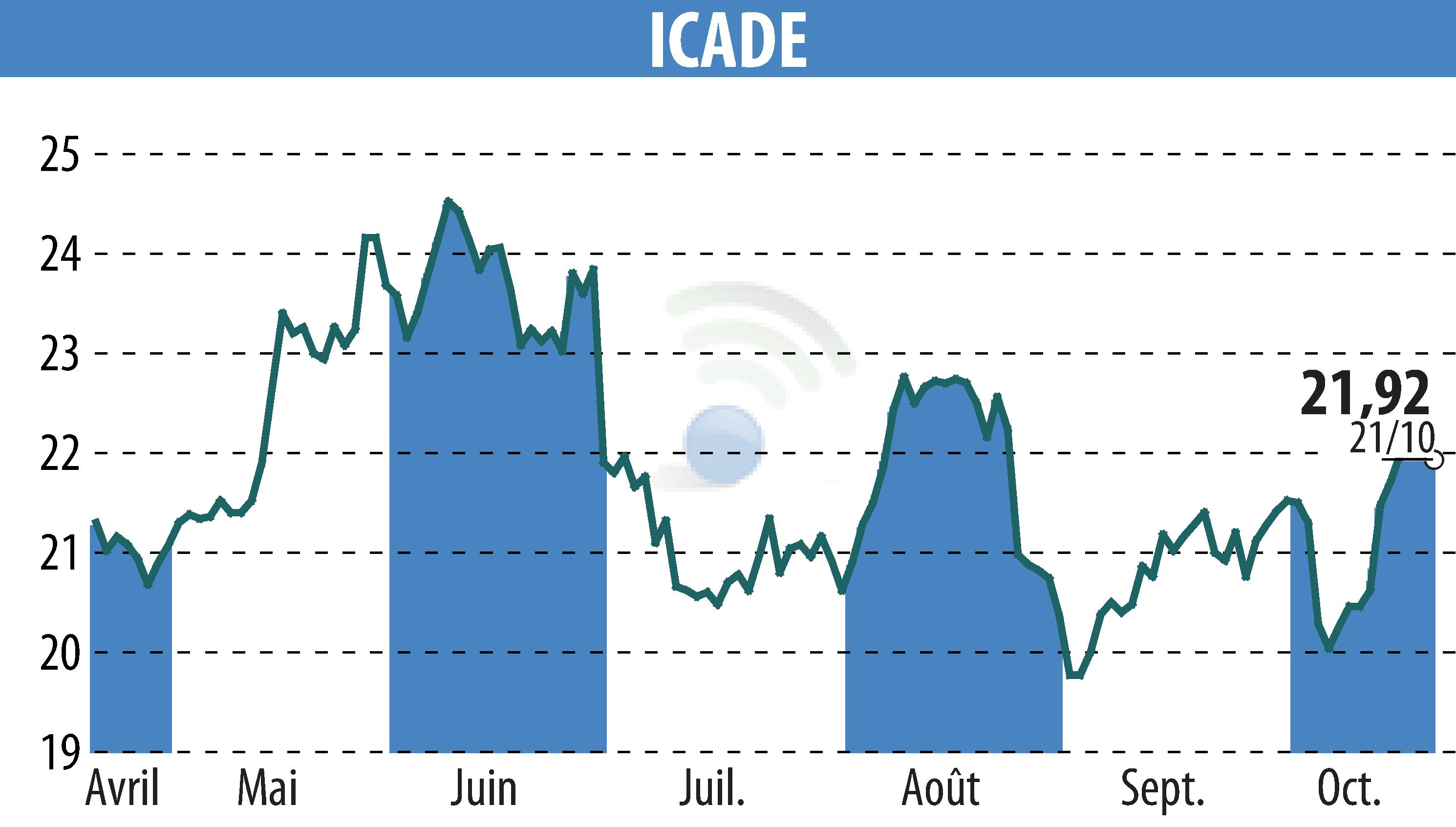

on ICADE (EPA:ICAD)

Icade's 9-Month Update: Steady Strategy Amidst Economic Challenges

Icade has announced its 9-month trading update, highlighting a significant increase in asset disposals amounting to approximately €430 million. The company reported a 9% decrease in consolidated IFRS revenue, mainly due to a 4.8% decline in like-for-like gross rental income and continued low development activity. Despite these challenges, leasing activity remained robust, with around 166,000 sq.m already signed or renewed, reflecting improved financial occupancy rates in office and light industrial segments.

The company's CEO, Nicolas Joly, reaffirmed the 2025 guidance of a Group net current cash flow between €3.40 and €3.60 per share. Icade has made substantial headway in its healthcare business divestitures and asset sales, having completed about €220 million in mature or non-strategic asset disposals. The company's commitment to adapting to climate change has also been emphasized, demonstrated by its improvement in ESG rankings and recent pledges.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all ICADE news