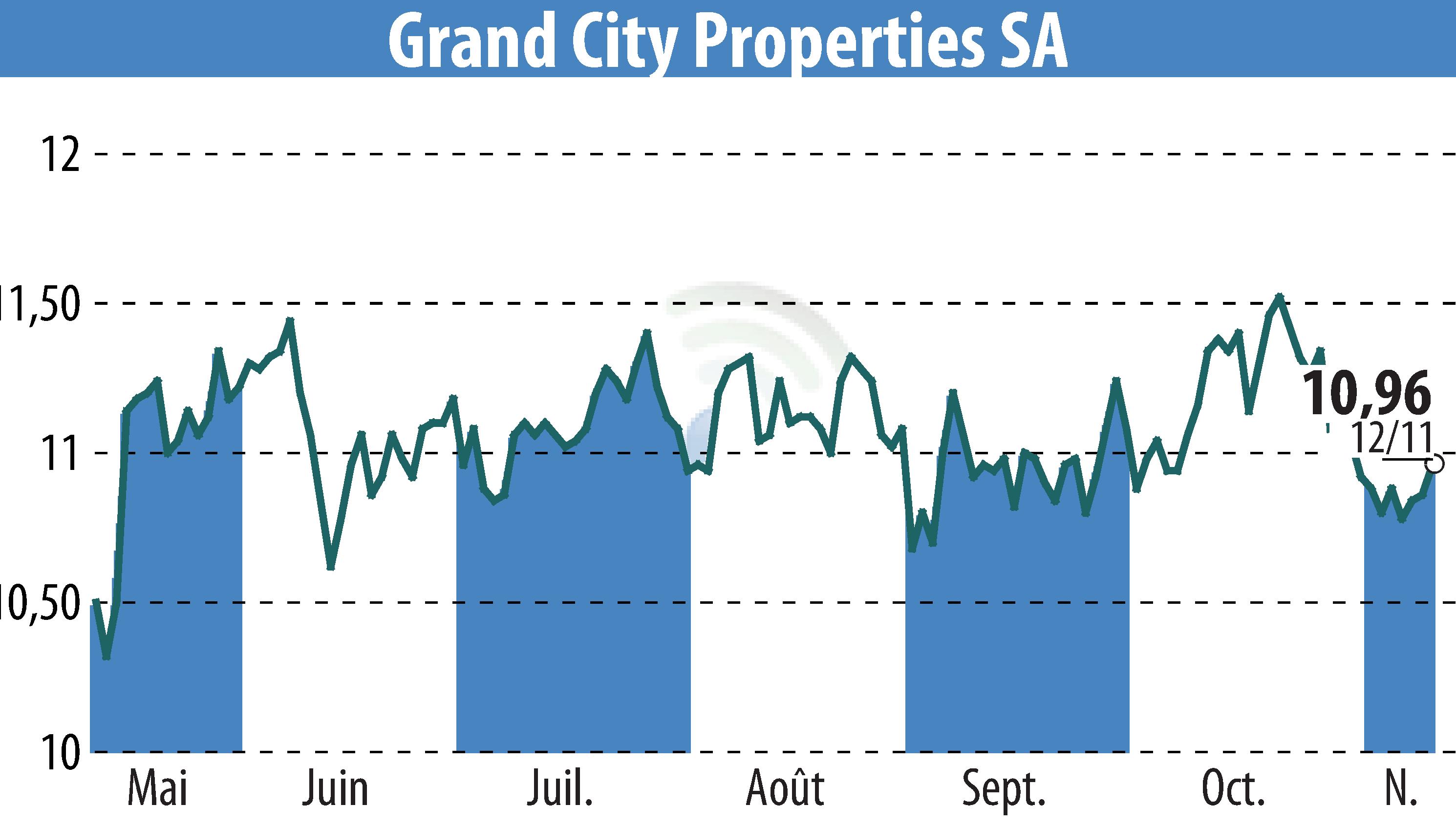

on Grand City Properties S.A., (ETR:GYC)

Grand City Properties S.A. Reports Stable Performance for 9M 2025

Grand City Properties S.A. announced its results for the nine-month period of 2025, showcasing stable financial performance. Net rental income reached €320 million, a 1% increase from €317 million in 9M 2024, supported by a 3.7% like-for-like rental growth. Despite disposals of €140 million, which were converted into acquisitions of €85 million, adjusted EBITDA grew to €253 million, up 1% from the previous year.

The company reported a significant profit of €410 million, a turnaround from a loss of €17 million in 9M 2024, attributed to positive revaluations and deferred tax income due to changes in the German tax regime. FFO I remained stable at €141 million, supporting FY 2025 guidance.

Grand City Properties maintained a strong liquidity position with €1.4 billion in cash, representing 32% of total debt, and confirmed a low loan-to-value ratio of 33%, ensuring a conservative financial profile. The appointment of Michael Bar-Yosef as Chief Capital Markets Officer was announced, enhancing the company's capital markets strategy.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Grand City Properties S.A., news