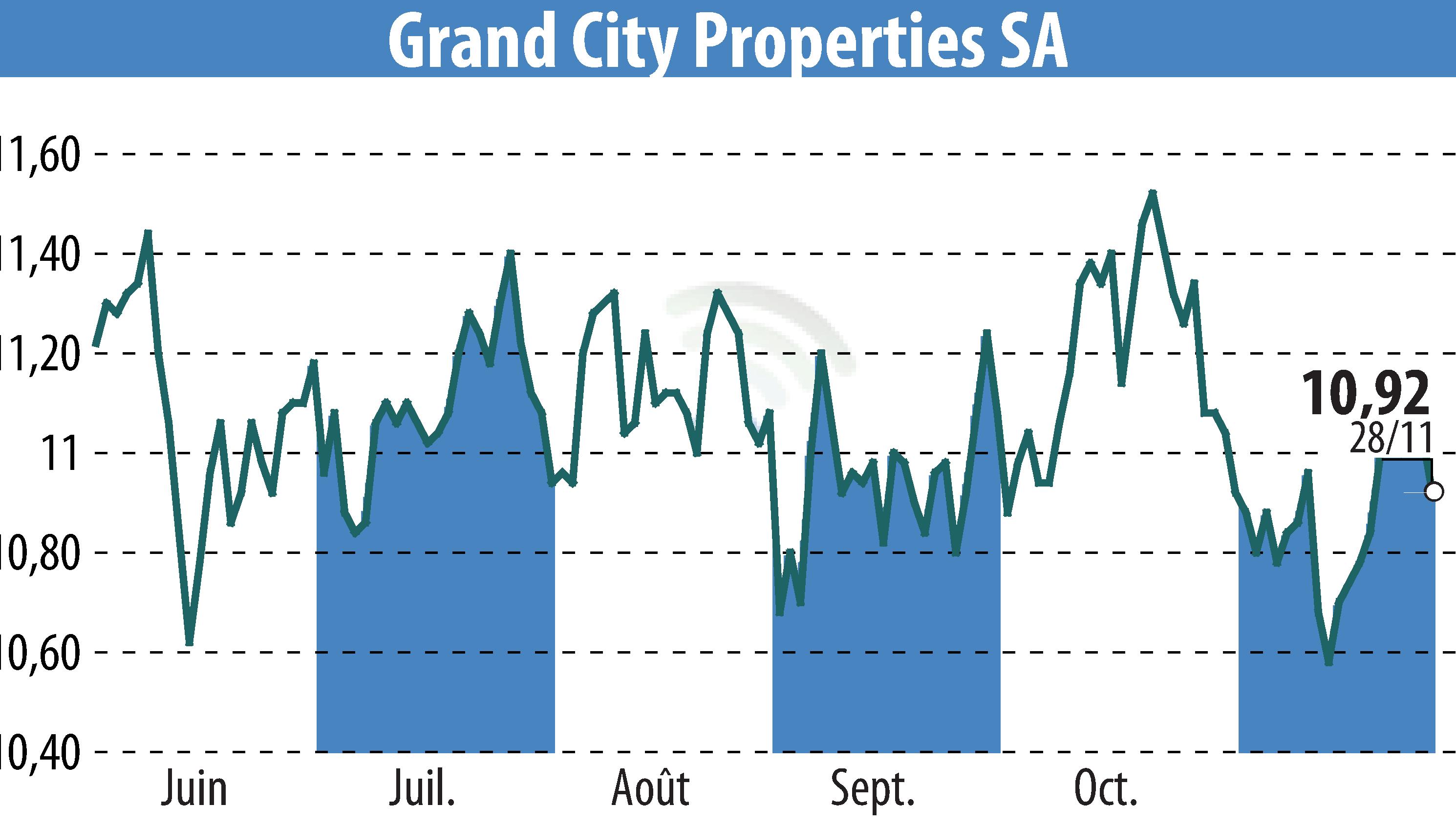

on Grand City Properties S.A., (ETR:GYC)

Grand City Properties S.A. Issues €600 Million Perpetual Notes and Launches Tender Offer

Grand City Properties S.A. has announced the successful issuance of €600 million in perpetual notes with a 4.75% coupon. This issuance drew over €2 billion in orders, showcasing strong demand from investors. The notes are classified as 100% equity under IFRS and receive a BB+ rating from S&P, including 50% equity content under their methodology.

The company plans to utilize proceeds to repurchase higher coupon notes and refinance upcoming notes due in 2026. A tender offer was launched on December 1, set to expire on December 8, 2025. Through these actions, GCP aims to lower its average coupon rate, support FFO and enhance S&P credit metrics.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Grand City Properties S.A., news