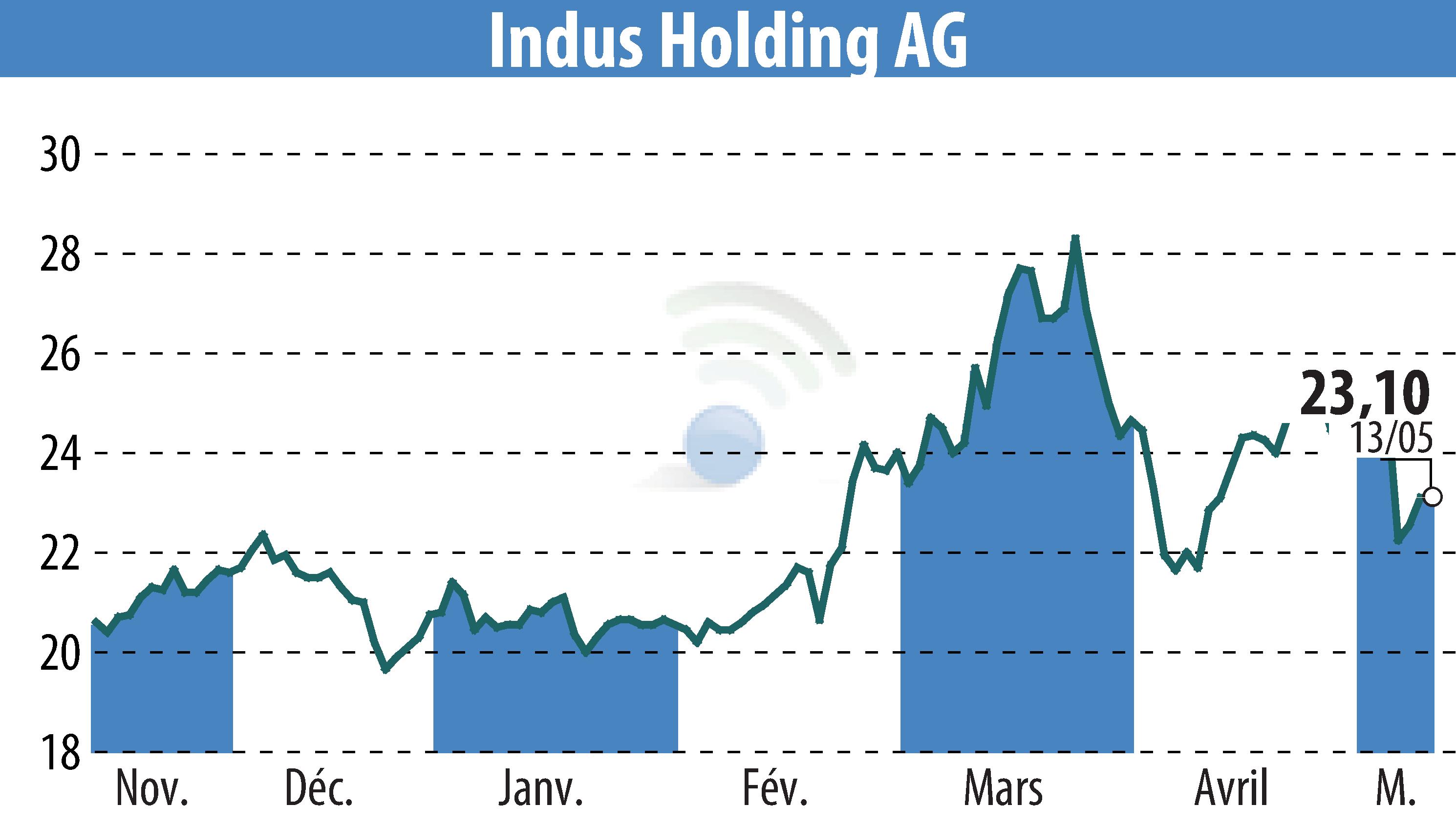

on INDUS Holding AG (ETR:INH)

INDUS Group's Financial Performance in Q1 2025

INDUS Holding AG reported sales of EUR 402.4 million and an adjusted EBITA of EUR 24.9 million for Q1 2025. The Engineering segment boosted order intake, though sales dipped to EUR 123.2 million. Despite challenges from international trade tensions, a 19.5% increase in orders was noted, suggesting a positive future trend. Three acquisitions were completed, expanding the portfolio with HBS, KETTLER, and ELECTRO TRADING.

The Infrastructure segment saw sales rise to EUR 136.4 million, although adjusted EBITA fell. Market conditions remained competitive, yet prospects for demand improvements are anticipated. An increase in sales and a projection for growth in the segment suggest potential recovery ahead.

The Material Solutions segment experienced a slight sales decline, but adjusted EBITA grew, with order intake increasing at metal processing companies. However, US tariffs and Chinese export controls present ongoing risks, leading to cautious expectations for the year.

INDUS' earnings per share reached EUR 0.63, driven by non-periodic tax income. The equity ratio increased slightly to 38.8%, with free cash flow expected to recover by year-end. Overall, INDUS maintains a sales forecast between EUR 1.70 billion to EUR 1.85 billion, aiming for an adjusted EBITA margin of 7.5% to 9%.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all INDUS Holding AG news