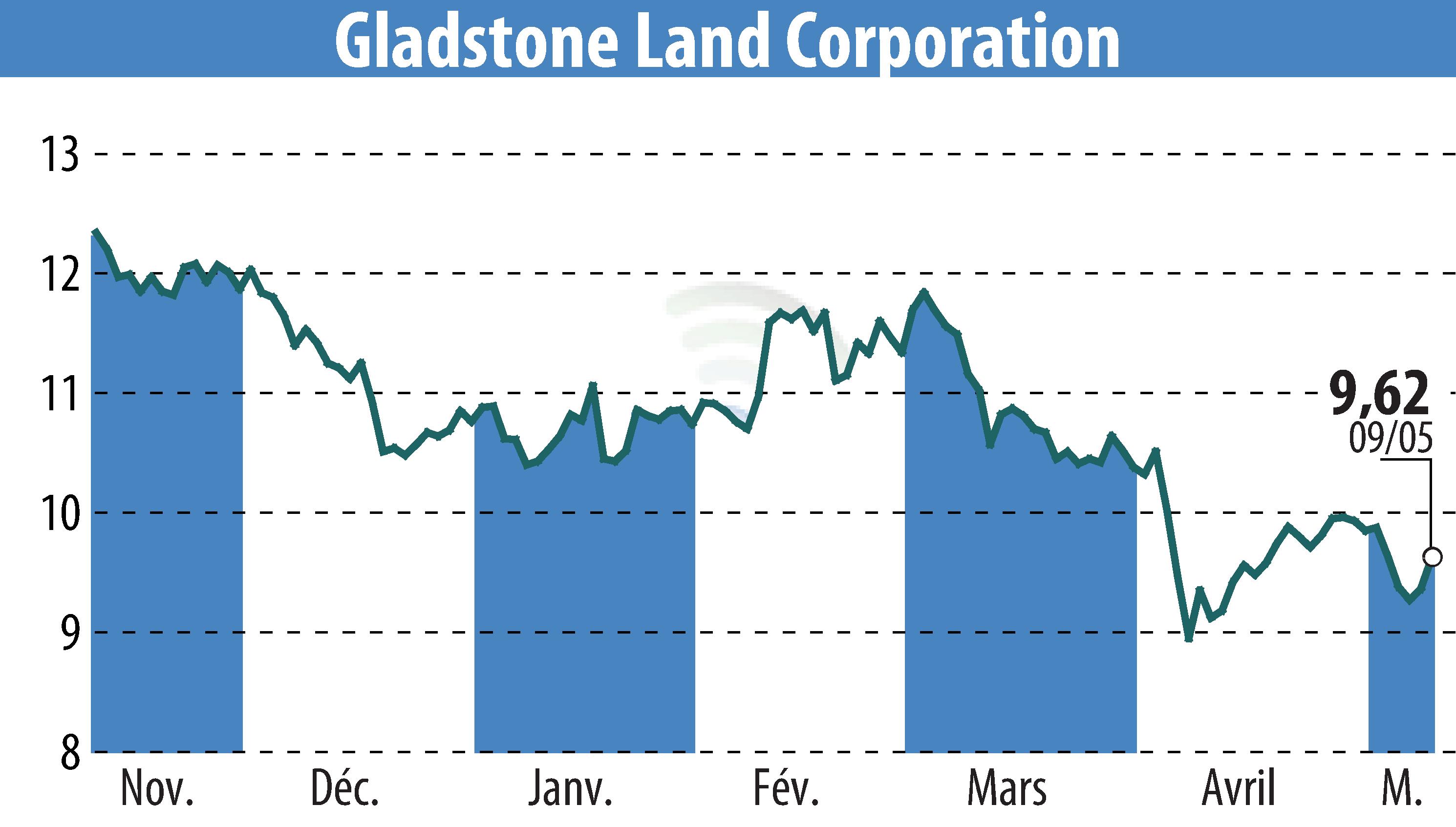

on Gladstone Land Corporation (NASDAQ:LAND)

Gladstone Land Reports Q1 2025 Financial Results

Gladstone Land Corporation has announced its financial outcomes for the first quarter of 2025. The company revealed property sales of seven farms in Florida and Nebraska, resulting in a net gain of $15.7 million. Despite these sales, total operating revenues fell by 17% compared to the previous year, due to decreased fixed base cash rents, offset slightly by an increase in participation rents and a lease termination fee from a former tenant.

Net income saw a rise to $15.1 million, compared to $13.6 million a year earlier, while net income per share increased to $0.25. However, Adjusted Funds From Operations (AFFO) declined significantly to $2.0 million, marking a 60.3% drop from the prior year.

The company repaid $19.4 million in loans and made $1.7 million in interest patronage, benefiting from reduced interest rates on its 2024 borrowings. Gladstone also maintained strong liquidity with access to over $180 million, ensuring stability amid transition in lease structures towards heavily participation-based rents.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Gladstone Land Corporation news