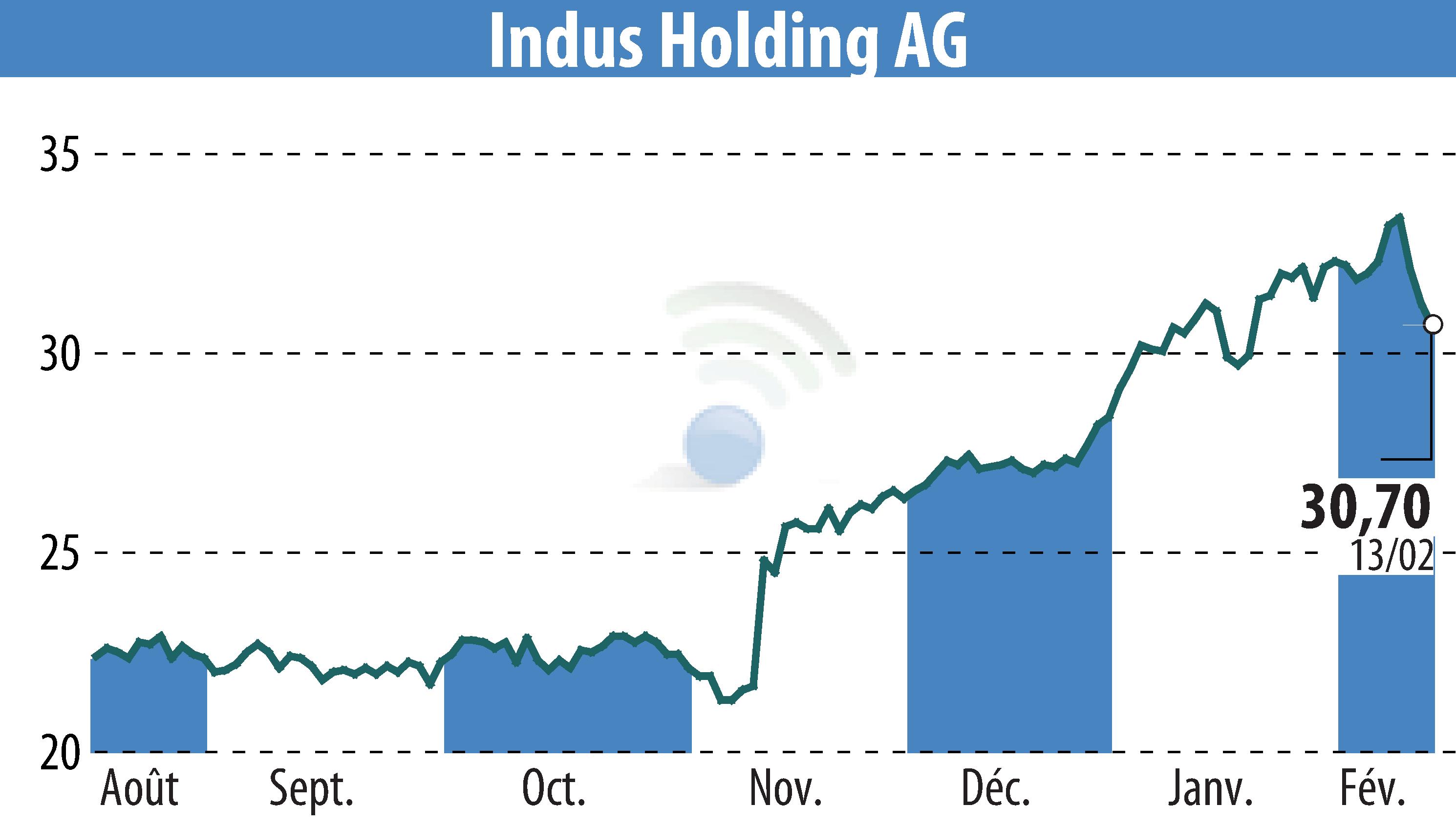

on INDUS Holding AG (ETR:INH)

INDUS Holding AG Forecasts Strong 2026 Performance

INDUS Holding AG is expected to start 2026 on a positive note, bolstered by its recent acquisition of Pro Video. The company projects a 6.1% year-on-year revenue growth, reaching €1.85 billion. Organic growth is anticipated at 4.9%, driven by favorable conditions in the Engineering and Infrastructure sectors.

The Pro Video deal and additional acquisitions in 2026 are predicted to contribute significantly, with the potential for up to €30 million in revenue. The Adjusted EBITA margin is set to rise by 0.9 percentage points, reaching 9.1%, thanks to reduced pricing pressure and effective cost management.

Engineering revenue is forecasted to grow by 7%, while Infrastructure is expected to see a 10.5% increase. However, the Materials Solutions segment may face challenges with a projected 3% sales decline, primarily due to tungsten supply constraints. Despite this, INDUS remains committed to its strategic focus on acquisitions and diversification.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all INDUS Holding AG news