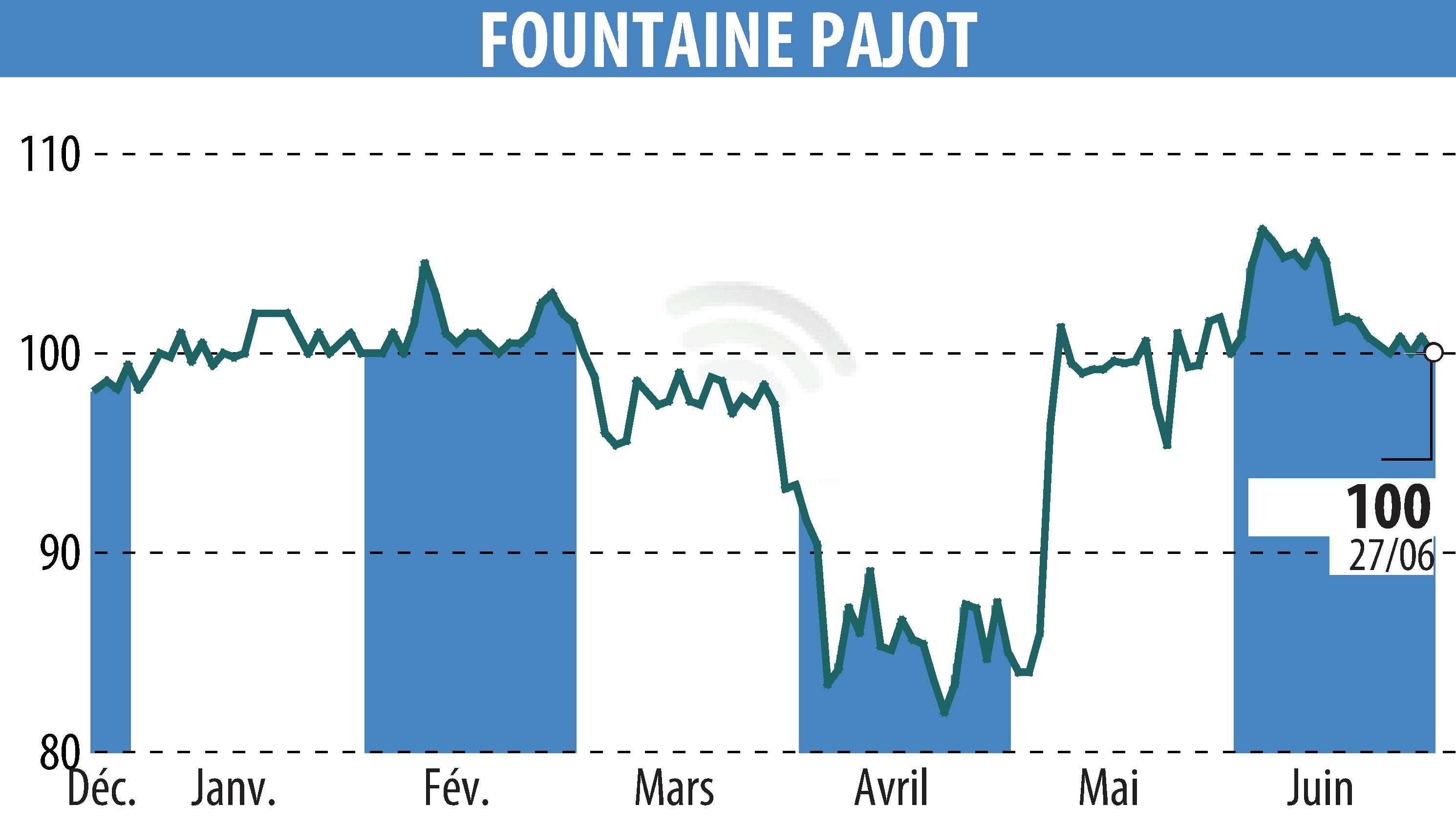

on FOUNTAINE PAJOT (EPA:ALFPC)

Fountaine Pajot: Solid Results and Future Strategy

Fountaine Pajot posted robust half-year results for 2024/25 despite an unfavorable economic environment. Revenue declined slightly by 5.3% to €156.2 million. However, net profit attributable to the Group increased to €15.3 million, compared to €13.5 million the previous year. This momentum is supported by an advantageous product mix and customer confidence.

The Group maintains a healthy financial structure, with generated cash of €20.1 million and a gross cash flow of €22.3 million. Investment is at the heart of its strategy, with an ambitious €23 million plan focused on innovation, site modernization, and geographic expansion, particularly in Asia-Pacific.

Fountaine Pajot is pursuing its responsible development strategy, focusing on technical innovation and reducing its carbon footprint with virtuous solutions such as hybrid propulsion. These initiatives, along with agile management in response to demand, position the Group favorably to seize future opportunities.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all FOUNTAINE PAJOT news