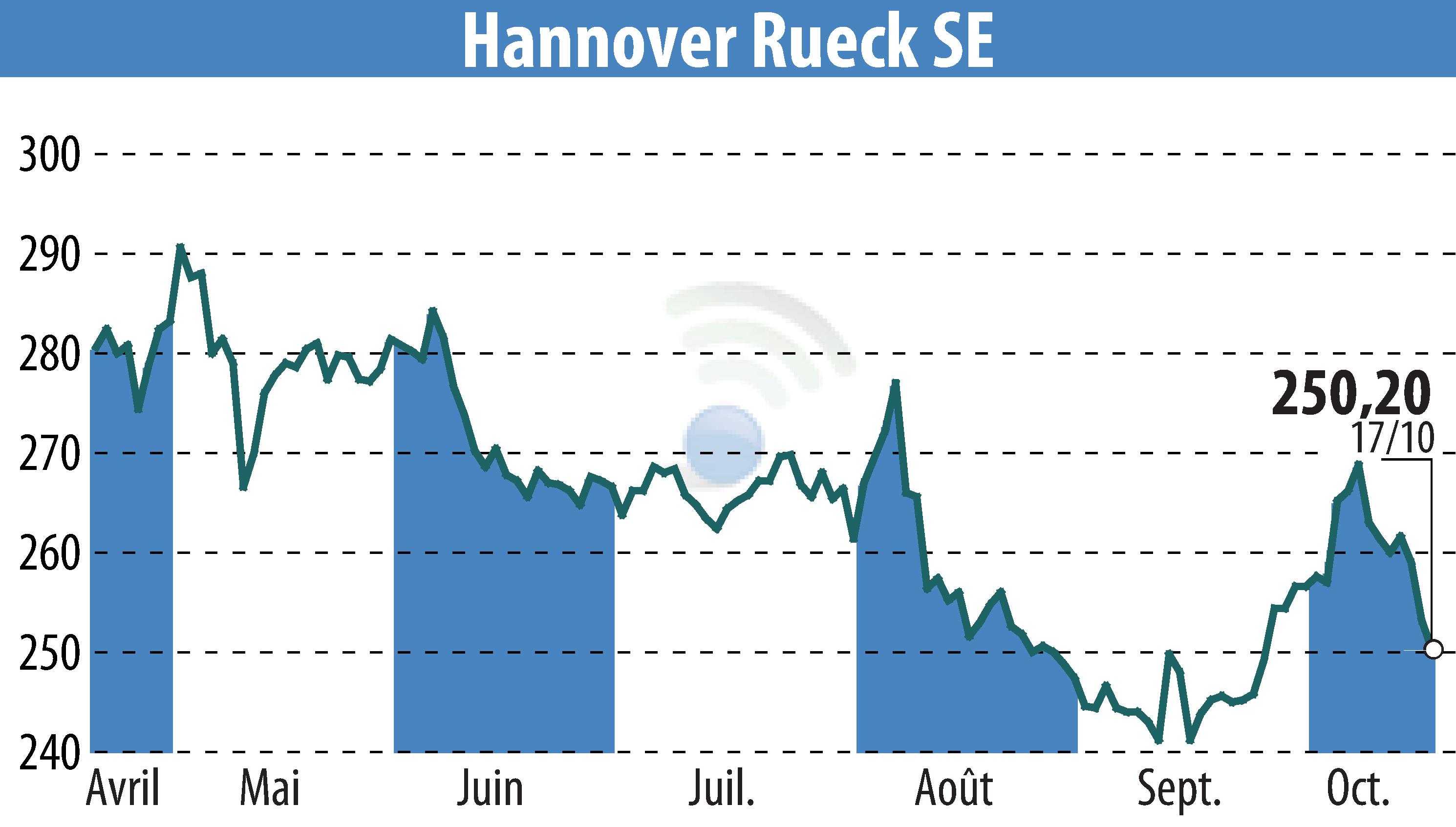

on Hannover Rück SE (ETR:HNR1)

E+S Rück Predicts Stable 2026 Market with Growing Reinsurance Demand

Hannover Re's subsidiary, E+S Rück, foresees a stable market in Germany for 2026, with increasing demand for reinsurance protection. Despite signs of a softening property and casualty market, E+S Rück aims for growth during the 1 January renewals. Their robust capital and enduring partnerships are seen as drivers for future profitability.

Motor insurance in Germany has shown recovery after tariff adjustments and reduced natural perils claims in 2025. Yet, claims inflation surpasses general inflation, necessitating further rate hikes. The property line has a softening price trend, with fewer large fire losses. Demand for natural catastrophe coverage continues to rise moderately.

The specialties, like marine and aviation, are experiencing geopolitical impacts. However, cyber insurance demand is growing. E+S Rück, together with Hannover Re, offers innovative solutions in reinsurance and maintains a strong market position globally.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Hannover Rück SE news