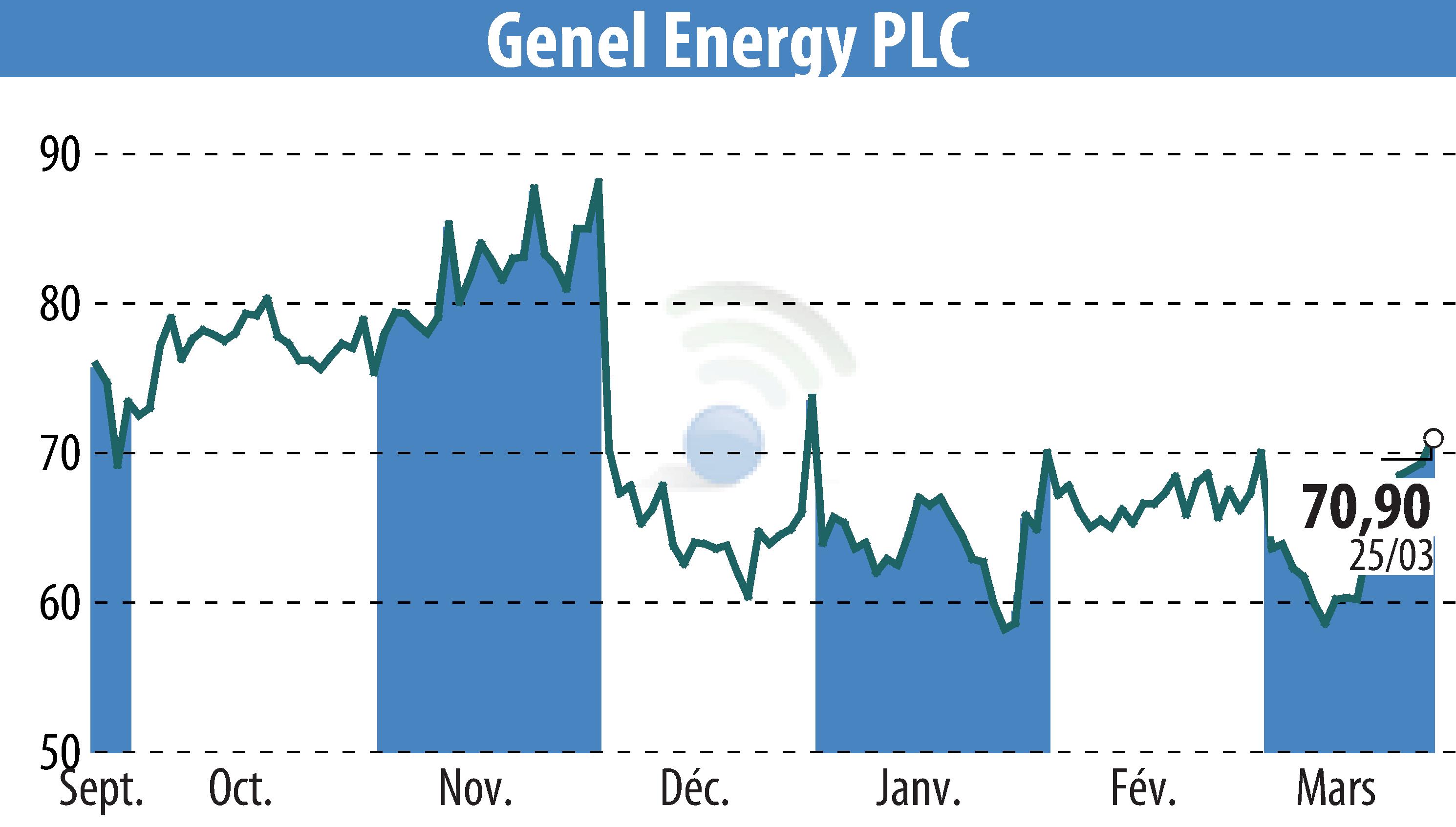

on Genel Energy (isin : JE00B55Q3P39)

Genel Energy Completes Successful Bond Placement

Genel Energy plc has finalized the issuance of USD 100 million in five-year senior unsecured bonds, featuring an annual coupon rate of 11%. This private placement generated robust interest from international investors and attracted a diverse group of high-quality participants.

The settlement is anticipated on or around April 9, 2025, subject to standard conditions. Plans are in motion to list the bonds on the Nordic ABM and Frankfurt Open Market. The new bond proceeds aim to refinance an existing unsecured bond and support general corporate objectives.

In conjunction with this operation, Genel has committed to repurchasing current bonds and will issue a call notice for outstanding bonds at their par value during the settlement. Pareto Securities AS managed the bond issuance.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Genel Energy news