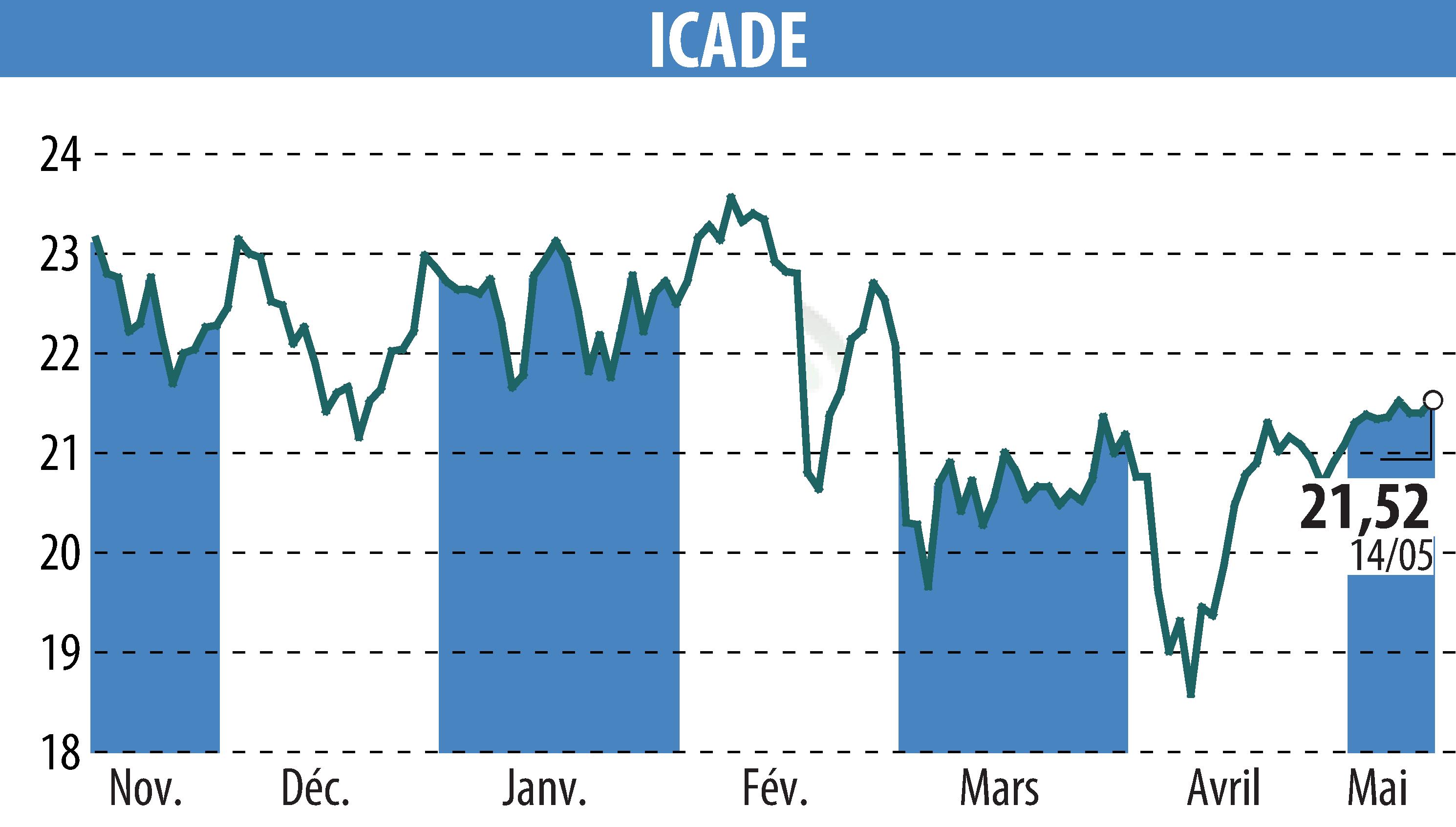

on ICADE (EPA:ICAD)

Icade's €500 Million Green Bond Success

Icade has successfully issued a new €500 million Green Bond with a 10-year maturity. Rated BBB with a stable outlook by S&P, the real estate company saw its bond offering oversubscribed threefold, reflecting strong investor confidence.

The bond priced at a spread of 197 basis points with an annual coupon rate of 4.375%. Proceeds will finance or refinance environmentally positive projects under Icade’s Green Financing Framework. This bond issue is part of the Euro Medium Term Note (EMTN) program from December 2024.

Simultaneously, Icade initiated a cash tender offer for four existing notes series, concluding on May 21, 2025. This allows Icade to actively manage and extend its debt maturities.

The operation was managed by a syndicate including BNP Paribas and Société Générale. This marks Icade’s effective return to the primary market after more than three years.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all ICADE news