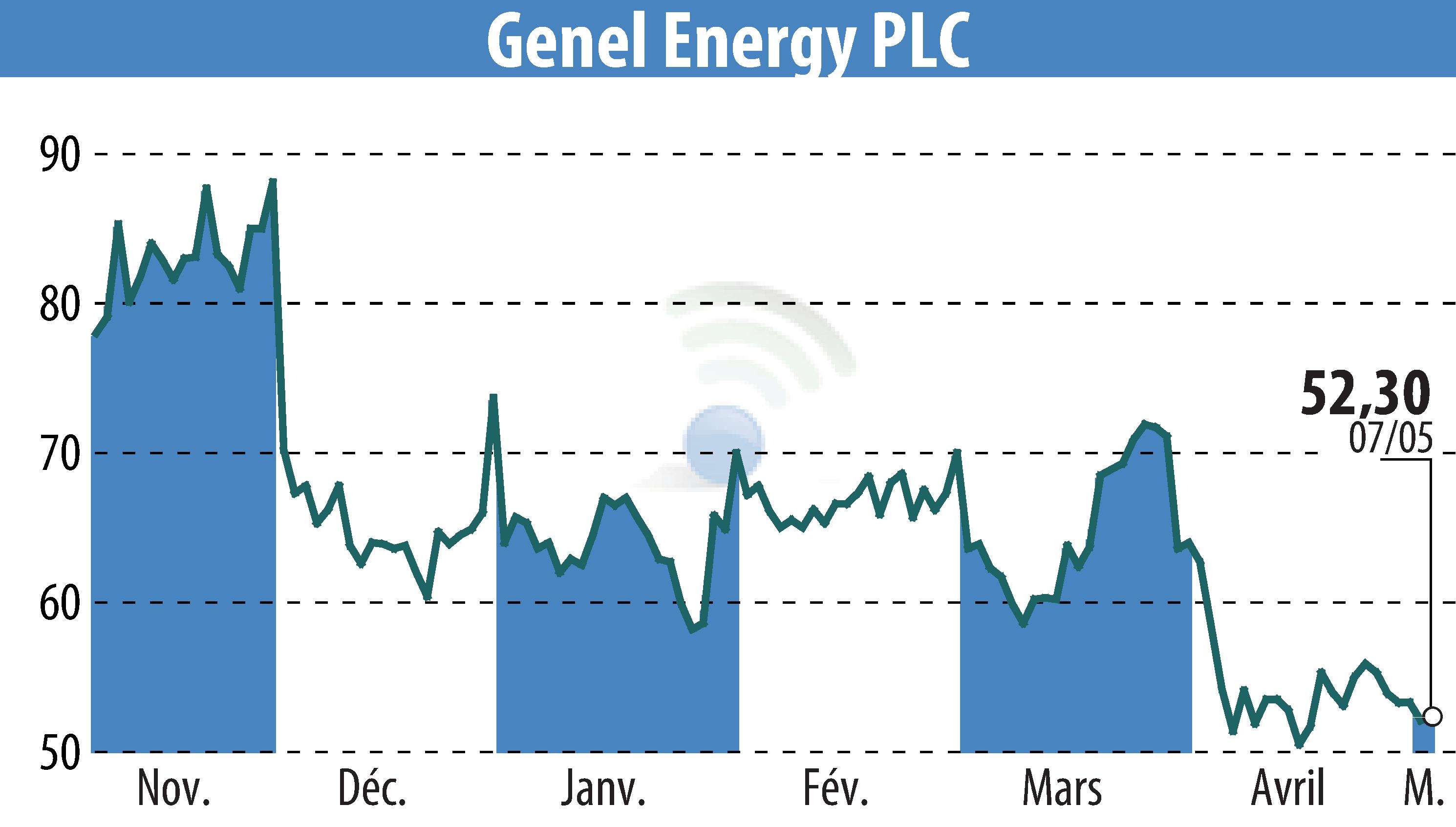

on Genel Energy (isin : JE00B55Q3P39)

Genel Energy Reports Stable Q1 2025 Performance and Strategic Moves

Genel Energy PLC provided its trading and operations update for Q1 2025. The company reported stable production and cash flow, highlighting a gross production of 82,081 bopd from the Tawke license in Kurdistan. This consistent output continues to contribute significantly to Genel's financial stability.

Progress in strategic diversification is noted with impending completion of entry into Block 54 in Oman, where operations are slated to commence later this year. Genel has also restructured its financials by calling its old bond and issuing a new $100 million bond, enhancing its capital framework.

Additionally, Genel exited the Sarta and Qara Dagh licenses, reducing potential liabilities. In financial terms, the company reported a slight increase in net cash, totaling $135 million by March's end, while maintaining a steady cash reserve of $201 million.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Genel Energy news