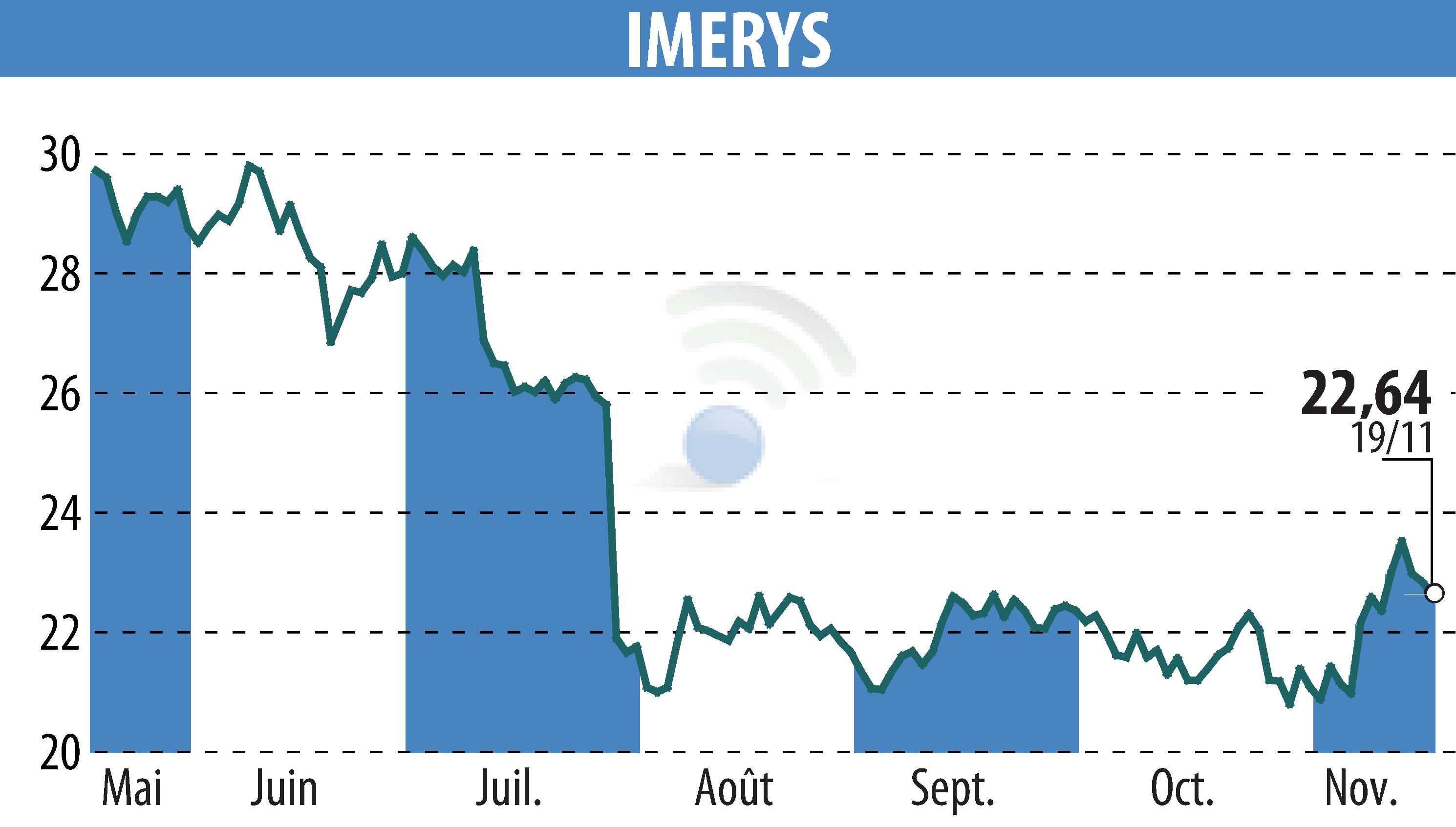

on IMERYS (EPA:NK)

Imerys Enhances Financial Structure with €600 Million Bond Issuance

Imerys, a global leader in mineral-based specialty solutions, has successfully issued €600 million in senior unsecured notes. These notes, part of its EMTN Programme, have a 7-year maturity and offer a fixed annual coupon of 4.00%. The offering, completed on November 13, 2025, attracted strong demand from institutional investors, reflecting their confidence in Imerys' financial stability and business model.

Concurrently, Imerys conducted a tender offer for its €600 million notes maturing in January 2027. The company accepted offers totaling €256.5 million, reducing the outstanding amount to €343.5 million. The settlement for the tender offer is anticipated for November 24, 2025. These actions have extended the average maturity of Imerys' bonds to 4.4 years.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all IMERYS news