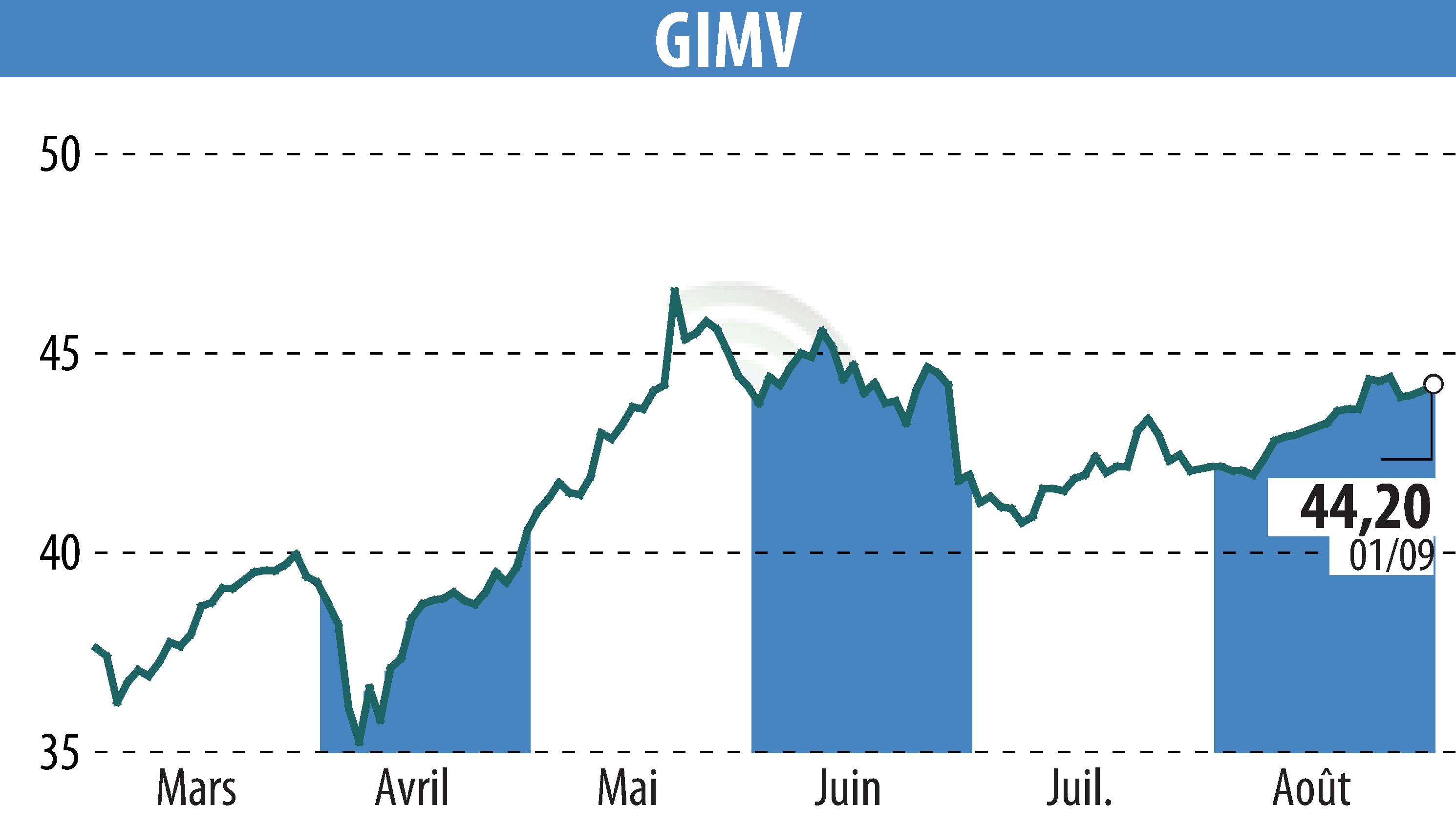

on Gimv (EBR:GIMB)

Gimv Reports Strong Start to Fiscal Year with Robust Investment Activity

Gimv has reported a dynamic beginning to its fiscal year, marked by significant investments in both new and existing portfolio companies. This activity supports its accelerated growth strategy. Despite a soft European private equity market, Gimv’s dedicated sourcing capabilities have led to notable new investments and a strong deal pipeline.

Recent investments include entries into Healthcare and Sustainable Cities in various European markets. Gimv also completed a successful exit of Joolz, followed by a strategic reinvestment into the Bugaboo/Joolz combination, and is planning further investments in major portfolio companies. The company's recent capital operations sum to over EUR 300 million.

Gimv’s portfolio companies have demonstrated resilience amid economic challenges, delivering solid EBITDA growth. The portfolio's return for the quarter stood at 4.7%, in line with Gimv’s ambitious targets. This driven performance reflects in a growing Net Asset Value per share, reaching EUR 52.4 by June 2025. The company anticipates achieving record portfolio levels by the fiscal year's end.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Gimv news