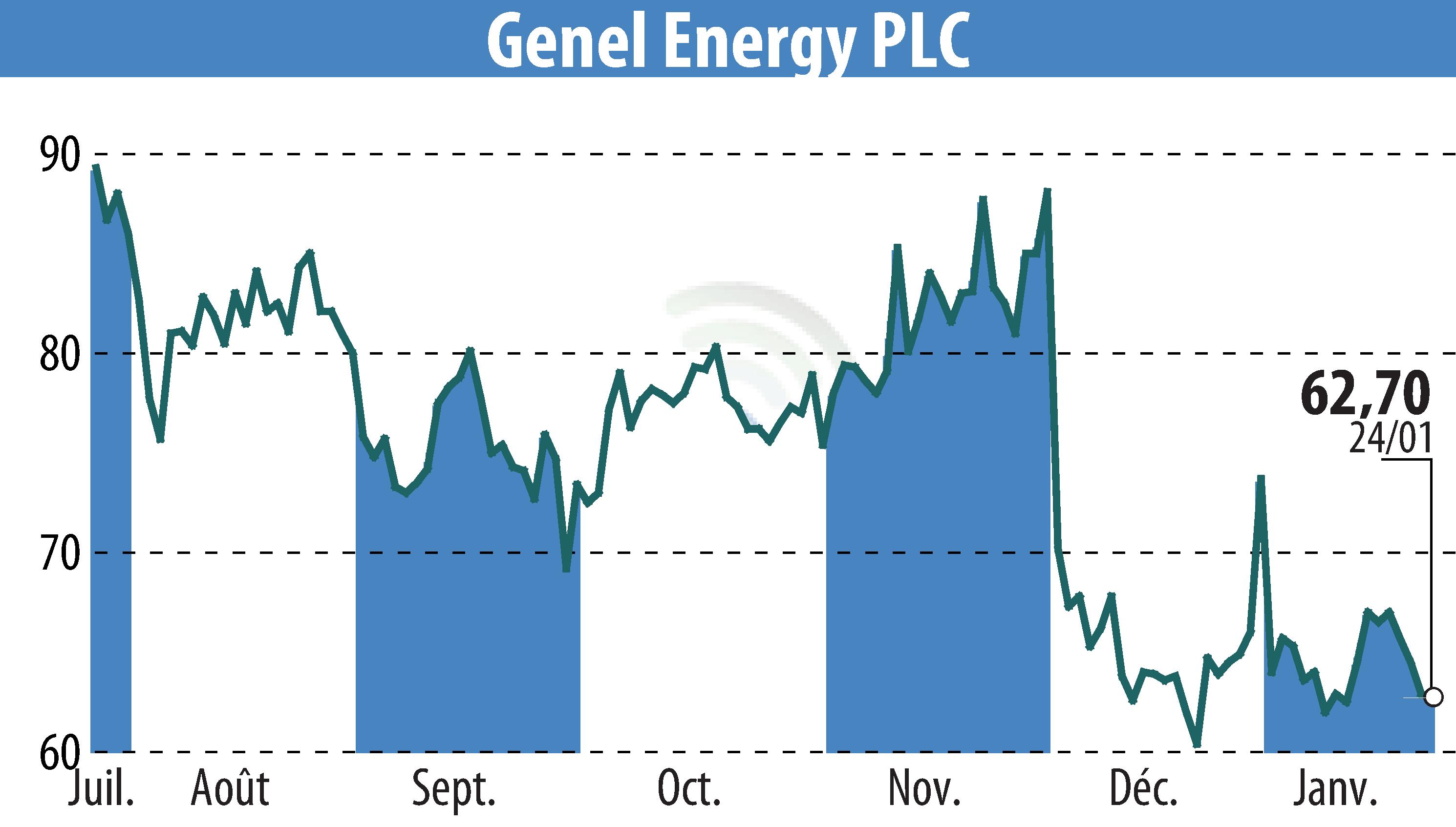

on Genel Energy (isin : JE00B55Q3P39)

Genel Energy Provides Trading and Operations Update for 2024

Genel Energy plc has issued a trading and operations update ahead of its full-year 2024 results. The company reports a substantial free cash flow of $19 million, contrasting with the previous year's $71 million outflow. Production averaged 19,650 bopd, up from 12,410 bopd in 2023. Genel's balance sheet shows total debt reduced from $248 million to $66 million, with $131 million in net cash.

Despite selling domestically at an average of $35/bbl, talks to resume international exports are underway. The company faced challenges, including an arbitration loss against the Kurdistan Regional Government regarding the Miran and Bina Bawi contracts.

Genel is actively pursuing asset acquisition and geographical diversification. In Somaliland and Morocco, exploration initiatives continue. The divestment of the Taq Taq PSC is expected to eliminate potential liabilities. Genel remains focused on a robust strategy to ensure sustained shareholder value.

R. H.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Genel Energy news