjusted EBITA ranging from €130 million to €165 million.

The company's order intake increased by 17.2% during the first nine months, driven notably by the Engineering segment. The strong order book hints at sustained future growth. Despite a slight reduction in the revenue forecast, the adjusted EBITA margin is expected to improve slightly. INDUS shares remain attractive, trading at a P/E ratio of 9.1 with a dividend yield above 5%.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all INDUS Holding AG news