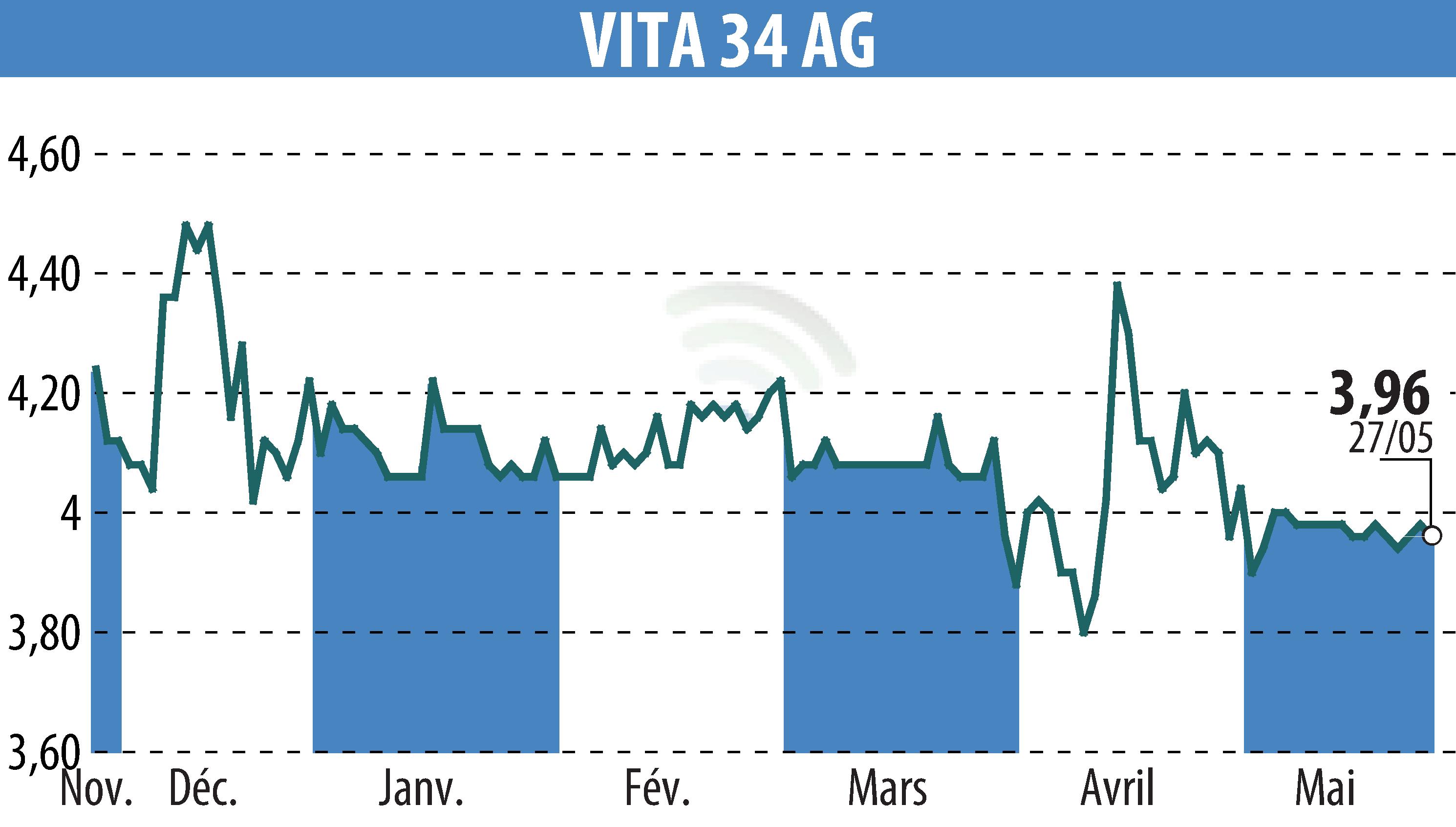

on Vita 34 AG (ETR:V3V)

FamiCord AG Begins 2025 with Strong Growth and Profitability Boost

FamiCord AG, Europe's leading cell bank and the third largest globally, reports a robust start to the 2025 financial year. The company's Group revenue surged by 19% to EUR 22.1 million, while EBITDA climbed sharply by 76.3% to EUR 2.7 million due to effective sales, marketing investments, and cost-cutting efforts in Poland and Germany.

The year-on-year growth was supported by a rise in annual payment contracts despite a temporary dip in operating cash flow to EUR 1.3 million. Regional recoveries were noted with strong demand in Eastern Europe and organic growth in Central Europe.

Financial challenges remain, notably from unfavorable exchange rates and hyperinflation in Turkey, impacting net results. Despite these hurdles, FamiCord's overall financial position remains solid, with cash reserves rising by 1.5%.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Vita 34 AG news