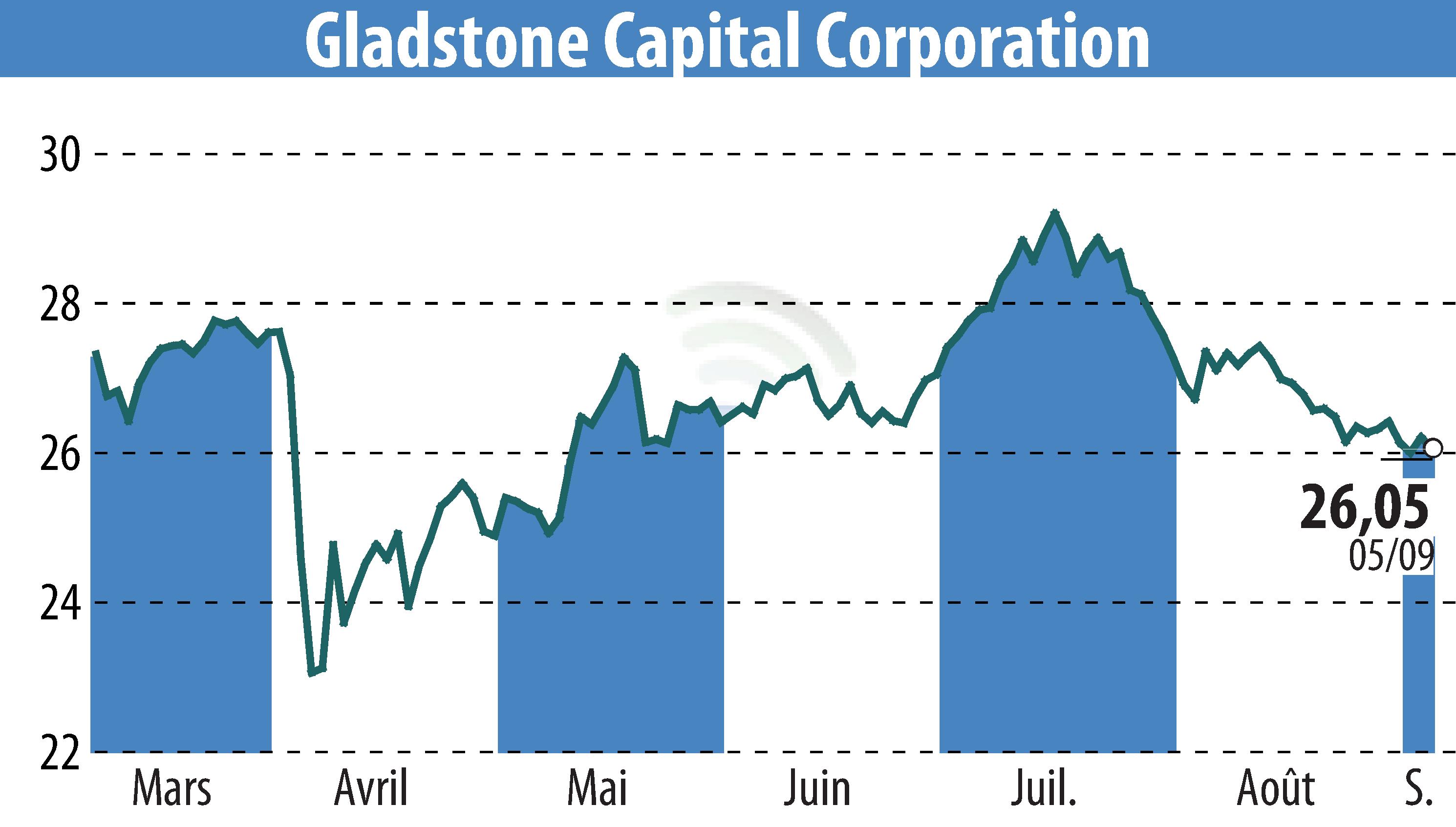

on Gladstone Capital Corporation (NASDAQ:GLAD)

Gladstone Capital Corporation Launches Convertible Notes Offering

Gladstone Capital Corporation announced a public offering of $110 million in unsecured convertible notes due in 2030. The company may also allow the underwriter an option to purchase an additional $16.5 million in notes. These notes will mature in 2030 and will offer semi-annual interest payments. Upon conversion, payment may be made in cash, shares, or a mix of both, subject to the company's discretion.

The funds raised from this offering will be used to repay part of Gladstone's revolving credit facility debt and for other corporate purposes. Oppenheimer & Co. Inc. will manage the offering. Interested investors should review the preliminary prospectus and accompanying documents filed with the SEC for complete details.

The offering will be conducted under the company’s shelf registration statement effective since January 17, 2024. It is crucial for investors to understand the risks and charges associated with this offering before making investment decisions.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Gladstone Capital Corporation news